Question: From the information below, prepare a complete tax return with all supporting schedules. From the information below, prepare a complete tax return with all supporting

From the information below, prepare a complete tax return with all supporting schedules.

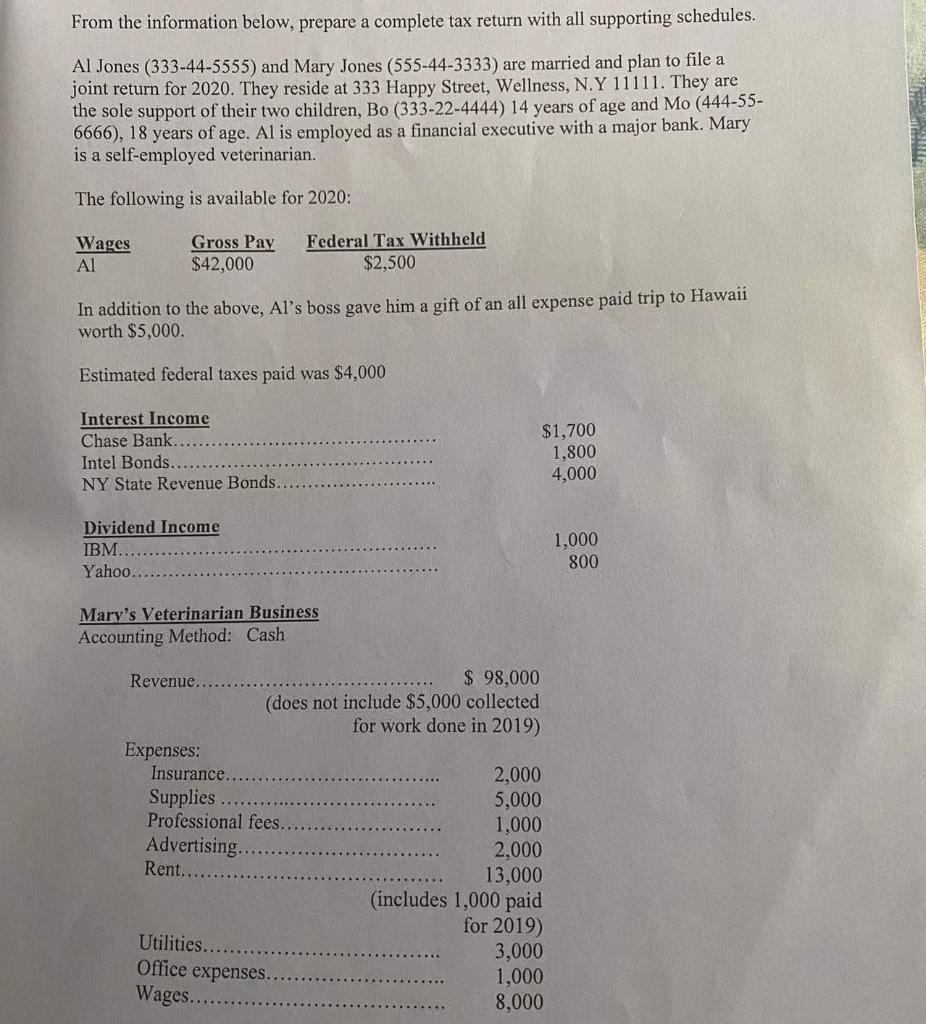

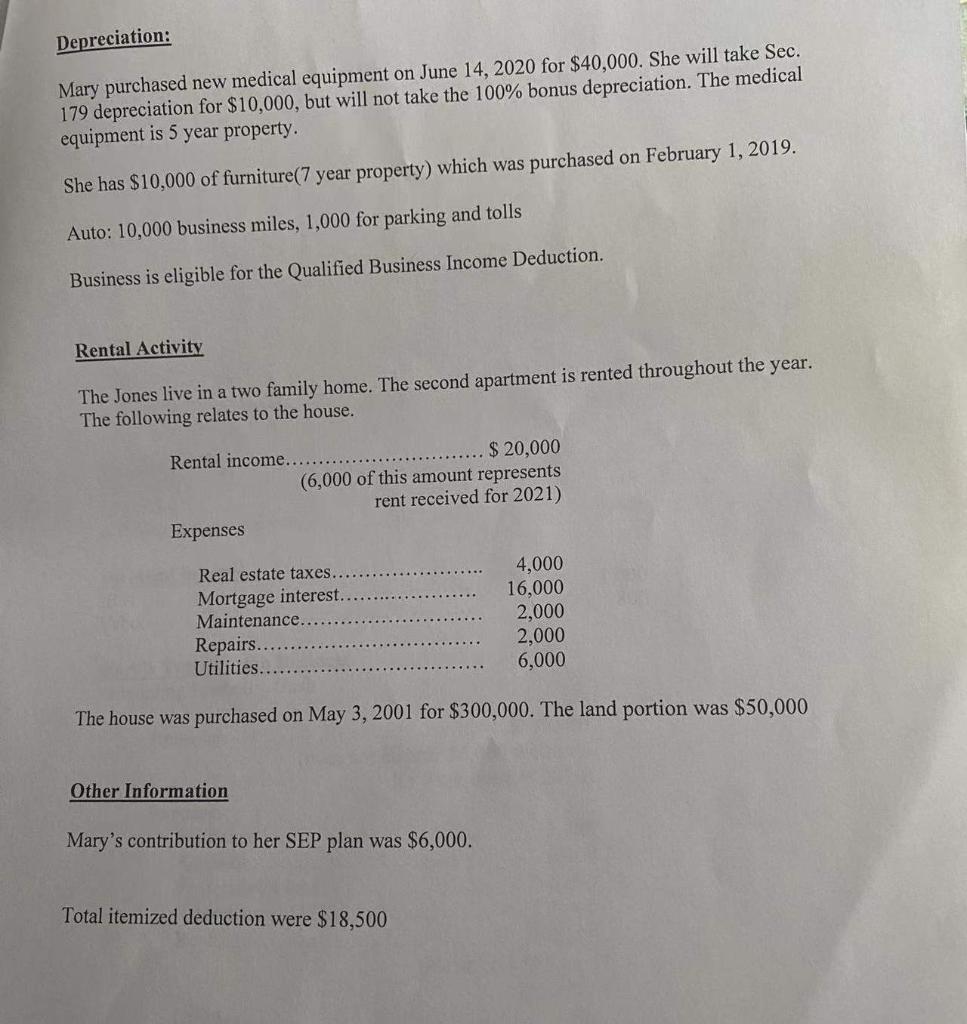

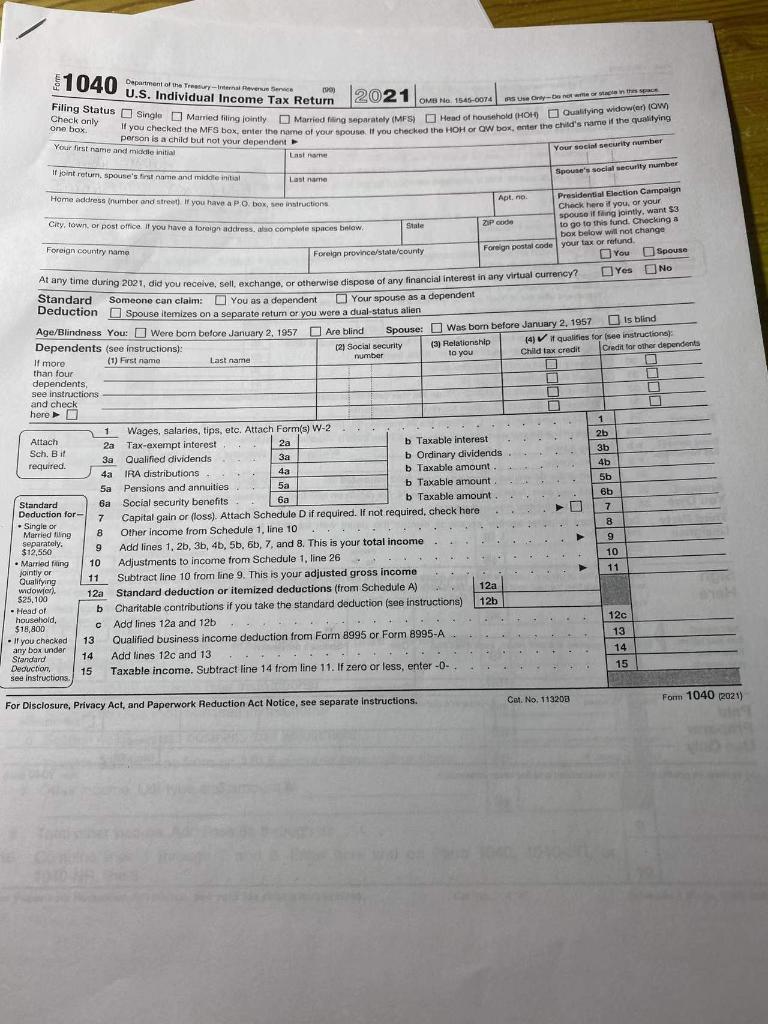

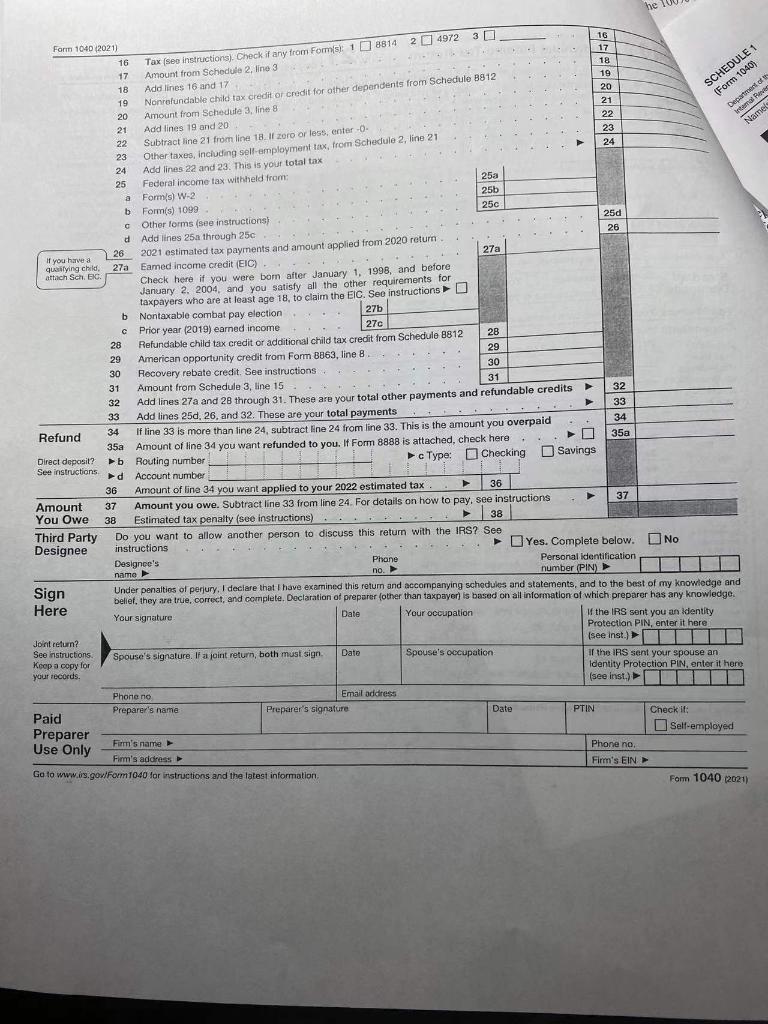

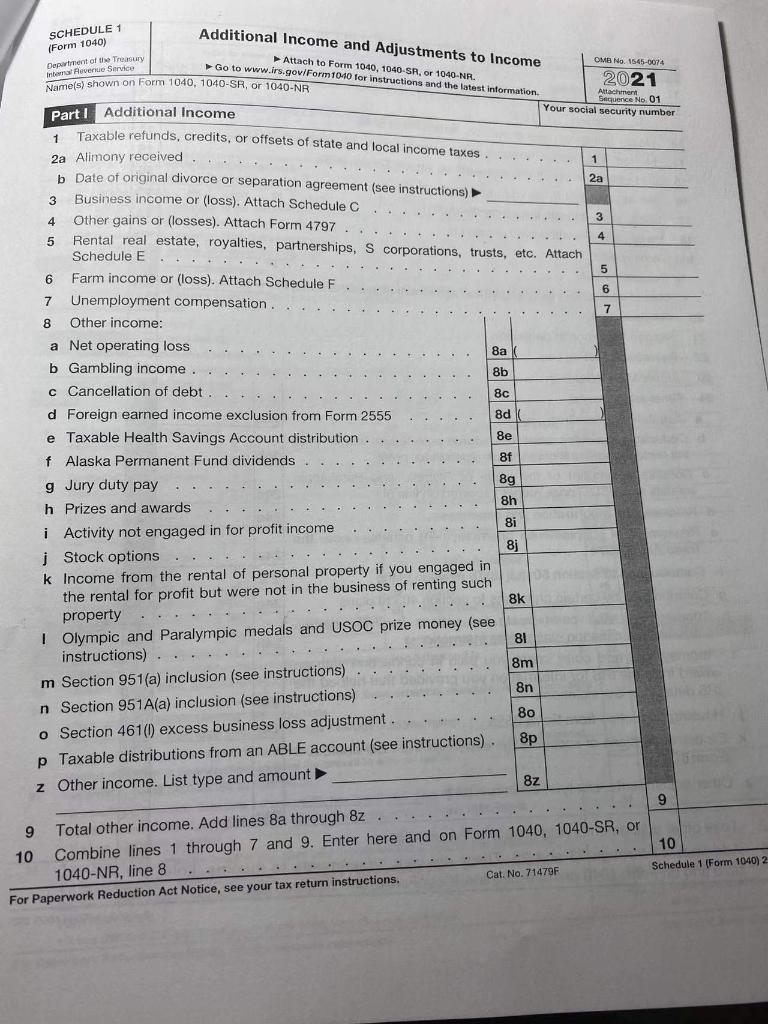

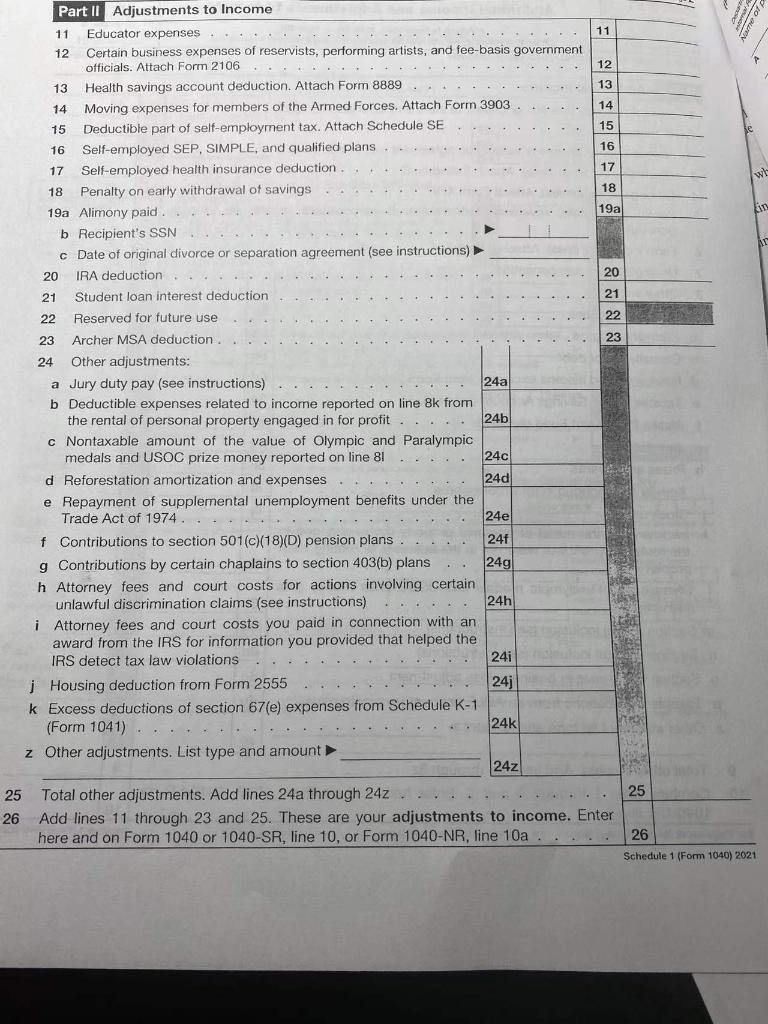

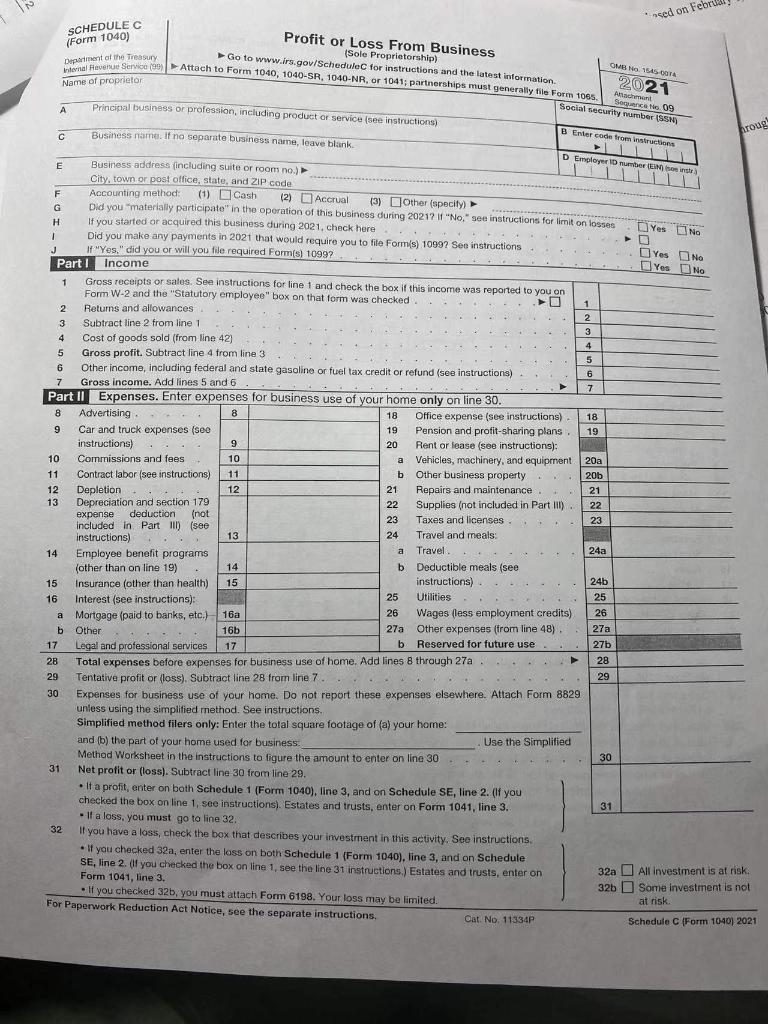

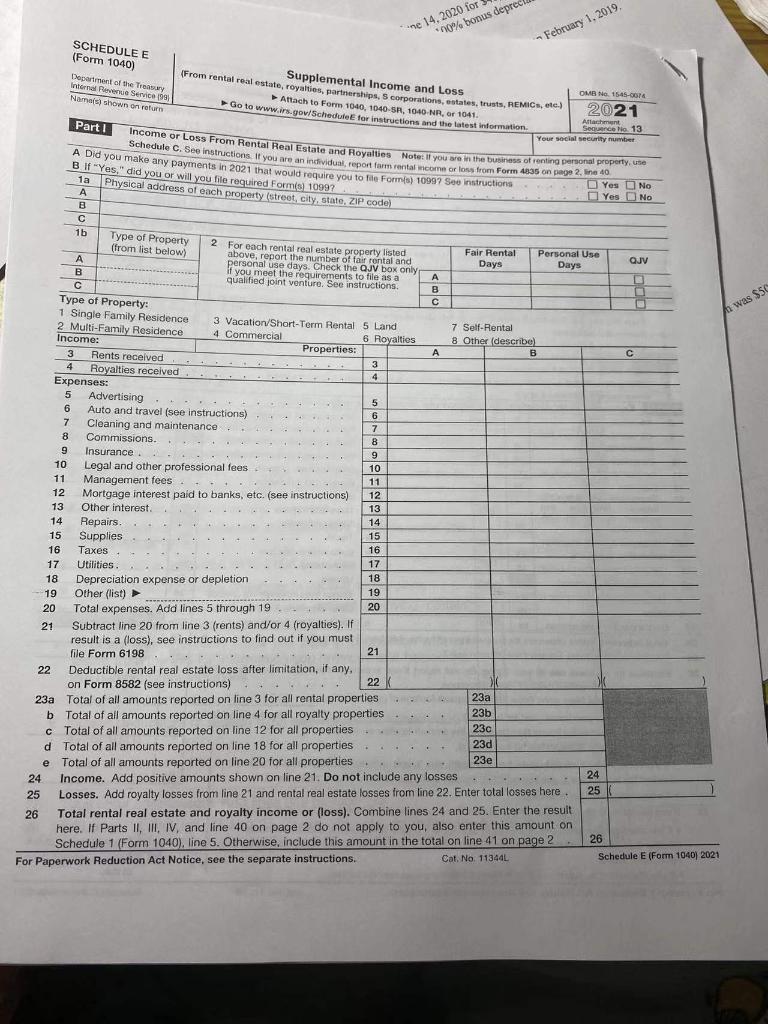

From the information below, prepare a complete tax return with all supporting schedules. Al Jones (333-44-5555) and Mary Jones (555-44-3333) are married and plan to file a joint return for 2020. They reside at 333 Happy Street, Wellness, N.Y 11111. They are the sole support of their two children, Bo (333-22-4444) 14 years of age and Mo (444-55- 6666), 18 years of age. Al is employed as a financial executive with a major bank. Mary is a self-employed veterinarian. The following is available for 2020: Wages Gross Pay $42,000 Federal Tax Withheld $2,500 In addition to the above, Al's boss gave him a gift of an all expense paid trip to Hawaii worth $5,000. Estimated federal taxes paid was $4,000 Interest Income Chase Bank Intel Bonds. NY State Revenue Bonds.. $1,700 1,800 4,000 Dividend Income IBM.. Yahoo... 1,000 800 Mary's Veterinarian Business Accounting Method: Cash Revenue.. $ 98,000 (does not include $5,000 collected for work done in 2019) Expenses: Insurance. 2,000 Supplies .... 5,000 Professional fees. 1,000 Advertising 2,000 Rent.... 13,000 (includes 1,000 paid for 2019) Utilities... 3,000 Office expenses. 1,000 Wages.. 8,000 Depreciation: Mary purchased new medical equipment on June 14, 2020 for $40,000. She will take Sec. 179 depreciation for $10,000, but will not take the 100% bonus depreciation. The medical equipment is 5 year property. She has $10,000 of furniture(7 year property) which was purchased on February 1, 2019. Auto: 10,000 business miles, 1,000 for parking and tolls Business is eligible for the Qualified Business Income Deduction. Rental Activity The Jones live in a two family home. The second apartment is rented throughout the year. The following relates to the house. Rental income.. $ 20,000 (6,000 of this amount represents rent received for 2021) Expenses Real estate taxes. Mortgage interest. Maintenance. Repairs... Utilities.. 4,000 16,000 2,000 2,000 6,000 The house was purchased on May 3, 2001 for $300,000. The land portion was $50,000 Other Information Mary's contribution to her SEP plan was $6,000. Total itemized deduction were $18,500 $1040 u.s. Individual Income Tax Return 2021 user or paint mo U.S. OMB No 1545-0074 Filing Status Single Married fiting jointly Married filing separately (MFS) Head of household (HOH Oualifying widower) (OW) one box If you checked the MFS box, enter the name of your spouse. If you checked the HOH or w box, enter the child's name if the quallying person is a child but not your dependent Your first name and middle initial taste Check only Your social security number Spouse's social security number If joint return, spouse's first name and middle initial Last name Home address number and street I you have a PO box, see instructions Apt.no Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below spouse iffing jointly, want 53 State ZIP code to go to this tund. Checking a box below will not change Foreign country name Foreign province/stat/county Foreign postal code your tax or refund You Spouse At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent : Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual status alien Is blind Age/Blindness You Were bom before January 2, 1957 Are blind Spouse: Was born before January 2, 1957 Dependents (see instructions): (2) Social security (3) Relationship (4) qualifies for see instructions: Credit for other dependents Child tax credit If more (1) First name number Last name to you than four dependents see instructions and check here 1 1 Wages, salaries, tips, etc. Attach Form(s) W-2.. s Attach 2a 2b 2a Tax-exempt interest b Taxable interest Sch. Bil 3b 3a Qualified dividends b Ordinary dividends... required. 4b 4a IRA distributions b Taxable amount. 4a 5a 5b 5a Pensions and annuities b Taxable amount Standard 6a Social security benefits 6a b Taxable amount 6b Deduction for- 7 7 Capital gain or loss). Attach Schedule D if required. If not required, check here - Single or 8 8 Married fing 8 Other Income from Schedule 1, line 10 ...... separately. 9 9 $12,550 9 Add lines 1, 2, 3, 4, 5, 6, 7, and 8. This is your total income 10 fining 10 Adjustments to income from Schedule 1. line 26 jounty or 11 Qualifying 11 Subtract line 10 from line 9. This is your adjusted gross income widower) 12a Standard deduction or itemized deductions (from Schedule A) 12a $25,100 12b - Head of b Charitable contributions if you take the standard deduction (see instructions) household, $18,800 Add lines 12a and 12b 12c - If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 12c and 13 14 Deduction 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -- 15 see instructions FA 8988 M c Con No. 113203 Fonn 1040 (202) For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. he 100 SCHEDULE 1 Form 1040) Departments Intel Namels Form 1040 (2021) 16 : 17 16 Tax (see instructions). Check if any trom Forms 1 8814 24972 30 18 17 Amount from Schedule 2, line 3 19 18 Add lines 16 and 17 20 19 Nonrolundable child tax credit or credit for other dependents from Schedule 8812 21 20 Amount from Schedule 3, line 8 22 21 Add lines 19 and 20 23 22 Subtract line 21 from line 18. Il zoro or less enter-O. 24 23 Other taxes, including sell-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23. This is your total tax 25 Federal income tax withheld from 25a a Forms) W-2 25b b Form(s) 1099 25c Other forms (see instructions) 25d d Add lines 25a through 250 26 If you have a 26 2021 estimated tax payments and amount applied from 2020 return 27a quallying child, 27a Eamed Income credit (EIC). attach Sch. BC Check here if you were bom after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18, to claim the EIC. See instructions b b Nontaxable combat pay election 27b Prior year (2019) earned income 27c 28 28 Refundable child tax credit or additional child tax credit from Schedule 8812 29 29 American opportunity credit from Form 3863, line 8 30 30 Recovery rebate credit. See instructions 31 | 31 Amount from Schedule 3, line 15 O 32 32 Add lines 27 and 28 through 31. These are your total other payments and refundable credits 33 33 Add lines 25d, 26, and 32. These are your total payments 34 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 35a 35a Amount of line 34 you want refunded to you. I Form 8888 is attached, check here Direct deposit? b Routing number c Type: Checking Savings See instructions Account number d 36 Amount of line 34 you want applied to your 2022 estimated tax 36 Amount 37 Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions 37 You Owe 38 Estimated tax penalty (see instructions)..... 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions - Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury. I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an identity Protection PIN, enter it here Jont return? ( (see Inst.)III See Instructions Spouse's signature. If a joint return, both must sign Date Kcop a copy for Spouse's occupation If the IRS sent your spouse an your records. Identity Protection PIN, enter it here (see inst.) Phone no Email address Preparer's name Paid Preparer's signature Date PTIN Check it Preparer Self-employed Firm's name Phone no. Fimm's address Go to www.lrs.gov/Form 1040 for instructions and the latest information Firm's EIN Form 1040 (2021) H Use Only Additional Income and Adjustments to Income OMB No 1545-0074 Attach to Form 1040, 040-SR, or 1040-NR. 2021 Go to www.irs.goviForm 1040 for instructions and the latest information Atan01 OR Your social security number Name(s) shown on Form 1040, 1040-SR, or 1040-NR SCHEDULE 1 (Form 1040) the Treasury 1 1 2a 3 4 5 6 7 8a 8c 8d 8e Part Additional Income Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received ...... b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or (osses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income: a Net operating loss b Gambling income. 8b c Cancellation of debt d Foreign earned income exclusion from Form 2555 e Taxable Health Savings Account distribution f Alaska Permanent Fund dividends 8f g Jury duty pay 8g 8h h Prizes and awards 8i i Activity not engaged in for profit income 8j i Stock options .. k Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such 8k property.. 1 Olympic and Paralympic medals and USOC prize money (see 81 instructions).... 8m m Section 951(a) inclusion (see instructions) 8n n Section 951A(a) inclusion (see instructions) 80 o Section 461() excess business loss adjustment. 8p p Taxable distributions from an ABLE account (see instructions) z Other income. List type and amount 8z 9 9 Total other income. Add lines Ba through 8z 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 71479F 10 Schedule 1 (Form 1040) 2 Part II Adjustments to Income 11 Educator expenses.... 11 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 12 13 Health savings account deduction. Attach Form 8889 13 14 Moving expenses for members of the Armed Forces. Attach Form 3903 14 15 Deductible part of self-employment tax. Attach Schedule SE 15 16 Self-employed SEP, SIMPLE, and qualified plans 16 17 Self-employed health insurance deduction 17 18 Penalty on early withdrawal of savings 18 19a Alimony paid. 19a 10 b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 20 IRA deduction 20 21 Student loan interest deduction 21 22 Reserved for future use 22 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) 24al b Deductible expenses related to income reported on line 8k from the rental of personal property engaged in for profit... 24b c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 81 24c d Reforestation amortization and expenses. 24d e Repayment of supplemental unemployment benefits under the Trade Act of 1974.. f Contributions to section 501(c)(18)(D) pension plans... 241 g Contributions by certain chaplains to section 403(b) plans 24g h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) 24h i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations 24i Housing deduction from Form 2555 24j k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) 24k z Other adjustments. List type and amount 242 25 Total other adjustments. Add lines 24a through 24z... 25 26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a..... 26 Schedule 1 (Form 1040) 2021 24el nsed on Februid SCHEDULEC (Form 1040) Profit or Loss From Business (Sole Proprietorship) Go to www.irs.gov/Schedule for instructions and the latest information Pen Fever Service Attach to Form 1040, 1040-SR. 1040-NR. or 1041; partnerships must generally tile Form 1055 Department of the Treasury OM NO 7545 OOTA Name of proprietor 2021 Patachment Sequence No.09 Social security amber (5 A Principal business or profession, including product or service (see instructions) Business name. If no separate business name, leave blank broug C C B Enter code from instructions LU D Employer ID number (Einste ULLLLL Yes No Yes No Yes No E Business address (including suite or room no.) City, town or post office, state, and ZIP code F F Accounting method: (1) Cash (2) Accrual Did you materially participate in the operation of this business during 2021? If "No." see instructions for limit on losset G (3) other (specity) H If you started or acquired this business during 2021. check here Did you make any payments in 2021 that would require you to file Forms) 1099? See instructions J 14 "Yes." did you or will you file required Form(s) 10997 Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked O 2 Returns and allowances 1 2 3 Subtract line 2 from line 1 3 4 Cost of goods sold (from line 42) 4 5 Gross profit. Subtract line 4 from line 3 5 5 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 6 6 7 Gross income. Add lines 5 and 6 7 7 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising 8 18 Office expense (see instructions) 18 9 Car and truck expenses (seo 19 Pension and profit-sharing plans. 19 instructions) 9 20 Rent or lease (see instructions): 10 Commissions and fees 10 a Vehicles, machinery, and equipment 20a 11 Contract labor see instructions) 11 b Other business property 20b 12 Depletion 12 21 Repairs and maintenance 21 13 Depreciation and section 179 22 Supplies (not included in Part II) 22 expense deduction (not 23 Taxes and licenses... 23 included in Part III) (see instructions) 13 24 Travel and meals: To 14 Employee benefit programs Travel 24a (other than on line 19) 14 b b Deductible meals (see 15 Insurance (other than health) 15 instructions) 24b 16 Interest (see instructions): 25 Utilities 25 a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits) 26 b Other 16b 27a Other expenses (from line 48). 27a 17 Legal and professional services 27b 17 b Reserved for future use 28 Thai neeh Total expenses before expenses for business use of home. Add lines 8 through 27a 28 29 29 Tentative profit or loss). Subtract line 28 from line 7. 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only: Enter the total square footage of (a) your home: and b) the part of your home used for business Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 31 Net profit or loss). Subtract line 30 from line 29 It a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (if you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 - If a loss, you must go to line 32 32 If you have a loss, check the box that describes your investment in this activity. See instructions. . If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on 32a All Investment is at risk. Form 1041, line 3 - If you checked 32b, you must attach Form 6198. Your loss may be limited. 326 Some Investment is not at risk. For Paperwork Reduction Act Notice, see the separate instructions Cat No. 11334P Schedule C (Form 1040) 2021 a ne 14.2020 for *50% bonus deprec February 1.2019 SCHEDULE E (Form 1040) Department of the Treasury more Revue Service 1991 Namns shown on return Supplemental Income and Loss (From rental real estate, royalties, partnerships, corporations, ootates, trusts, REMIC, etc.) Attach to Form 1040, 1040-5A, 1040 NR or 1041 Go to www.irs.gov/Schedule for instructions and the latest information OMB No 1545-0074 2021 Atlant Part Serchio 13 i was $50 income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property.us Your social security number Schedule C See instructions. If you are an individual report for rental income or loss from Form 4835 on page 2 line 40 A Did you make any payments in 2021 that would require you to file Formis) 10097 Soe instructions B If "Yes," did you or will you file required Formis) 1099? 1a Physical address of each property (street, city, state, ZIP code) Yes No A Yes No B 1b Type of Property (from list below) 2 For each rental real estate property listed Fair Rental Personal Use above, report the number of fair rental and QJV A personal use days. Check the QJV box only Days Days B if you meet the requirements to file as a A qualified joint venture. See instructions. B B Type of Property 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 2 Multi-Family Residence 7 Self-Rental 4 Commercial Income: 6 Royalties 8 Other (describe Properties: A B 3 Pents received 3 3 4 Royalties received 4 4 Expenses: 5 Advertising 5 6 Auto and travel (see instructions) 6 6 7 Cleaning and maintenance 7 8 Commissions. .. 8 9 Insurance 9 10 Legal and other professional fees 10 11 Management fees . 11 12 Mortgage interest paid to banks, etc. (see instructions) 12 13 Other interest 13 14 14 Repairs. 15 Supplies 15 16 16 Taxes 17 Utilities 17 18 18 Depreciation expense or depletion 19 19 Other (list) 20 20 Total expenses. Add lines 5 through 19. 21 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must 21 file Form 6198 ..... 22 Deductible rental real estate loss after limitation, if any, 22 on Form 8582 (see instructions) + + 23a 23a Total of all amounts reported on line 3 for all rental properties 23b b Total of all amounts reported on line 4 for all royalty properties 230 c Total of all amounts reported on line 12 for all properties 23d d Total of all amounts reported on line 18 for all properties mounts reported 23e e Total of all amounts reported on line 20 for all properties 24 24 Income. Add positive amounts shown on line 21. Do not include any losses 25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses here 26 Total rental real estate and royalty income or (loss). Combine lines 24 and 25. Enter the result here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on 26 Schedule 1 (Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2 Cat, No. 11344L Schedule E (Form 1040) 2021 For Paperwork Reduction Act Notice, see the separate instructions. 25 From the information below, prepare a complete tax return with all supporting schedules. Al Jones (333-44-5555) and Mary Jones (555-44-3333) are married and plan to file a joint return for 2020. They reside at 333 Happy Street, Wellness, N.Y 11111. They are the sole support of their two children, Bo (333-22-4444) 14 years of age and Mo (444-55- 6666), 18 years of age. Al is employed as a financial executive with a major bank. Mary is a self-employed veterinarian. The following is available for 2020: Wages Gross Pay $42,000 Federal Tax Withheld $2,500 In addition to the above, Al's boss gave him a gift of an all expense paid trip to Hawaii worth $5,000. Estimated federal taxes paid was $4,000 Interest Income Chase Bank Intel Bonds. NY State Revenue Bonds.. $1,700 1,800 4,000 Dividend Income IBM.. Yahoo... 1,000 800 Mary's Veterinarian Business Accounting Method: Cash Revenue.. $ 98,000 (does not include $5,000 collected for work done in 2019) Expenses: Insurance. 2,000 Supplies .... 5,000 Professional fees. 1,000 Advertising 2,000 Rent.... 13,000 (includes 1,000 paid for 2019) Utilities... 3,000 Office expenses. 1,000 Wages.. 8,000 Depreciation: Mary purchased new medical equipment on June 14, 2020 for $40,000. She will take Sec. 179 depreciation for $10,000, but will not take the 100% bonus depreciation. The medical equipment is 5 year property. She has $10,000 of furniture(7 year property) which was purchased on February 1, 2019. Auto: 10,000 business miles, 1,000 for parking and tolls Business is eligible for the Qualified Business Income Deduction. Rental Activity The Jones live in a two family home. The second apartment is rented throughout the year. The following relates to the house. Rental income.. $ 20,000 (6,000 of this amount represents rent received for 2021) Expenses Real estate taxes. Mortgage interest. Maintenance. Repairs... Utilities.. 4,000 16,000 2,000 2,000 6,000 The house was purchased on May 3, 2001 for $300,000. The land portion was $50,000 Other Information Mary's contribution to her SEP plan was $6,000. Total itemized deduction were $18,500 $1040 u.s. Individual Income Tax Return 2021 user or paint mo U.S. OMB No 1545-0074 Filing Status Single Married fiting jointly Married filing separately (MFS) Head of household (HOH Oualifying widower) (OW) one box If you checked the MFS box, enter the name of your spouse. If you checked the HOH or w box, enter the child's name if the quallying person is a child but not your dependent Your first name and middle initial taste Check only Your social security number Spouse's social security number If joint return, spouse's first name and middle initial Last name Home address number and street I you have a PO box, see instructions Apt.no Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below spouse iffing jointly, want 53 State ZIP code to go to this tund. Checking a box below will not change Foreign country name Foreign province/stat/county Foreign postal code your tax or refund You Spouse At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent : Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual status alien Is blind Age/Blindness You Were bom before January 2, 1957 Are blind Spouse: Was born before January 2, 1957 Dependents (see instructions): (2) Social security (3) Relationship (4) qualifies for see instructions: Credit for other dependents Child tax credit If more (1) First name number Last name to you than four dependents see instructions and check here 1 1 Wages, salaries, tips, etc. Attach Form(s) W-2.. s Attach 2a 2b 2a Tax-exempt interest b Taxable interest Sch. Bil 3b 3a Qualified dividends b Ordinary dividends... required. 4b 4a IRA distributions b Taxable amount. 4a 5a 5b 5a Pensions and annuities b Taxable amount Standard 6a Social security benefits 6a b Taxable amount 6b Deduction for- 7 7 Capital gain or loss). Attach Schedule D if required. If not required, check here - Single or 8 8 Married fing 8 Other Income from Schedule 1, line 10 ...... separately. 9 9 $12,550 9 Add lines 1, 2, 3, 4, 5, 6, 7, and 8. This is your total income 10 fining 10 Adjustments to income from Schedule 1. line 26 jounty or 11 Qualifying 11 Subtract line 10 from line 9. This is your adjusted gross income widower) 12a Standard deduction or itemized deductions (from Schedule A) 12a $25,100 12b - Head of b Charitable contributions if you take the standard deduction (see instructions) household, $18,800 Add lines 12a and 12b 12c - If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 12c and 13 14 Deduction 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -- 15 see instructions FA 8988 M c Con No. 113203 Fonn 1040 (202) For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. he 100 SCHEDULE 1 Form 1040) Departments Intel Namels Form 1040 (2021) 16 : 17 16 Tax (see instructions). Check if any trom Forms 1 8814 24972 30 18 17 Amount from Schedule 2, line 3 19 18 Add lines 16 and 17 20 19 Nonrolundable child tax credit or credit for other dependents from Schedule 8812 21 20 Amount from Schedule 3, line 8 22 21 Add lines 19 and 20 23 22 Subtract line 21 from line 18. Il zoro or less enter-O. 24 23 Other taxes, including sell-employment tax, from Schedule 2, line 21 24 Add lines 22 and 23. This is your total tax 25 Federal income tax withheld from 25a a Forms) W-2 25b b Form(s) 1099 25c Other forms (see instructions) 25d d Add lines 25a through 250 26 If you have a 26 2021 estimated tax payments and amount applied from 2020 return 27a quallying child, 27a Eamed Income credit (EIC). attach Sch. BC Check here if you were bom after January 1, 1998, and before January 2, 2004, and you satisfy all the other requirements for taxpayers who are at least age 18, to claim the EIC. See instructions b b Nontaxable combat pay election 27b Prior year (2019) earned income 27c 28 28 Refundable child tax credit or additional child tax credit from Schedule 8812 29 29 American opportunity credit from Form 3863, line 8 30 30 Recovery rebate credit. See instructions 31 | 31 Amount from Schedule 3, line 15 O 32 32 Add lines 27 and 28 through 31. These are your total other payments and refundable credits 33 33 Add lines 25d, 26, and 32. These are your total payments 34 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid 35a 35a Amount of line 34 you want refunded to you. I Form 8888 is attached, check here Direct deposit? b Routing number c Type: Checking Savings See instructions Account number d 36 Amount of line 34 you want applied to your 2022 estimated tax 36 Amount 37 Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions 37 You Owe 38 Estimated tax penalty (see instructions)..... 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions - Yes. Complete below. No Designee's Phone Personal identification name no. number (PIN) Sign Under penalties of perjury. I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Here Your signature Date Your occupation If the IRS sent you an identity Protection PIN, enter it here Jont return? ( (see Inst.)III See Instructions Spouse's signature. If a joint return, both must sign Date Kcop a copy for Spouse's occupation If the IRS sent your spouse an your records. Identity Protection PIN, enter it here (see inst.) Phone no Email address Preparer's name Paid Preparer's signature Date PTIN Check it Preparer Self-employed Firm's name Phone no. Fimm's address Go to www.lrs.gov/Form 1040 for instructions and the latest information Firm's EIN Form 1040 (2021) H Use Only Additional Income and Adjustments to Income OMB No 1545-0074 Attach to Form 1040, 040-SR, or 1040-NR. 2021 Go to www.irs.goviForm 1040 for instructions and the latest information Atan01 OR Your social security number Name(s) shown on Form 1040, 1040-SR, or 1040-NR SCHEDULE 1 (Form 1040) the Treasury 1 1 2a 3 4 5 6 7 8a 8c 8d 8e Part Additional Income Taxable refunds, credits, or offsets of state and local income taxes 2a Alimony received ...... b Date of original divorce or separation agreement (see instructions) 3 Business income or (loss). Attach Schedule C 4 Other gains or (osses). Attach Form 4797 5 Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E 6 Farm income or (loss). Attach Schedule F 7 Unemployment compensation 8 Other income: a Net operating loss b Gambling income. 8b c Cancellation of debt d Foreign earned income exclusion from Form 2555 e Taxable Health Savings Account distribution f Alaska Permanent Fund dividends 8f g Jury duty pay 8g 8h h Prizes and awards 8i i Activity not engaged in for profit income 8j i Stock options .. k Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such 8k property.. 1 Olympic and Paralympic medals and USOC prize money (see 81 instructions).... 8m m Section 951(a) inclusion (see instructions) 8n n Section 951A(a) inclusion (see instructions) 80 o Section 461() excess business loss adjustment. 8p p Taxable distributions from an ABLE account (see instructions) z Other income. List type and amount 8z 9 9 Total other income. Add lines Ba through 8z 10 Combine lines 1 through 7 and 9. Enter here and on Form 1040, 1040-SR, or 1040-NR, line 8 For Paperwork Reduction Act Notice, see your tax return instructions. Cat No. 71479F 10 Schedule 1 (Form 1040) 2 Part II Adjustments to Income 11 Educator expenses.... 11 12 Certain business expenses of reservists, performing artists, and fee-basis government officials. Attach Form 2106 12 13 Health savings account deduction. Attach Form 8889 13 14 Moving expenses for members of the Armed Forces. Attach Form 3903 14 15 Deductible part of self-employment tax. Attach Schedule SE 15 16 Self-employed SEP, SIMPLE, and qualified plans 16 17 Self-employed health insurance deduction 17 18 Penalty on early withdrawal of savings 18 19a Alimony paid. 19a 10 b Recipient's SSN c Date of original divorce or separation agreement (see instructions) 20 IRA deduction 20 21 Student loan interest deduction 21 22 Reserved for future use 22 23 Archer MSA deduction 24 Other adjustments: a Jury duty pay (see instructions) 24al b Deductible expenses related to income reported on line 8k from the rental of personal property engaged in for profit... 24b c Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 81 24c d Reforestation amortization and expenses. 24d e Repayment of supplemental unemployment benefits under the Trade Act of 1974.. f Contributions to section 501(c)(18)(D) pension plans... 241 g Contributions by certain chaplains to section 403(b) plans 24g h Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) 24h i Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations 24i Housing deduction from Form 2555 24j k Excess deductions of section 67(e) expenses from Schedule K-1 (Form 1041) 24k z Other adjustments. List type and amount 242 25 Total other adjustments. Add lines 24a through 24z... 25 26 Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, line 10, or Form 1040-NR, line 10a..... 26 Schedule 1 (Form 1040) 2021 24el nsed on Februid SCHEDULEC (Form 1040) Profit or Loss From Business (Sole Proprietorship) Go to www.irs.gov/Schedule for instructions and the latest information Pen Fever Service Attach to Form 1040, 1040-SR. 1040-NR. or 1041; partnerships must generally tile Form 1055 Department of the Treasury OM NO 7545 OOTA Name of proprietor 2021 Patachment Sequence No.09 Social security amber (5 A Principal business or profession, including product or service (see instructions) Business name. If no separate business name, leave blank broug C C B Enter code from instructions LU D Employer ID number (Einste ULLLLL Yes No Yes No Yes No E Business address (including suite or room no.) City, town or post office, state, and ZIP code F F Accounting method: (1) Cash (2) Accrual Did you materially participate in the operation of this business during 2021? If "No." see instructions for limit on losset G (3) other (specity) H If you started or acquired this business during 2021. check here Did you make any payments in 2021 that would require you to file Forms) 1099? See instructions J 14 "Yes." did you or will you file required Form(s) 10997 Part I Income 1 Gross receipts or sales. See instructions for line 1 and check the box if this income was reported to you on Form W-2 and the "Statutory employee" box on that form was checked O 2 Returns and allowances 1 2 3 Subtract line 2 from line 1 3 4 Cost of goods sold (from line 42) 4 5 Gross profit. Subtract line 4 from line 3 5 5 6 Other income, including federal and state gasoline or fuel tax credit or refund (see instructions) 6 6 7 Gross income. Add lines 5 and 6 7 7 Part II Expenses. Enter expenses for business use of your home only on line 30. 8 Advertising 8 18 Office expense (see instructions) 18 9 Car and truck expenses (seo 19 Pension and profit-sharing plans. 19 instructions) 9 20 Rent or lease (see instructions): 10 Commissions and fees 10 a Vehicles, machinery, and equipment 20a 11 Contract labor see instructions) 11 b Other business property 20b 12 Depletion 12 21 Repairs and maintenance 21 13 Depreciation and section 179 22 Supplies (not included in Part II) 22 expense deduction (not 23 Taxes and licenses... 23 included in Part III) (see instructions) 13 24 Travel and meals: To 14 Employee benefit programs Travel 24a (other than on line 19) 14 b b Deductible meals (see 15 Insurance (other than health) 15 instructions) 24b 16 Interest (see instructions): 25 Utilities 25 a Mortgage (paid to banks, etc.) 16a 26 Wages (less employment credits) 26 b Other 16b 27a Other expenses (from line 48). 27a 17 Legal and professional services 27b 17 b Reserved for future use 28 Thai neeh Total expenses before expenses for business use of home. Add lines 8 through 27a 28 29 29 Tentative profit or loss). Subtract line 28 from line 7. 30 Expenses for business use of your home. Do not report these expenses elsewhere. Attach Form 8829 unless using the simplified method. See instructions. Simplified method filers only: Enter the total square footage of (a) your home: and b) the part of your home used for business Use the Simplified Method Worksheet in the instructions to figure the amount to enter on line 30 30 31 Net profit or loss). Subtract line 30 from line 29 It a profit, enter on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. (if you checked the box on line 1, see instructions). Estates and trusts, enter on Form 1041, line 3. 31 - If a loss, you must go to line 32 32 If you have a loss, check the box that describes your investment in this activity. See instructions. . If you checked 32a, enter the loss on both Schedule 1 (Form 1040), line 3, and on Schedule SE, line 2. If you checked the box on line 1, see the line 31 instructions.) Estates and trusts, enter on 32a All Investment is at risk. Form 1041, line 3 - If you checked 32b, you must attach Form 6198. Your loss may be limited. 326 Some Investment is not at risk. For Paperwork Reduction Act Notice, see the separate instructions Cat No. 11334P Schedule C (Form 1040) 2021 a ne 14.2020 for *50% bonus deprec February 1.2019 SCHEDULE E (Form 1040) Department of the Treasury more Revue Service 1991 Namns shown on return Supplemental Income and Loss (From rental real estate, royalties, partnerships, corporations, ootates, trusts, REMIC, etc.) Attach to Form 1040, 1040-5A, 1040 NR or 1041 Go to www.irs.gov/Schedule for instructions and the latest information OMB No 1545-0074 2021 Atlant Part Serchio 13 i was $50 income or Loss From Rental Real Estate and Royalties Note: If you are in the business of renting personal property.us Your social security number Schedule C See instructions. If you are an individual report for rental income or loss from Form 4835 on page 2 line 40 A Did you make any payments in 2021 that would require you to file Formis) 10097 Soe instructions B If "Yes," did you or will you file required Formis) 1099? 1a Physical address of each property (street, city, state, ZIP code) Yes No A Yes No B 1b Type of Property (from list below) 2 For each rental real estate property listed Fair Rental Personal Use above, report the number of fair rental and QJV A personal use days. Check the QJV box only Days Days B if you meet the requirements to file as a A qualified joint venture. See instructions. B B Type of Property 1 Single Family Residence 3 Vacation/Short-Term Rental 5 Land 2 Multi-Family Residence 7 Self-Rental 4 Commercial Income: 6 Royalties 8 Other (describe Properties: A B 3 Pents received 3 3 4 Royalties received 4 4 Expenses: 5 Advertising 5 6 Auto and travel (see instructions) 6 6 7 Cleaning and maintenance 7 8 Commissions. .. 8 9 Insurance 9 10 Legal and other professional fees 10 11 Management fees . 11 12 Mortgage interest paid to banks, etc. (see instructions) 12 13 Other interest 13 14 14 Repairs. 15 Supplies 15 16 16 Taxes 17 Utilities 17 18 18 Depreciation expense or depletion 19 19 Other (list) 20 20 Total expenses. Add lines 5 through 19. 21 Subtract line 20 from line 3 (rents) and/or 4 (royalties). If result is a (loss), see instructions to find out if you must 21 file Form 6198 ..... 22 Deductible rental real estate loss after limitation, if any, 22 on Form 8582 (see instructions) + + 23a 23a Total of all amounts reported on line 3 for all rental properties 23b b Total of all amounts reported on line 4 for all royalty properties 230 c Total of all amounts reported on line 12 for all properties 23d d Total of all amounts reported on line 18 for all properties mounts reported 23e e Total of all amounts reported on line 20 for all properties 24 24 Income. Add positive amounts shown on line 21. Do not include any losses 25 Losses. Add royalty losses from line 21 and rental real estate losses from line 22. Enter total losses here 26 Total rental real estate and royalty income or (loss). Combine lines 24 and 25. Enter the result here. If Parts II, III, IV, and line 40 on page 2 do not apply to you, also enter this amount on 26 Schedule 1 (Form 1040), line 5. Otherwise, include this amount in the total on line 41 on page 2 Cat, No. 11344L Schedule E (Form 1040) 2021 For Paperwork Reduction Act Notice, see the separate instructions. 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts