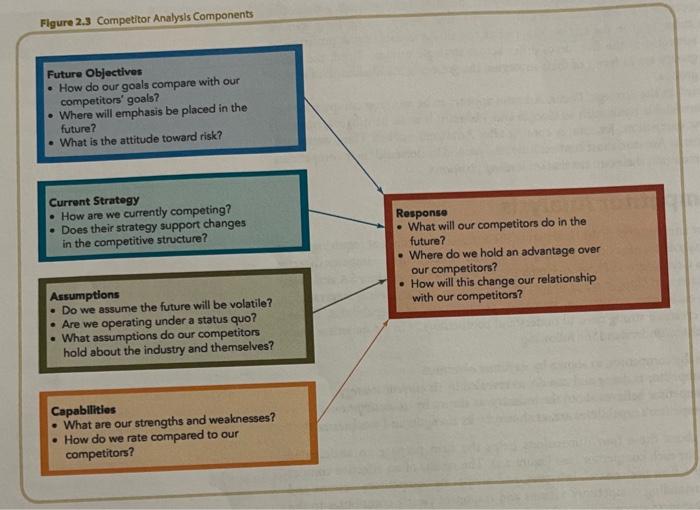

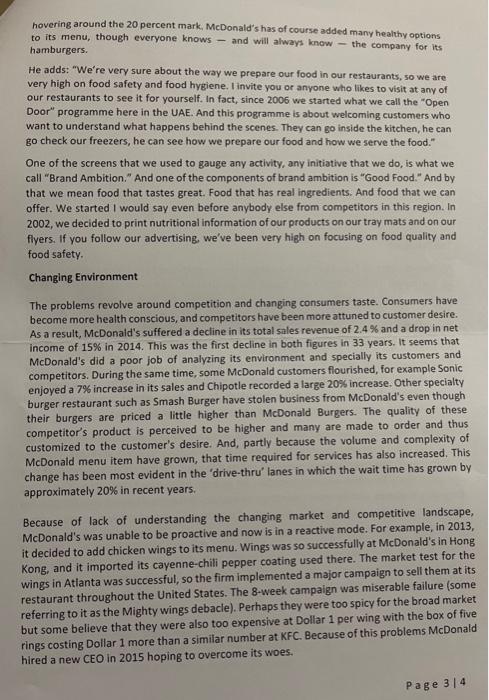

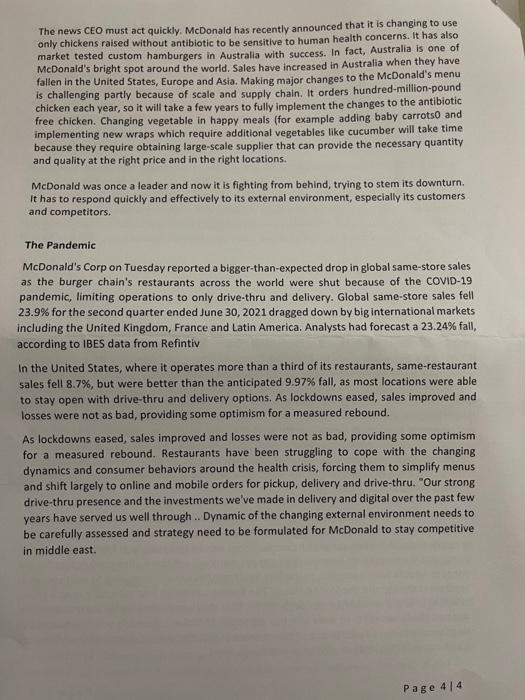

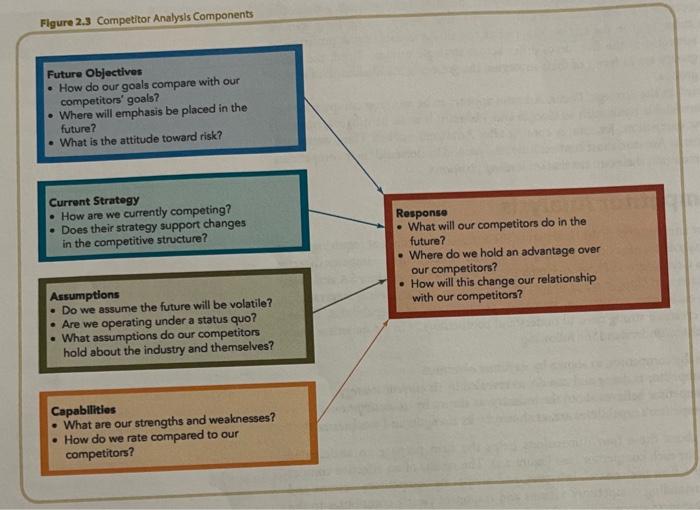

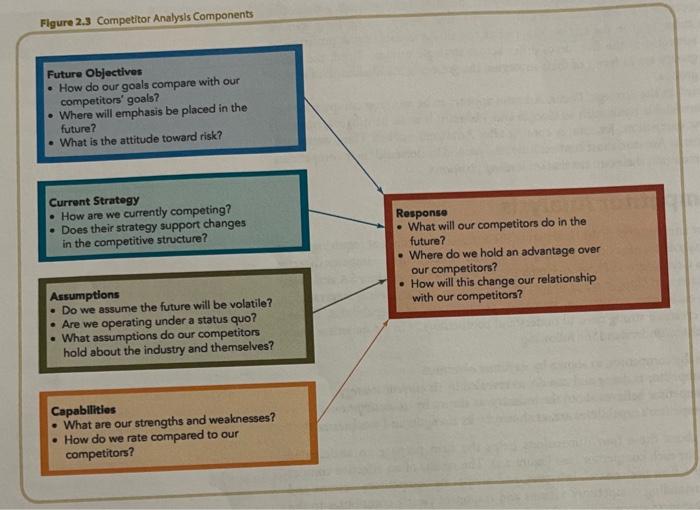

Question: From the case determine/identify the competitor analysis ( future objectives , current strategy , assumptions , capabilities and response) you have to analyse from the

From the case determine/identify the competitor analysis ( future objectives , current strategy , assumptions , capabilities and response)

you have to analyse from the given case the competitor analysis component to make it clear i share you this figure from the book

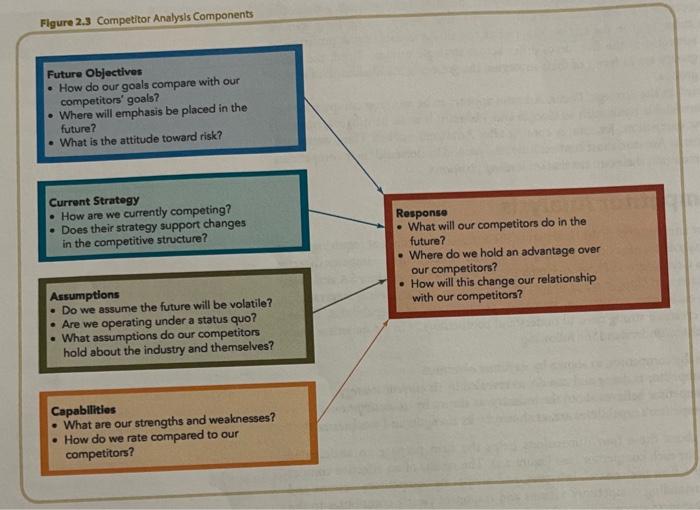

Figure 2.3 Competitor Analysis Components Future Objectives How do our goals compare with our competitors' goals? Where will emphasis be placed in the future? What is the attitude toward risk? Current Strategy How are we currently competing? - Does their strategy support changes in the competitive structure? Response What will our competitors do in the future? Where do we hold an advantage over our competitors? How will this change our relationship with our competitors? Assumptions Do we assume the future will be volatile? Are we operating under a status quo? What assumptions do our competitors hold about the industry and themselves? Capabilities What are our strengths and weaknesses? How do we rate compared to our competitors? MCDONALD'S IN THE MIDDLE EAST: MEAL DEALS McDonald's has become one of the region's biggest success stories, with a staggering 900,000 customers a day eating at its 369 restaurants across the GCC bringing in annual revenues of $750m. Fancy a hamburger? With fries? Go large? Chances are you probably do. Whichever way you look at the numbers, they are nothing short of astonishing: 69 million people a day eat from one of McDonald's 34,000 restaurants across 119 countries, with 1.7 million employees. That's about the entire population of Abu Dhabi. Little wonder its global income is close to $28bn a year. The company may have become a focus for debates on obesity, corporate ethics and consumer habits, but when it comes to a business success story, there are few better ones to be found. It was Ray Kroc, who in 1954 discovered a small burger restaurant in California that was at the time owned by brothers Dick and Mac McDonald. He turned it into McDonald's, and 59 years later it is a global phenomenon. Nowhere is that more visible than in the GCC where 369 outlets can be found, a figure that will rise to 585 by 2015. Surprised? You shouldn't be after all, 900,000 people a day in the GCC seem to fancy a bite, and punters are liking their Big Macs in increasing numbers. But as far as this region is concerned, the best is yet to come. "We need to sharpen our saws and we need to work harder and more aggressively to attain our goals," says Yousif Abdulghani, managing director of McDonald's Middle East Development Company. Abdulghani already has plenty on his plate. Since opening the company's first GCC restaurant in Riyadh in 1993, it has evolved into seven separate partner organisations that are 100 percent locally owned and operated (two in Saudi Arabia). They each own development licences, with McDonald's acting as the business facilitator. Total sales, when the Middle East and Africa region is included, came in at $1.5bn last year, with the GCC accounting for around $750m. He explains: "McDonald's is well known to be the biggest franchiser across the world, and when you look at our ownership model across the system we have different models. Of course, the Middle East is a bit unique because we had a lot of people who were interested in the brand, in bringing the franchise to the region. Yet they were not really willing to dedicate (their) full time and best efforts to the business." Abdulghani adds: "So we moved into (a) new ownership structure called development licensees... So these investors basically own their assets in the markets here. We provided them with all the support and know-how that is needed to run the business, but the day-to- day activities are managed, really, by the partners." It's clearly working. Last year's revenues were "a record year in the sense that we have been growing, growing at the rate of fifteen to 20 percent on revenues," he says. Big numbers, but then again, these are big names entrusted with the GCC franchises: HH Prince Mishaal Bin Khalid Al Saud, president of Riyadh International Catering Company, runs the Central, Eastern and Northern Regions in Saudi Arabia. The country's Western and Page 14 Southern Regions are looked after by Abdulrahman Alireza, general manager of Reza Food Services. Emirates Fast Food Company, led by Rafic Fakih, has the UAE, and the formidable Kamal Saleh Al Mana, managing director of Al Mana Restaurants & Food Company oversees Qatar. The UAE already has 108 outlets, but that figure is heading to 150 by 2015. Saudi Arabia is another "big market", accounting for 136 restaurants. But again, Abdulghani Isn't satisfied, targeting 240 restaurants by 2015. Between these two countries, McDonald's has 6,000 staff on the books. There is also likely to be considerable growth in other GCC countries, where currently McDonald's has 120 restaurants between Kuwait, Qatar, Bahrain and Oman. He adds: "Our relationship with our franchisees is based on partnership so they understand the marketplace more than us. So when we sit down every year in our business planning meetings, we agree mutually on what the potential is and what will be the acceptable growth rate of the market. So it's really mutual, they come across with their projections and we look at also to our research and all the intelligence that we gather of what the potential should be. In the end you know it is a joint understanding by both parties." One of the keys to the company's success is managing its suppliers. It may all sound very simple, given that 900,000 people a day are walking into McDonald's restaurants in the GCC and mostly paying cash. But ensuring food hygiene and safety, including using only halal meat, is crucial. He explains: "We spend a lot of energy and time to make sure we have the right suppliers for the business. Now, as you know, (we are) a global company working with global suppliers that have been developed over many decades. Despite this, we try to also develop regional and local suppliers as much as possible, provided they meet a number of criteria including food quality, food safety, farm biosecurity, employee working conditions and animal welfare." Abdulghani adds: "We set our own standards for local suppliers, we upgraded also their capabilities, technical know-how, by giving them all the expertise and knowledge that they needed and the work that we have done with them has paid off. Today we have got some good, I would say reputable, suppliers in the region, whether it's in Saudi Arabia, the UAE, Kuwait, Jordan and Egypt." Another cornerstone of the operation is what Abdulghani describes as "Business Unusual" - it's about continually challenging the norm to do better. Most people would be more than happy with 900,000 customers a day. Around $2m a day flows through the tills, and there appears to be no slowdown. Given the company has been relatively insulated from the recession with customers becoming thriftier in their buying decisions, you could argue that Abdulghani doesn't have to do much more than count the money. No matter what Abdulghani does, there is of course always going to be an element of sniping over health issues. Given the numbers, some of that may well be jealousy. But then again, according to the International Diabetes Federation (IDF), five of the ten countries with the worst rates of diabetes anywhere on the planet are right here in the GCC. The IDF figures show that 21.1 percent of people in Kuwait are diabetes sufferers, the rest of the GCC Page 214 hovering around the 20 percent mark, McDonald's has of course added many healthy options to its menu, though everyone knows - and will always know - the company for its hamburgers. He adds: "We're very sure about the way we prepare our food in our restaurants, so we are very high on food safety and food hygiene. I invite you or anyone who likes to visit at any of our restaurants to see it for yourself. In fact, since 2006 we started what we call the "Open Door" programme here in the UAE. And this programme is about welcoming customers who want to understand what happens behind the scenes. They can go inside the kitchen, he can go check our freezers, he can see how we prepare our food and how we serve the food." One of the screens that we used to gauge any activity, any initiative that we do, is what we call "Brand Ambition." And one of the components of brand ambition is "Good Food." And by that we mean food that tastes great. Food that has real ingredients. And food that we can offer. We started I would say even before anybody else from competitors in this region. In 2002, we decided to print nutritional information of our products on our tray mats and on our flyers. If you follow our advertising, we've been very high on focusing on food quality and food safety. Changing Environment The problems revolve around competition and changing consumers taste. Consumers have become more health conscious, and competitors have been more attuned to customer desire. As a result, McDonald's suffered a decline in its total sales revenue of 2.4 % and a drop in net income of 15% in 2014. This was the first decline in both figures in 33 years. It seems that McDonald's did a poor job of analyzing its environment and specially its customers and competitors. During the same time, some McDonald customers flourished, for example Sonic enjoyed a 7% increase in its sales and Chipotle recorded a large 20% increase. Other specialty burger restaurant such as Smash Burger have stolen business from McDonald's even though their burgers are priced a little higher than McDonald Burgers. The quality of these competitor's product is perceived to be higher and many are made to order and thus customized to the customer's desire. And, partly because the volume and complexity of McDonald menu item have grown, that time required for services has also increased. This change has been most evident in the 'drive-thru' lanes in which the wait time has grown by approximately 20% in recent years. Because of lack of understanding the changing market and competitive landscape, McDonald's was unable to be proactive and now is in a reactive mode. For example, in 2013, it decided to add chicken wings to its menu. Wings was so successfully at McDonald's in Hong Kong, and it imported its cayenne-chili pepper coating used there. The market test for the wings in Atlanta was successful, so the firm implemented a major campaign to sell them at its restaurant throughout the United States. The 8-week campaign was miserable failure (some referring to it as the Mighty wings debacle). Perhaps they were too spicy for the broad market but some believe that they were also too expensive at Dollar 1 per wing with the box of five rings costing Dollar 1 more than a similar number at KFC. Because of this problems McDonald hired a new CEO in 2015 hoping to overcome its woes. Page 34 The news CEO must act quickly. McDonald has recently announced that it is changing to use only chickens raised without antibiotic to be sensitive to human health concerns. It has also market tested custom hamburgers in Australia with success. In fact, Australia is one of McDonald's bright spot around the world. Sales have increased in Australia when they have fallen in the United States, Europe and Asia. Making major changes to the McDonald's menu is challenging partly because of scale and supply chain. It orders hundred-million-pound chicken each year, so it will take a few years to fully implement the changes to the antibiotic free chicken. Changing vegetable in happy meals (for example adding baby carrots and implementing new wraps which require additional vegetables like cucumber will take time because they require obtaining large-scale supplier that can provide the necessary quantity and quality at the right price and in the right locations McDonald was once a leader and now it is fighting from behind, trying to stem its downturn. It has to respond quickly and effectively to its external environment, especially its customers and competitors. The Pandemic McDonald's Corp on Tuesday reported a bigger than expected drop in global same-store sales as the burger chain's restaurants across the world were shut because of the COVID-19 pandemic, limiting operations to only drive-thru and delivery. Global same-store sales fell 23.9% for the second quarter ended June 30, 2021 dragged down by big international markets including the United Kingdom, France and Latin America. Analysts had forecast a 23.24% fall, according to IBES data from Refintiv in the United States, where it operates more than a third of its restaurants, same-restaurant sales fell 8.7%, but were better than the anticipated 9.97% fall, as most locations were able to stay open with drive-thru and delivery options. As lockdowns eased, sales improved and losses were not as bad, providing some optimism for a measured rebound. As lockdowns eased, sales improved and losses were not as bad, providing some optimism for a measured rebound. Restaurants have been struggling to cope with the changing dynamics and consumer behaviors around the health crisis, forcing them to simplify menus and shift largely to online and mobile orders for pickup, delivery and drive-thru. "Our strong drive-thru presence and the investments we've made in delivery and digital over the past few years have served us well through .. Dynamic of the changing external environment needs to be carefully assessed and strategy need to be formulated for McDonald to stay competitive in middle east. Page 414 Figure 2.3 Competitor Analysis Components Future Objectives How do our goals compare with our competitors' goals? Where will emphasis be placed in the future? What is the attitude toward risk? Current Strategy How are we currently competing? - Does their strategy support changes in the competitive structure? Response What will our competitors do in the future? Where do we hold an advantage over our competitors? How will this change our relationship with our competitors? Assumptions Do we assume the future will be volatile? Are we operating under a status quo? What assumptions do our competitors hold about the industry and themselves? Capabilities What are our strengths and weaknesses? How do we rate compared to our competitors? Figure 2.3 Competitor Analysis Components Future Objectives How do our goals compare with our competitors' goals? Where will emphasis be placed in the future? What is the attitude toward risk? Current Strategy How are we currently competing? - Does their strategy support changes in the competitive structure? Response What will our competitors do in the future? Where do we hold an advantage over our competitors? How will this change our relationship with our competitors? Assumptions Do we assume the future will be volatile? Are we operating under a status quo? What assumptions do our competitors hold about the industry and themselves? Capabilities What are our strengths and weaknesses? How do we rate compared to our competitors? MCDONALD'S IN THE MIDDLE EAST: MEAL DEALS McDonald's has become one of the region's biggest success stories, with a staggering 900,000 customers a day eating at its 369 restaurants across the GCC bringing in annual revenues of $750m. Fancy a hamburger? With fries? Go large? Chances are you probably do. Whichever way you look at the numbers, they are nothing short of astonishing: 69 million people a day eat from one of McDonald's 34,000 restaurants across 119 countries, with 1.7 million employees. That's about the entire population of Abu Dhabi. Little wonder its global income is close to $28bn a year. The company may have become a focus for debates on obesity, corporate ethics and consumer habits, but when it comes to a business success story, there are few better ones to be found. It was Ray Kroc, who in 1954 discovered a small burger restaurant in California that was at the time owned by brothers Dick and Mac McDonald. He turned it into McDonald's, and 59 years later it is a global phenomenon. Nowhere is that more visible than in the GCC where 369 outlets can be found, a figure that will rise to 585 by 2015. Surprised? You shouldn't be after all, 900,000 people a day in the GCC seem to fancy a bite, and punters are liking their Big Macs in increasing numbers. But as far as this region is concerned, the best is yet to come. "We need to sharpen our saws and we need to work harder and more aggressively to attain our goals," says Yousif Abdulghani, managing director of McDonald's Middle East Development Company. Abdulghani already has plenty on his plate. Since opening the company's first GCC restaurant in Riyadh in 1993, it has evolved into seven separate partner organisations that are 100 percent locally owned and operated (two in Saudi Arabia). They each own development licences, with McDonald's acting as the business facilitator. Total sales, when the Middle East and Africa region is included, came in at $1.5bn last year, with the GCC accounting for around $750m. He explains: "McDonald's is well known to be the biggest franchiser across the world, and when you look at our ownership model across the system we have different models. Of course, the Middle East is a bit unique because we had a lot of people who were interested in the brand, in bringing the franchise to the region. Yet they were not really willing to dedicate (their) full time and best efforts to the business." Abdulghani adds: "So we moved into (a) new ownership structure called development licensees... So these investors basically own their assets in the markets here. We provided them with all the support and know-how that is needed to run the business, but the day-to- day activities are managed, really, by the partners." It's clearly working. Last year's revenues were "a record year in the sense that we have been growing, growing at the rate of fifteen to 20 percent on revenues," he says. Big numbers, but then again, these are big names entrusted with the GCC franchises: HH Prince Mishaal Bin Khalid Al Saud, president of Riyadh International Catering Company, runs the Central, Eastern and Northern Regions in Saudi Arabia. The country's Western and Page 14 Southern Regions are looked after by Abdulrahman Alireza, general manager of Reza Food Services. Emirates Fast Food Company, led by Rafic Fakih, has the UAE, and the formidable Kamal Saleh Al Mana, managing director of Al Mana Restaurants & Food Company oversees Qatar. The UAE already has 108 outlets, but that figure is heading to 150 by 2015. Saudi Arabia is another "big market", accounting for 136 restaurants. But again, Abdulghani Isn't satisfied, targeting 240 restaurants by 2015. Between these two countries, McDonald's has 6,000 staff on the books. There is also likely to be considerable growth in other GCC countries, where currently McDonald's has 120 restaurants between Kuwait, Qatar, Bahrain and Oman. He adds: "Our relationship with our franchisees is based on partnership so they understand the marketplace more than us. So when we sit down every year in our business planning meetings, we agree mutually on what the potential is and what will be the acceptable growth rate of the market. So it's really mutual, they come across with their projections and we look at also to our research and all the intelligence that we gather of what the potential should be. In the end you know it is a joint understanding by both parties." One of the keys to the company's success is managing its suppliers. It may all sound very simple, given that 900,000 people a day are walking into McDonald's restaurants in the GCC and mostly paying cash. But ensuring food hygiene and safety, including using only halal meat, is crucial. He explains: "We spend a lot of energy and time to make sure we have the right suppliers for the business. Now, as you know, (we are) a global company working with global suppliers that have been developed over many decades. Despite this, we try to also develop regional and local suppliers as much as possible, provided they meet a number of criteria including food quality, food safety, farm biosecurity, employee working conditions and animal welfare." Abdulghani adds: "We set our own standards for local suppliers, we upgraded also their capabilities, technical know-how, by giving them all the expertise and knowledge that they needed and the work that we have done with them has paid off. Today we have got some good, I would say reputable, suppliers in the region, whether it's in Saudi Arabia, the UAE, Kuwait, Jordan and Egypt." Another cornerstone of the operation is what Abdulghani describes as "Business Unusual" - it's about continually challenging the norm to do better. Most people would be more than happy with 900,000 customers a day. Around $2m a day flows through the tills, and there appears to be no slowdown. Given the company has been relatively insulated from the recession with customers becoming thriftier in their buying decisions, you could argue that Abdulghani doesn't have to do much more than count the money. No matter what Abdulghani does, there is of course always going to be an element of sniping over health issues. Given the numbers, some of that may well be jealousy. But then again, according to the International Diabetes Federation (IDF), five of the ten countries with the worst rates of diabetes anywhere on the planet are right here in the GCC. The IDF figures show that 21.1 percent of people in Kuwait are diabetes sufferers, the rest of the GCC Page 214 hovering around the 20 percent mark, McDonald's has of course added many healthy options to its menu, though everyone knows - and will always know - the company for its hamburgers. He adds: "We're very sure about the way we prepare our food in our restaurants, so we are very high on food safety and food hygiene. I invite you or anyone who likes to visit at any of our restaurants to see it for yourself. In fact, since 2006 we started what we call the "Open Door" programme here in the UAE. And this programme is about welcoming customers who want to understand what happens behind the scenes. They can go inside the kitchen, he can go check our freezers, he can see how we prepare our food and how we serve the food." One of the screens that we used to gauge any activity, any initiative that we do, is what we call "Brand Ambition." And one of the components of brand ambition is "Good Food." And by that we mean food that tastes great. Food that has real ingredients. And food that we can offer. We started I would say even before anybody else from competitors in this region. In 2002, we decided to print nutritional information of our products on our tray mats and on our flyers. If you follow our advertising, we've been very high on focusing on food quality and food safety. Changing Environment The problems revolve around competition and changing consumers taste. Consumers have become more health conscious, and competitors have been more attuned to customer desire. As a result, McDonald's suffered a decline in its total sales revenue of 2.4 % and a drop in net income of 15% in 2014. This was the first decline in both figures in 33 years. It seems that McDonald's did a poor job of analyzing its environment and specially its customers and competitors. During the same time, some McDonald customers flourished, for example Sonic enjoyed a 7% increase in its sales and Chipotle recorded a large 20% increase. Other specialty burger restaurant such as Smash Burger have stolen business from McDonald's even though their burgers are priced a little higher than McDonald Burgers. The quality of these competitor's product is perceived to be higher and many are made to order and thus customized to the customer's desire. And, partly because the volume and complexity of McDonald menu item have grown, that time required for services has also increased. This change has been most evident in the 'drive-thru' lanes in which the wait time has grown by approximately 20% in recent years. Because of lack of understanding the changing market and competitive landscape, McDonald's was unable to be proactive and now is in a reactive mode. For example, in 2013, it decided to add chicken wings to its menu. Wings was so successfully at McDonald's in Hong Kong, and it imported its cayenne-chili pepper coating used there. The market test for the wings in Atlanta was successful, so the firm implemented a major campaign to sell them at its restaurant throughout the United States. The 8-week campaign was miserable failure (some referring to it as the Mighty wings debacle). Perhaps they were too spicy for the broad market but some believe that they were also too expensive at Dollar 1 per wing with the box of five rings costing Dollar 1 more than a similar number at KFC. Because of this problems McDonald hired a new CEO in 2015 hoping to overcome its woes. Page 34 The news CEO must act quickly. McDonald has recently announced that it is changing to use only chickens raised without antibiotic to be sensitive to human health concerns. It has also market tested custom hamburgers in Australia with success. In fact, Australia is one of McDonald's bright spot around the world. Sales have increased in Australia when they have fallen in the United States, Europe and Asia. Making major changes to the McDonald's menu is challenging partly because of scale and supply chain. It orders hundred-million-pound chicken each year, so it will take a few years to fully implement the changes to the antibiotic free chicken. Changing vegetable in happy meals (for example adding baby carrots and implementing new wraps which require additional vegetables like cucumber will take time because they require obtaining large-scale supplier that can provide the necessary quantity and quality at the right price and in the right locations McDonald was once a leader and now it is fighting from behind, trying to stem its downturn. It has to respond quickly and effectively to its external environment, especially its customers and competitors. The Pandemic McDonald's Corp on Tuesday reported a bigger than expected drop in global same-store sales as the burger chain's restaurants across the world were shut because of the COVID-19 pandemic, limiting operations to only drive-thru and delivery. Global same-store sales fell 23.9% for the second quarter ended June 30, 2021 dragged down by big international markets including the United Kingdom, France and Latin America. Analysts had forecast a 23.24% fall, according to IBES data from Refintiv in the United States, where it operates more than a third of its restaurants, same-restaurant sales fell 8.7%, but were better than the anticipated 9.97% fall, as most locations were able to stay open with drive-thru and delivery options. As lockdowns eased, sales improved and losses were not as bad, providing some optimism for a measured rebound. As lockdowns eased, sales improved and losses were not as bad, providing some optimism for a measured rebound. Restaurants have been struggling to cope with the changing dynamics and consumer behaviors around the health crisis, forcing them to simplify menus and shift largely to online and mobile orders for pickup, delivery and drive-thru. "Our strong drive-thru presence and the investments we've made in delivery and digital over the past few years have served us well through .. Dynamic of the changing external environment needs to be carefully assessed and strategy need to be formulated for McDonald to stay competitive in middle east. Page 414 Figure 2.3 Competitor Analysis Components Future Objectives How do our goals compare with our competitors' goals? Where will emphasis be placed in the future? What is the attitude toward risk? Current Strategy How are we currently competing? - Does their strategy support changes in the competitive structure? Response What will our competitors do in the future? Where do we hold an advantage over our competitors? How will this change our relationship with our competitors? Assumptions Do we assume the future will be volatile? Are we operating under a status quo? What assumptions do our competitors hold about the industry and themselves? Capabilities What are our strengths and weaknesses? How do we rate compared to our competitors

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock