Question: From the trial balance and the information given below, prepare annual adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not

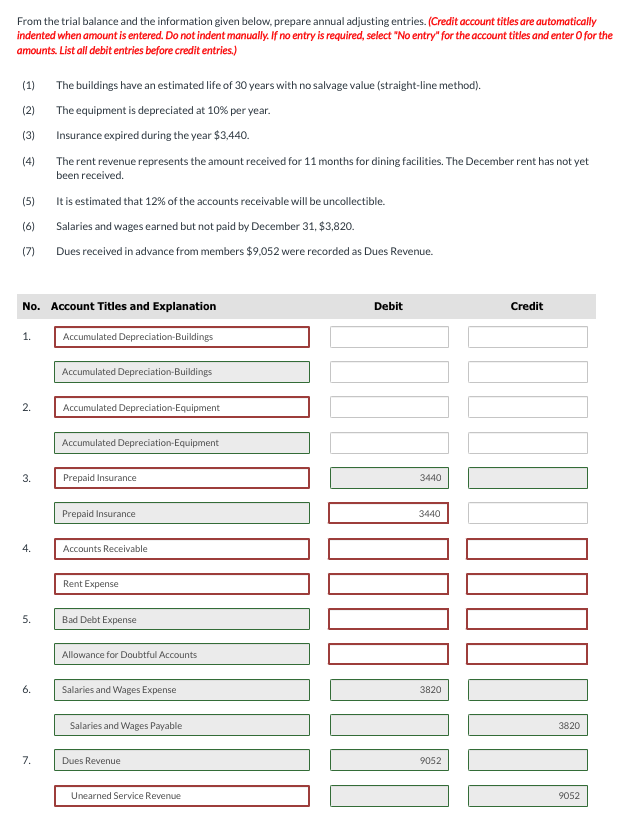

From the trial balance and the information given below, prepare annual adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) (1) The buildings have an estimated life of 30 years with no salvage value (straight-line method). (2) The equipment is depreciated at 10% per year. (3) Insurance expired during the year $3,440. (4) The rent revenue represents the amount received for 11 months for dining facilities. The December rent has not yet been received. (5) It is estimated that 12% of the accounts receivable will be uncollectible. (6) Salaries and wages earned but not paid by December 31,$3,820. (7) Dues received in advance from members $9,052 were recorded as Dues Revenue. From the trial balance and the information given below, prepare annual adjusting entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) (1) The buildings have an estimated life of 30 years with no salvage value (straight-line method). (2) The equipment is depreciated at 10% per year. (3) Insurance expired during the year $3,440. (4) The rent revenue represents the amount received for 11 months for dining facilities. The December rent has not yet been received. (5) It is estimated that 12% of the accounts receivable will be uncollectible. (6) Salaries and wages earned but not paid by December 31,$3,820. (7) Dues received in advance from members $9,052 were recorded as Dues Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts