Question: From the PVFIA and below can you please explain in more detail how you got your answers? I tried typing in the formula on my

From the PVFIA and below can you please explain in more detail how you got your answers? I tried typing in the formula on my financial calculator I think I am not getting the right answer because it won't work to put a ^-10. Additionally, for the number below 2,907,202.06 when I multiply the 557,350 and 5.21612 I am getting 2,907,204.48

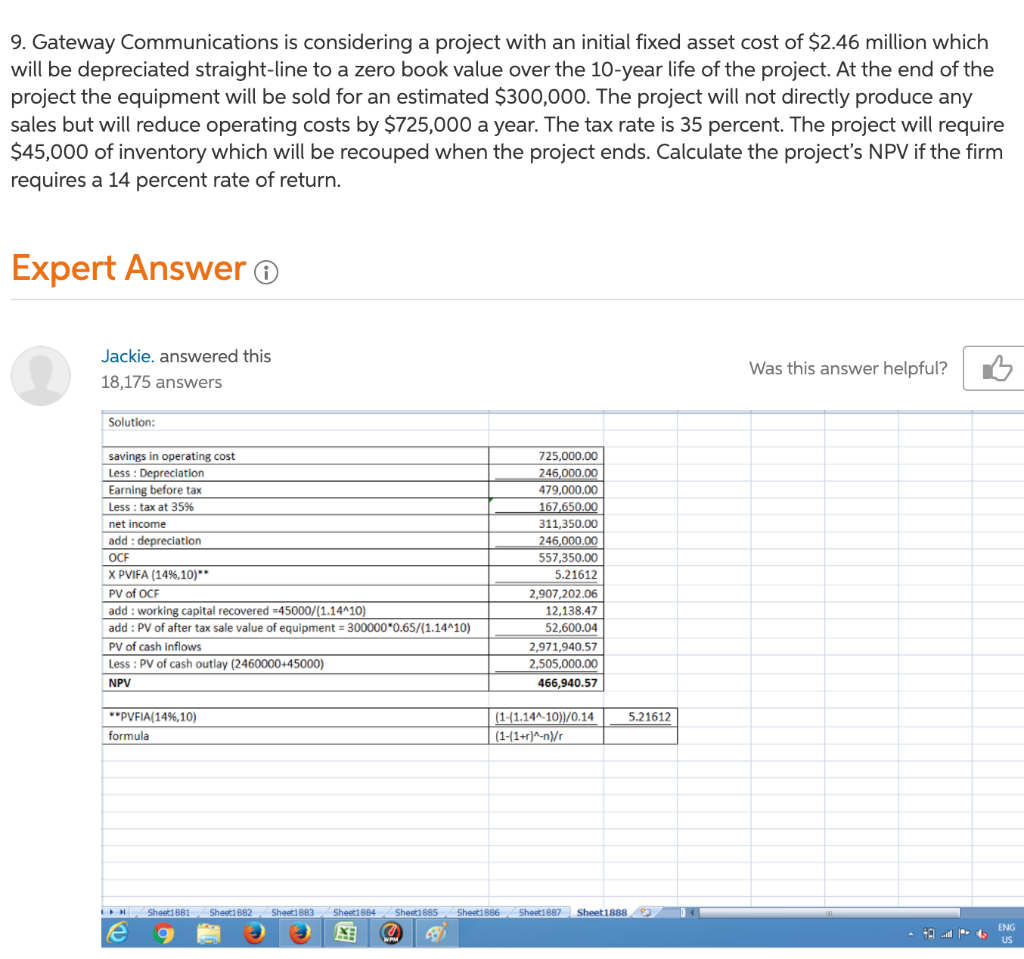

9. Gateway Communications is considering a project with an initial fixed asset cost of $2.46 million which will be depreciated straight-line to a zero book value over the 10-year life of the project. At the end of the project the equipment will be sold for an estimated $300,000. The project will not directly produce any sales but will reduce operating costs by $725,000 a year. The tax rate is 35 percent. The project will require $45,000 of inventory which will be recouped when the project ends. Calculate the project's NPV if the firm requires a 14 percent rate of return. Expert Answer o Jackie. answered this 18,175 answers Was this answer helpful? Solution: savings in operating cost Less : Depreciation Earning before tax Less : tax at 35% net income add : depreciation OCF X PVIFA (14%,10)" PV of OCE add : working capital recovered - 45000/(1.14-10) add : PV of after tax sale value of equipment = 300000*0.65/(1.14-10) PV of cash inflows Less : PV of cash outlay (2460000+45000) NPV 725,000.00 246,000.00 479,000.00 167,650.00 311,350.00 246,000.00 557,350.00 5.21612 2,907,202.06 12,138,47 52,600.04 2,971,940,57 2,505,000.00 466,940.57 5.21612 **PVFIA(14%,10) formula (1-(1.144.10)/0.14 (1-(1+r)^-n)/ Sheet1881 Sheet1882 Sheet1883 Sheet1884 Sheet1887 Sheet1888 e Sheet1885 Sheet1886 a ENG US

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts