Question: From the table above, analyze and interpret the calculated financial ratio for the Working Capital Ratio of Top Glove and Hartalega in 2020 as well

From the table above, analyze and interpret the calculated financial ratio for the Working Capital Ratio of Top Glove and Hartalega in 2020 as well as recommend which company should Salam Berhad invest in with proper justification.

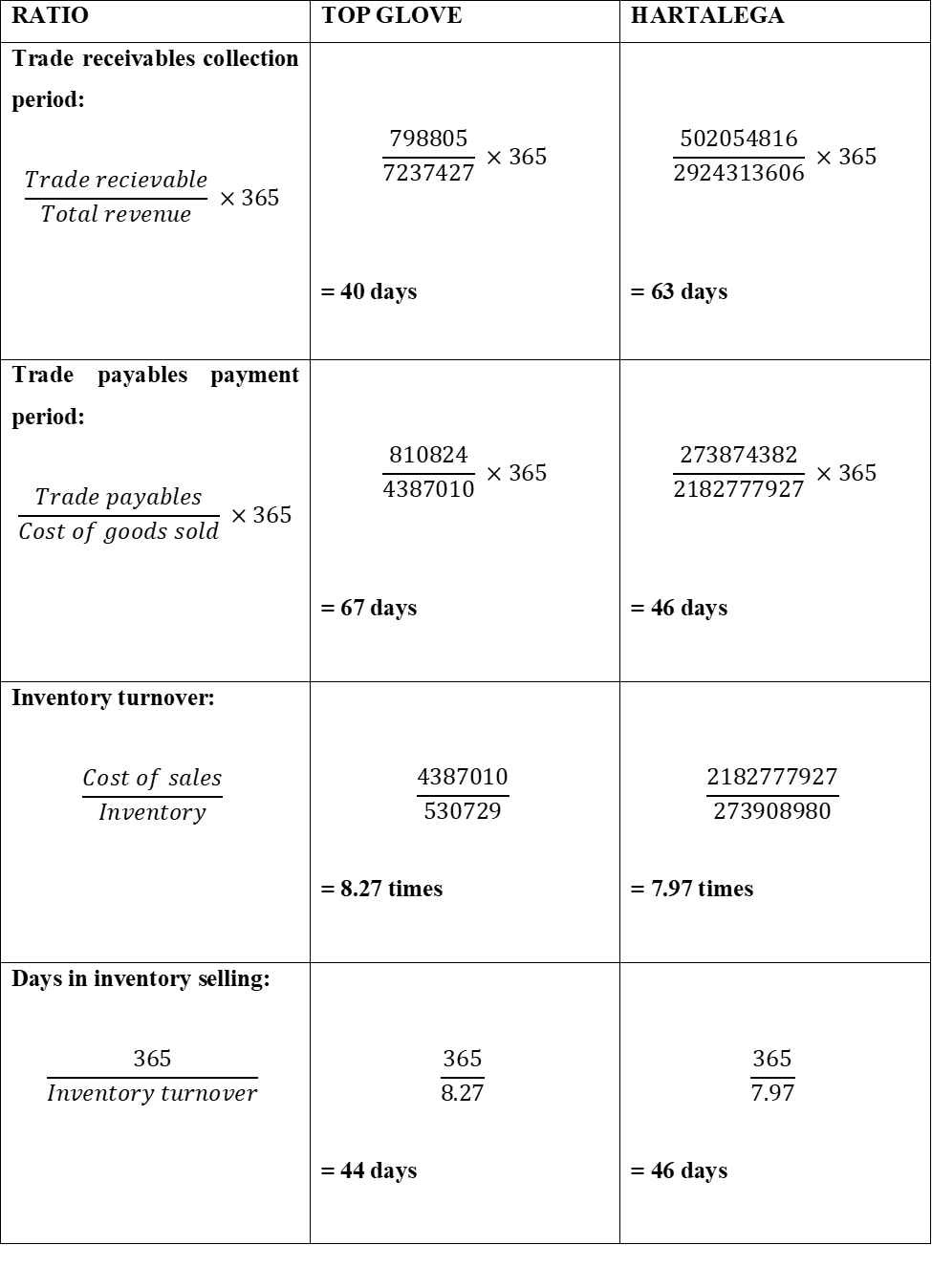

RATIO TOP GLOVE HARTALEGA Trade receivables collection period: 798805 502054816 x 365 x 365 Trade recievable 7237427 2924313606 365 Total reve = 40 days = 63 days Trade payables payment period: 810824 273874382 365 365 Trade payables 4387010 2182777927 365 Cost of goods sold = 67 days = 46 days Inventory turnover: Cost of sales 4387010 2182777927 Inventory 530729 273908980 = 8.27 times = 7.97 times Days in inventory selling: 365 365 365 Inventory turnover 8.27 7.97 = 44 days = 46 days

Step by Step Solution

There are 3 Steps involved in it

Question 1 3 Working Capital ratios Top Glove Hartalega Inventory turnover 827 797 Inventory turnover ration indicates that how many times company is ... View full answer

Get step-by-step solutions from verified subject matter experts