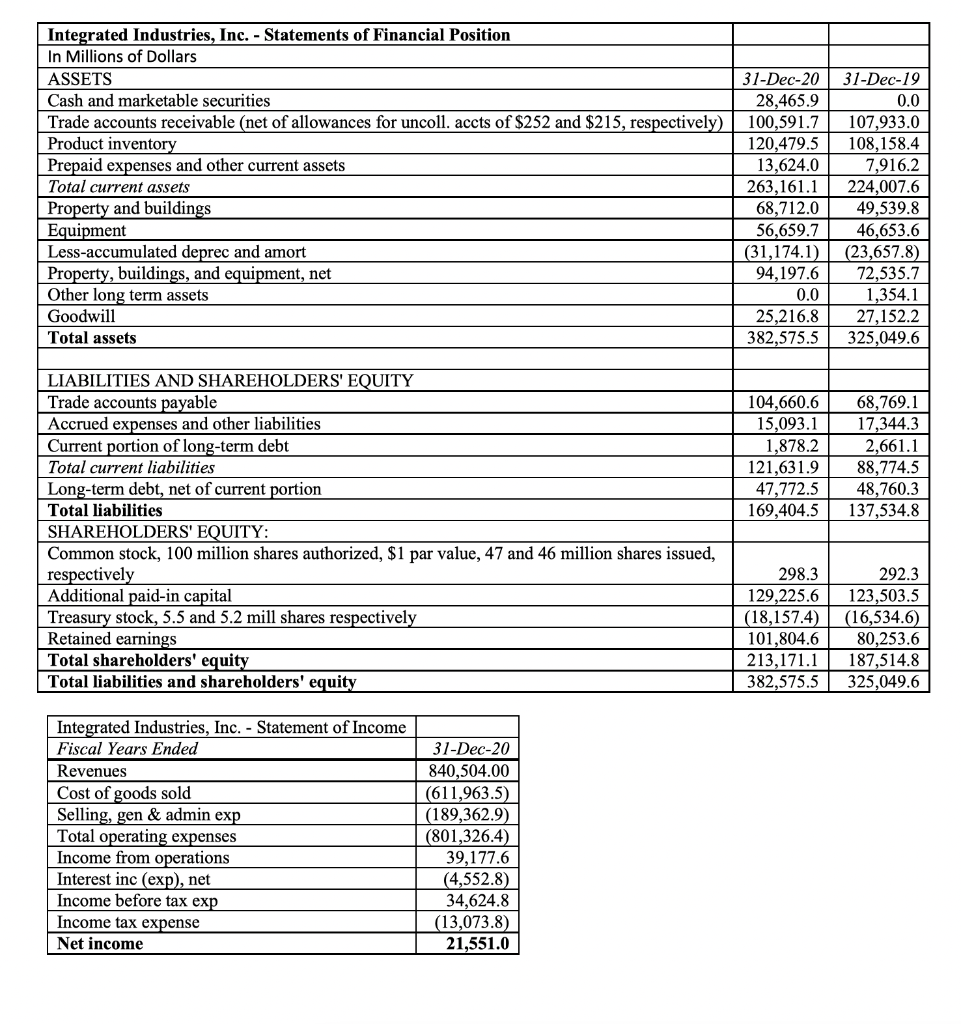

Question: From the alternatives below, choose the answer that best completes the following sentence. As of December 31, 2019 Integrated Industries had obtained about _____ percent

From the alternatives below, choose the answer that best completes the following sentence. As of December 31, 2019 Integrated Industries had obtained about _____ percent of its financing from creditors. a. 15.00

b. 42. 31

c. 73.35

d. 35.45

e. None of these answers are correct.

Integrated Industries, Inc. - Statements of Financial Position In Millions of Dollars ASSETS Cash and marketable securities Trade accounts receivable (net of allowances for uncoll. accts of $252 and $215, respectively) Product inventory Prepaid expenses and other current assets Total current assets Property and buildings Equipment Less-accumulated deprec and amort Property, buildings, and equipment, net Other long term assets Goodwill Total assets 31-Dec-20 28,465.9 100,591.7 120,479.5 13,624.0 263,161.1 68,712.0 56,659.7 (31,174.1) 94,197.6 0.0 25,216.8 382,575.5 31-Dec-19 0.0 107,933.0 108,158.4 7,916.2 224,007.6 49,539.8 46,653.6 (23,657.8) 72,535.7 1,354.1 27,152.2 325,049.6 104,660.6 15,093.1 1,878.2 121,631.9 47,772.5 169,404.5 68,769.1 17,344.3 2,661.1 88,774.5 48,760.3 137,534.8 LIABILITIES AND SHAREHOLDERS' EQUITY Trade accounts payable Accrued expenses and other liabilities Current portion of long-term debt Total current liabilities Long-term debt, net of current portion Total liabilities SHAREHOLDERS' EQUITY: Common stock, 100 million shares authorized, $1 par value, 47 and 46 million shares issued, respectively Additional paid-in capital Treasury stock, 5.5 and 5.2 mill shares respectively Retained earnings Total shareholders' equity Total liabilities and shareholders' equity 298.3 129,225.6 (18,157.4) 101,804.6 213,171.1 382,575.5 292.3 123,503.5 (16,534.6) 80,253.6 187,514.8 325,049.6 Integrated Industries, Inc. - Statement of Income Fiscal Years Ended Revenues Cost of goods sold Selling, gen & admin exp Total operating expenses Income from operations Interest inc (exp), net Income before tax exp Income tax expense Net income 31-Dec-20 840,504.00 (611,963.5) (189,362.9) (801,326.4) 39,177.6 (4,552.8) 34,624.8 (13,073.8) 21,551.0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts