Question: From the following data, perform a sensitivity analysis for the proposed project. From this analysis identify the major variables that should receive the most attention

From the following data, perform a sensitivity analysis for the proposed project. From this analysis identify the major variables that should receive the most attention before determining whether the project should be proceeded with. Initially you should determine the net present value of the project for order-of-magnitude (initial) estimates of the various parameters. You should then determine the effect of changes in the various parameters on the net present value calculation; this should be done quantitatively. Then comment on the results. Your sensitivity results should be presented in tabular form.

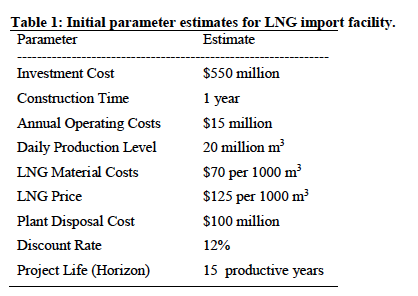

BHP Billiton was considering a $550 million investment in a liquefied natural gas (LNG) import facility off the coast of Sothern California. The company expected to supply 20 million cubic metres of natural gas per day beginning in 2008. For the order-of-magnitude analysis it may be assumed that production will occur for 300 days per year, allowing for maintenance and other downtime.

It may be assumed that the investment cost is paid according to the following schedule: $200 million at the beginning of year 1 and the remainder at the end of year 1, when the plant is completed.

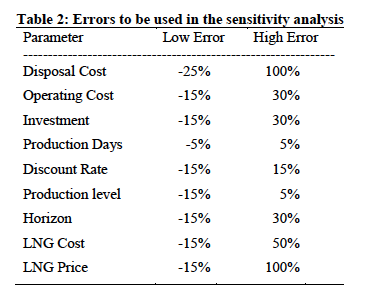

Engineers, finance and marketing personnel estimated that the above parameters could be in error by the amounts shown in Table 2.

In order to simplify the analysis, ignore the effects of taxation on your calculations the discount rate may be assumed to be inflation adjusted.

Table 1: Initial parameter estimates for LNG import facility. Estimate Parameter Investment Cost $550 million Construction Time 1 year Annual Operating Costs $15 million Daily Production Level 20 million m LNG Material Costs $70 per 1000 m $125 per 1000 m LNG Price Plant Disposal cost $100 million 12% Discount Rate Project Life (Horizon) 15 productive years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts