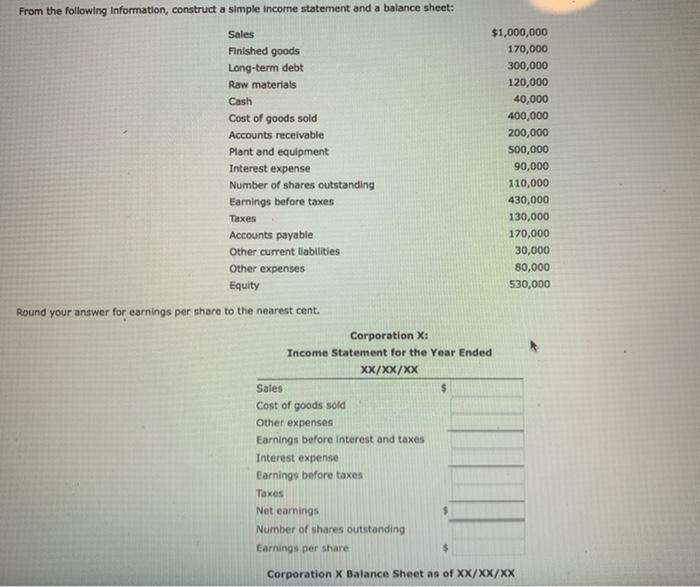

Question: From the following information, construct a simple income statement and a balance sheet: Sales $1,000,000 Finished goods 170,000 Long-term debt 300,000 Raw materials 120,000 Cash

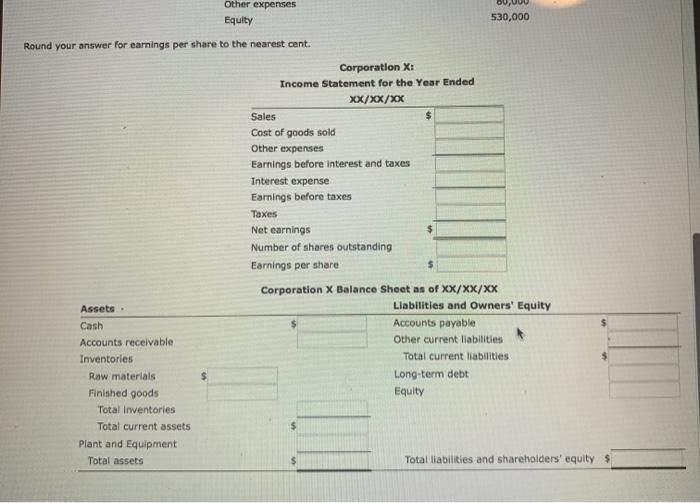

From the following information, construct a simple income statement and a balance sheet: Sales $1,000,000 Finished goods 170,000 Long-term debt 300,000 Raw materials 120,000 Cash 40,000 Cost of goods sold 400,000 Accounts receivable 200,000 Plant and equipment 500,000 Interest expense 90,000 Number of shares outstanding 110,000 Earnings before taxes 430,000 Taxes 130,000 Accounts payable 170,000 Other current liabilities 30,000 Other expenses 80,000 Equity 530,000 Round your answer for earnings per share to the nearest cent. Corporation X: Income Statement for the Year Ended XX/XX/XX Sales $ Cost of goods sold Other expenses Earnings before interest and taxes Interest expense Earnings before taxes Taxes Net earnings $ Number of shares outstanding Earnings per share $ Corporation X Balance Sheet as of XX/XX/XX Other expenses Equity 530,000 Round your answer for earnings per share to the nearest cent. Corporation X: Income Statement for the Year Ended XX/XX/XX Sales $ Cost of goods sold Other expenses Earnings before interest and taxes Interest expense Earnings before taxes Taxes Net earnings Number of shares outstanding Earnings per share Corporation X Balance Sheet as of XX/XX/XX Liabilities and Owners' Equity Accounts payable Other current liabilities Total current liabilities Long-term debt Equity Assets Cash Accounts receivable Inventories Raw materials Finished goods Total inventories Total current assets Plant and Equipment Total assets Total liabilities and shareholders' equity $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts