Question: From the information given how do I post to t-accounts for cash, accounts receivable, supplies, prepaid rent, prepaid insurance, office equipment, accounts payable, unearned revenue,

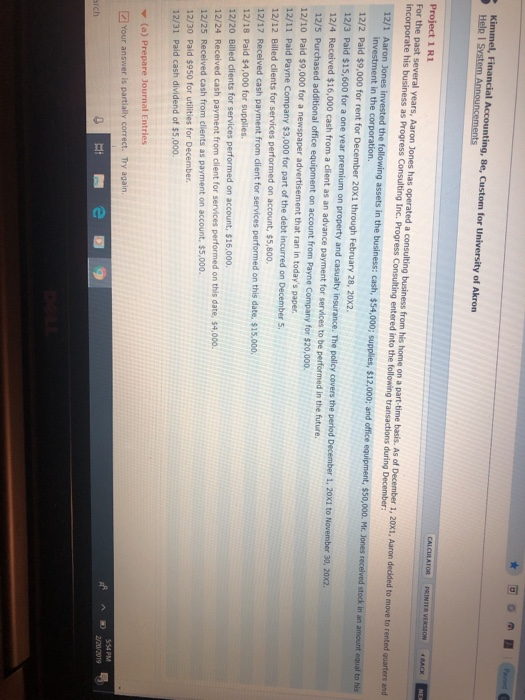

Help I Sys BACK 1 R1 For the past several years, Aaron Jones has operated a consulting business from his home on a part time basis. As of December 1, 20X1, incorporate his business as Progress Consulting Inc. Progress Consulting entered into the following transactions during December: Aaron decided to move to rented quarters and 12/1 Aaron Jones invested the following assets in the business: cash, $54,000; supplies, $12,000; and office equipment, $50,000. Mr. Jones received stock in an amount equal to his investment in the corporation. 12/2 Paid $9,000 for rent for December 20X1 through February 28, 20x2 12/3 Paid $15,600 for a one year premium on property and casualty insurance. The policy covers the period December 1, 20x1 to November 30, 20x2 12/4 Received $16,000 cash from a client as an advance payment for services to be performed in the future 12/5 Purchased additional office equipment on account from Payne Company for $20,000. 12/10 Paid $9,000 for a newspaper advertisement that ran in today's paper 12/11 Paid Payne Company $3,000 for part of the debt incurred on December S 12/12 Billed clients for services performed on account, $5,800. 12/17 Recel 12/18 Paid $4,000 for supplies. 12/20 Billed clients for services performed on account, $16,000. 12/24 Received cash payment from client for services performed on this date, $4,000. 12/25 Received cash from clients as payment on account, $5,000. 12/30 Paid $950 for utilities for December. 12/31 Paid cash dividend of $5,000o. ved cash payment from dlient for services performed on this date, $15.000. (a) Prepare Journal Entries 554 PM Your answer is partially correct. Try again. A 272 2019 rch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts