From the time the Ohio Farm Bureau Federation sold its first automobile insurance policy in 1926 until

Question:

From the time the Ohio Farm Bureau Federation sold its first automobile insurance policy in 1926 until today, the company has continually expanded its operations. By 1955, the company had so outgrown its original goals that it changed its name to Nationwide Insurance.

For most of Nationwide’s years in business, its expanding family of companies enjoyed considerable independence. The family grew to include not only property and casualty insurance providers but also life insurance, investment, and financial services providers. “Historically we’ve been a collection of business units with a lot of autonomy,” admits David Vasquez, Vice President of Data Warehousing for Nationwide. “Management at our subsidiaries had wide discretion with regard to how they deployed resources, what markets to enter and what risks they took on.”

This high level of business-unit independence and a lack of data management principles led to duplication of efforts, widely dissimilar data processing environments, and extreme data redundancy, as well as resulting higher expenses. The situation became critical in 2005 when Nationwide sought to merge Allied Insurance’s automobile policy system into its existing data environment in order to reduce costs.

Driven by its vision of business information as a strategic asset, Nationwide’s management soon recognized the severe limitations of existing systems and set out to create, from the ground up, a single, authoritative environment for clean, consistent, and complete data that could be effectively used with best-practice analytics to make strategic and tactical business decisions. Because data issues like duplication, redundancy, and inaccuracy are endemic to large, traditional insurance carriers with long histories, mul- tiple business units, data-intensive products, and disparate IT systems, Nationwide has taken a creative, forward-looking approach to managing these complex data issues uti- lizing a Teradata infrastructure.

Data Warehouse Mission Statement

The data warehouse’s missing statement reads as follows:

The data warehouse will support business strategy by enabling faster and more informed analytical and tactical decision making in the areas of customer growth, customer retention, product profitability, cost containment, and productivity improvements. As the data warehouse and business demands evolve, our environment will mature to address the needs. The next evolution will address the more operational and tactical requirements.

The data warehouse will become the company’s “authority source” for information and reporting within the organization. Nationwide will utilize this customer-centric foundation of data as a competitive advantage by leveraging the cross-functional relationships and opportunities inherent within the data.

With those clear goals in mind, Nationwide turned to Teradata to develop an enterprise data warehouse (EDW) that would address a wide range of data needs and concerns throughout the organization.

The Catalysts for Change

Every area of the company’s data environment needed to be revamped, standardized, and consolidated into a central repository where departments across the organization could access and analyze mission-critical information.

Nationwide began working to overhaul its data environment and create an EDW that would support all of its requirements. “Teradata came in and were able to contribute immediately due to their ability to understand our business and issues in order to provide solutions,” says Vasquez. “Time and again, we threw work at them with little information, and they came through for us.”

Many areas of the company have benefited from the creation of the EDW. Four programs have shown the greatest impact and results:

Customer Knowledge Store (CKS) is a customer-centric database that integrates customer, product and externally acquired data.

Financial Performance Management transformed Nationwide’s “stovepiped” data infrastructure into a single integrated data management and reporting environment.

Goal State Rate Management (GSRM) brings together auto policy, premium, and loss information from various source systems into a single view that allows the product, pricing, and underwriting functions to access and analyze the same data to make informed pricing decisions and recommendations.

Revenue Connection grants users better access to customer and policy information in order to more effectively reach their sales targets.

Implementation and Results

In 2001, once Nationwide’s enterprise data warehouse was up and running, the company began its customer management initiative with the addition of product and pricing data to drive marketing campaigns. Previously, customer data was managed in a customer information file (CIF), which resided on a mainframe computer and, like many mainframe applications, could not be modified easily. Moreover, the CIF application was product focused and presented challenges for Nationwide as it began to move to a customer-centric paradigm.

The cost-effectiveness of each of the sales channels and the cross-selling opportunities they present are widely known by Nationwide. But in order to maximize the effectiveness of each channel, the company recognized that it needed more insight into its customers and the products they currently own as well as the products they could own in the future.

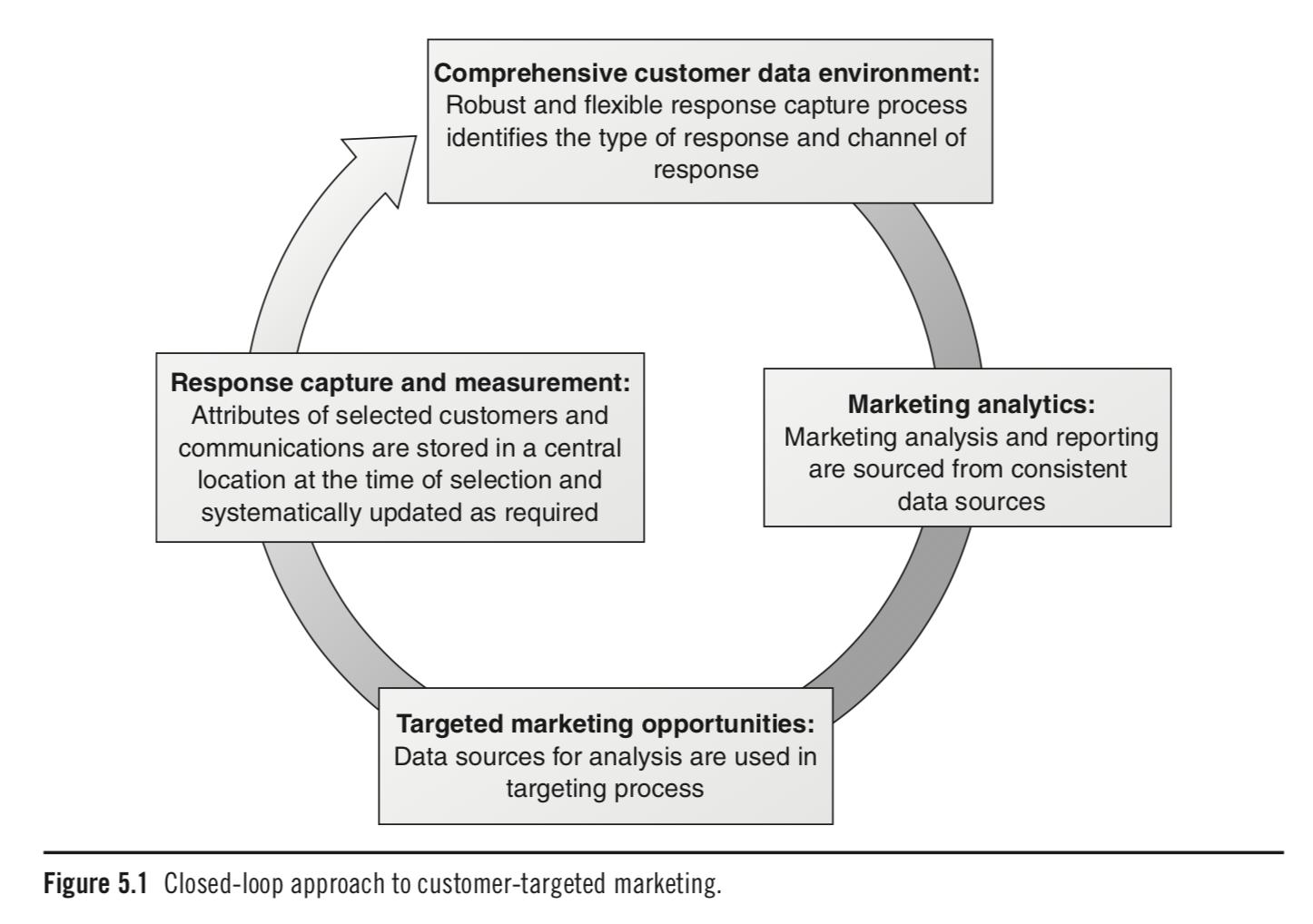

The initial solution for customer-targeted marketing was based on a closed-loop approach (see Figure 5.1). To support this approach, Nationwide developed a customer

data mart called Customer Knowledge Store (CKS) that delivers a holistic view of its customers.

CKS performs behavioral analysis to develop appropriate customer management actions (CMAs) for the target segments. These CMAs specify the right actions to deliver to the right customer at the right time through the right channel. When the customer interaction takes place, the activity is recorded and fed back into the system for further analysis and action.

The company believes CKS provides a competitive advantage through information- based decision making. The system is used for analysis, campaign development, customer communications, and response tracking. There is also a module designed to keep conventional agents informed about the potential product needs of their customers.

In 2008 and continuing into 2009, the company implemented behavioral analysis capabilities that help prioritize and focus front-line activities on the basis of historical and projected effectiveness. Thanks to actionable information, the result is an improved customer experience delivered by front-line employees through various customer touch points that are related to relevant sales and service opportunities.

Research indicates that proactive customer communications around certain customer lifetime events (e.g. marriage, birth of a child, or purchase of a home) have significant effect in terms of improving customer satisfaction scores. Unfortunately, with millions of policies in force, the task of being proactive in communicating with every customer experiencing key events has traditionally been cost-prohibitive.

By integrating customer contact history, product ownership and payment information into CKS, Nationwide’s behavioral analytics teams can now create prioritized models that identify which interaction is most important for a customer at any given

time. The result is a one-point improvement in the retention rate among the highest- priority contacts. There has also been a significant improvement in customer enthusiasm scores. More than $100 million in incremental sales can be attributed to CKS.

A second example of CKS’s power deals with another kind of proactive customer service. Nationwide tries to contact customers in advance of a possible weather catastrophe, such as a hurricane or flooding, to provide policyholder information and explain claims processes.

To improve its ability to deliver this service, Nationwide integrated customer telephone data from multiple systems into CKS and supplemented that data with an external telephone match. Through Teradata Relationship Manager, the lists can be developed quickly and distributed, allowing Nationwide to deliver an On Your Side® experience during stressful times. Although the results cannot be measured in terms of dollars, feedback from customers and agents has been overwhelmingly positive.

Next Steps

Because of the success of the CKS initiative, Nationwide has decided to transform what once was a property and casualty asset into an enterprise asset. The goal is to make customer information available to agents within all areas of the company, including life insurance and financial services. The underlying environment will allow Nationwide to create specific and timely CMAs that give agents the ability to interact with customers with an extremely high level of knowledge. Because the CMAs are driven by analytic insights created within CKS, customers will experience extremely personal customer service, as if each customer were the company’s only customer.

CKS is the foundation for all future capabilities utilizing customer information management and analytics. Nationwide’s goal is to expand the CKS environment and provide the ability:

to identify an appropriate CMA from a coordinated central point and make that information available to the operational front-end systems (right customer, right action, right time, right touch point);

to facilitate meaningful interactions with customers via robust scripts and training for those delivering the CMA;

to support optimal process definition and robust change management for CMA delivery;

to customize delivery and presentation by touch point as needed;

to capture all life cycle actions taken on CMA for future analysis within CKS.

Conclusion

Several years ago, Nationwide had the vision to leverage its data as a strategic asset. To achieve that vision, the company created an enterprise data warehouse that could support business strategy by enabling faster and more informed analytical and tactical decision making. Nationwide has executed that vision and, in the process, migrated from being a product-centric company to being a customer-centric company.

Nationwide realized that it could not truly be “on your side” if it continued to view customers, products, and services in a “siloed” environment. Today, Nationwide can view its customers, its agents, and its financial performance from every angle while ensuring that the underlying data is consistent, connected, and controlled.

By viewing information as a strategic asset, Nationwide can proactively act and react to the ever-changing needs of the business and its customers. In addition to the four solutions profiled in this case study, Nationwide has deployed numerous other business intelligence and data warehousing initiatives across a range of business units since it began its data management overhaul in 1999. The results have been significant, particularly in the areas of revenue enhancement, cost reduction, and productivity gains.

Revenue Enhancement

Through a customer relationship management initiative, Nationwide experienced a multimillion-dollar increase in new business premiums.

A premium underwriting realignment and review process, which realigns historical data with updated rating and territory structure, is projected to deliver a multimillion-dollar increase in revenue over a 12-month period.

Through Loss Record Review, Nationwide can make policy premium adjustments without increased coverage or risk exposure.

With increased business intelligence across multiple business units, including auto, life, property and identity theft protection, agents have seen a lift in cross- selling and upselling opportunities.

Cost Reduction

By retiring its outdated auto and property system in favor of a seven-year integrated history, Nationwide saw significant reductions in system footprint, maintenance and support costs.

It also saw other system enhancements, including green initiatives and reduced power and cooling requirements.

The integration of claims and policy data to increase control of the underwriting process resulted in an estimated reduction in overall loss ratio of one point.

Achieving better control of the motor vehicle record order process resulted in multimillion-dollar savings each year.

Better identification of over-coverage-limits payments has led to improved recovery of such payments.

Other cost reductions have resulted from improved claim fraud detection, improved subrogation and salvage recoveries, the introduction of volume purchase agreements, and enhanced reporting processes.

Productivity Gains

Financial analysts are able to run reports and analyze data 75% more efficiently.

Through workload reporting, claims adjusters have reduced the time spent on

each of the two million reported claims every year.

The Claims Business Solution Group experienced a threefold increase in report

generation as compared with the legacy system.

The Claims Special Investigation Unit achieved a productivity gain so great that it

was like having three additional full-time employees on staff.

Although substantial progress has been made with the strong analytical foundation for its property and casualty business, Nationwide has plans for the future to expand the enterprise data warehouse to all business areas. For example, delivering additional customer management capabilities will result in more targeted marketing campaigns. The company also wants to find new ways to leverage a variety of sales channels and customer touch points. With the addition of enhanced analytics applications, the company hopes to gain even greater insight about its customers and products across all business units.

Case Questions

1.If you were trying to win new business with this client (coming in from the out-

side), how would you propose doing so?

2.What key lessons and insights can be drawn from this case study? Make sure you

focus on how Teradata considered Nationwide’s sales processes and customer needs during implementation.

Income Tax Fundamentals 2013

ISBN: 9781285586618

31st Edition

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill