Question: From the Pre-closing Trial Balance and the two items listed below, complete the Budgetary Comparison Schedule. CREDITS 264.000 OTY OF BRIDGEVIEW GENERAL FUND PRECLOSING TRIAL

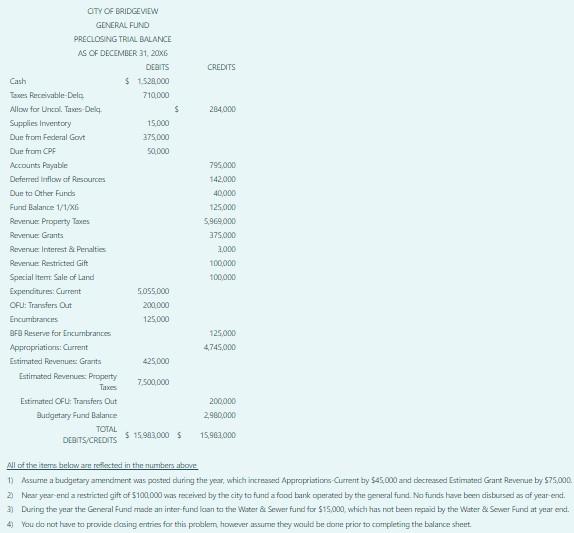

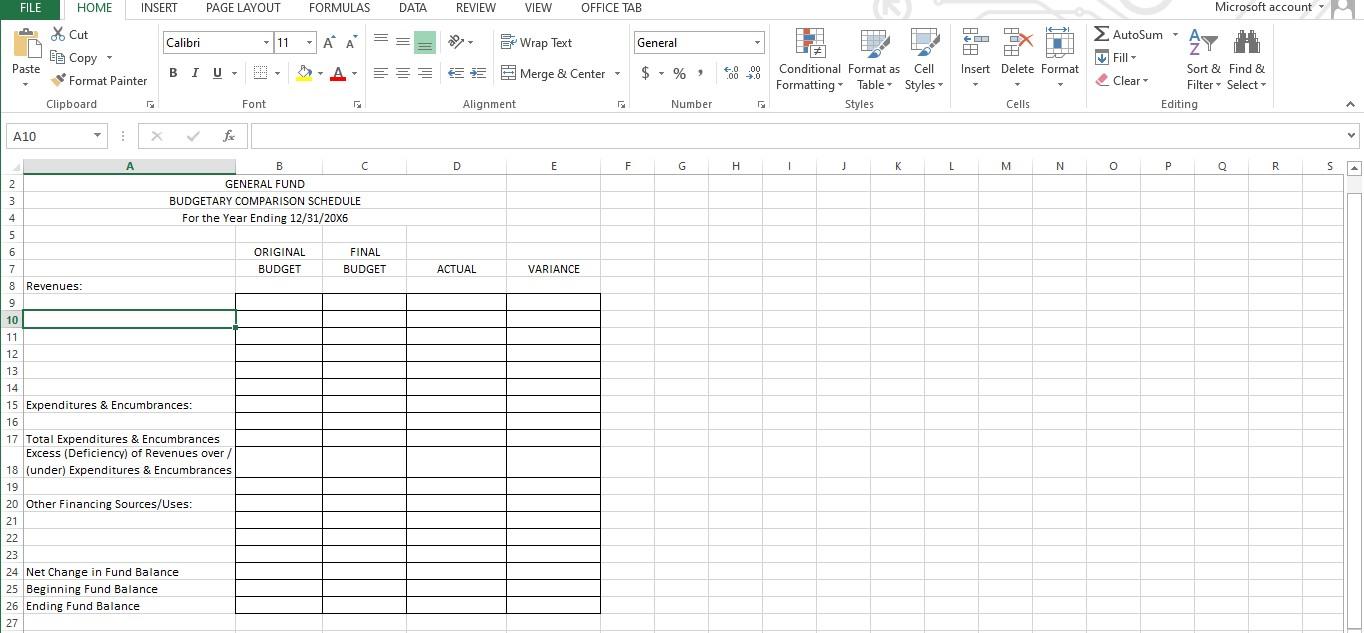

From the Pre-closing Trial Balance and the two items listed below, complete the Budgetary Comparison Schedule.

CREDITS 264.000 OTY OF BRIDGEVIEW GENERAL FUND PRECLOSING TRIAL BALANCE AS OF DECEMBER 31, 20X6 DEBITS Cash $ 120.000 Taxes Receivable Delo 710.000 Allow for Uncol Taxes Dela $ Supplies Inventory 15.000 Due from Federal Govt 275.000 Due from CPF 50.000 Accounts Payable Deferred inflow of Ressources Due to Other Funds Fland Balance 1/1/X6 Revenue Property Toes Revenue Grants Revenue Interest & Penalties Revenue Restricted Gift Specialiter Sale of Land Expenditures: Current 5.055.000 OFU: Transfers Out 200.000 Encurtirances 125.000 BFB Reserve for Ecumbrances Appropriations Current Estimated Revenue: Grants 425,000 Estimated Revenues. Property Taxes 7.500.000 Estimated OFL. Transfers Out Budgetary Fund Balance TOTAL DEBITS/CREDITS $15.983.000 $ 796.000 142,000 40,000 125.000 5.969.000 275.000 2,000 100,000 100.000 125.000 4745,000 200,000 2,980,000 15,962.000 All of the items below are reflected in the numbers above 1) Assume a budgetary amenciment was posted during the year, which increased Appropriations Current by $45.000 and decreased Estimated Grant Revenue by S75.000 2) Near year-end a restricted gift of 5100,000 was record by the city to fund a food barsk operated by the general fund No Fundsave been disbursed as of year end. 31 During the year the General Fund made an inter-fund ican to the Water & Sewer fund for $15.000, which has not been repaid by the Water & Sewer Fund at year end. 4 You do not have to provide desing entries for this problem however assume they would be done prior to completing the balance sheet FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW OFFICE TAB Microsoft account - 11 Calibri AutoSum - - A z Wrap Text General T IAI ED IT A H BI Insert Delete Format Fill - Cut LE Copy Format Painter Clipboard Paste BIU Y A- = 3 Merge & Center - $ Y % .00 .00 0 Conditional Format as Cell Formatting Table Styles Styles Clear Sort & Find & Filter - Select Editing Font Alignment Number Cells A A10 X for v D E F G H 1 J K L M N o P 0 R S 2 3 B C GENERAL FUND BUDGETARY COMPARISON SCHEDULE For the Year Ending 12/31/20X6 4 5 6 7 8 Revenues: 9 ORIGINAL BUDGET FINAL BUDGET ACTUAL VARIANCE 10 11 12 13 14 15 Expenditures & Encumbrances: 16 17 Total Expenditures & Encumbrances Excess (Deficiency) of Revenues over / 18 (under) Expenditures & Encumbrances 19 20 Other Financing Sources/Uses: 21 22 23 24 Net Change in Fund Balance 25 Beginning Fund Balance 26 Ending Fund Balance 27 CREDITS 264.000 OTY OF BRIDGEVIEW GENERAL FUND PRECLOSING TRIAL BALANCE AS OF DECEMBER 31, 20X6 DEBITS Cash $ 120.000 Taxes Receivable Delo 710.000 Allow for Uncol Taxes Dela $ Supplies Inventory 15.000 Due from Federal Govt 275.000 Due from CPF 50.000 Accounts Payable Deferred inflow of Ressources Due to Other Funds Fland Balance 1/1/X6 Revenue Property Toes Revenue Grants Revenue Interest & Penalties Revenue Restricted Gift Specialiter Sale of Land Expenditures: Current 5.055.000 OFU: Transfers Out 200.000 Encurtirances 125.000 BFB Reserve for Ecumbrances Appropriations Current Estimated Revenue: Grants 425,000 Estimated Revenues. Property Taxes 7.500.000 Estimated OFL. Transfers Out Budgetary Fund Balance TOTAL DEBITS/CREDITS $15.983.000 $ 796.000 142,000 40,000 125.000 5.969.000 275.000 2,000 100,000 100.000 125.000 4745,000 200,000 2,980,000 15,962.000 All of the items below are reflected in the numbers above 1) Assume a budgetary amenciment was posted during the year, which increased Appropriations Current by $45.000 and decreased Estimated Grant Revenue by S75.000 2) Near year-end a restricted gift of 5100,000 was record by the city to fund a food barsk operated by the general fund No Fundsave been disbursed as of year end. 31 During the year the General Fund made an inter-fund ican to the Water & Sewer fund for $15.000, which has not been repaid by the Water & Sewer Fund at year end. 4 You do not have to provide desing entries for this problem however assume they would be done prior to completing the balance sheet FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW OFFICE TAB Microsoft account - 11 Calibri AutoSum - - A z Wrap Text General T IAI ED IT A H BI Insert Delete Format Fill - Cut LE Copy Format Painter Clipboard Paste BIU Y A- = 3 Merge & Center - $ Y % .00 .00 0 Conditional Format as Cell Formatting Table Styles Styles Clear Sort & Find & Filter - Select Editing Font Alignment Number Cells A A10 X for v D E F G H 1 J K L M N o P 0 R S 2 3 B C GENERAL FUND BUDGETARY COMPARISON SCHEDULE For the Year Ending 12/31/20X6 4 5 6 7 8 Revenues: 9 ORIGINAL BUDGET FINAL BUDGET ACTUAL VARIANCE 10 11 12 13 14 15 Expenditures & Encumbrances: 16 17 Total Expenditures & Encumbrances Excess (Deficiency) of Revenues over / 18 (under) Expenditures & Encumbrances 19 20 Other Financing Sources/Uses: 21 22 23 24 Net Change in Fund Balance 25 Beginning Fund Balance 26 Ending Fund Balance 27

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts