Question: From this given scenario, Can I create an analysis to : 1) Compute Cost of Equity 2) Compute Debt Cost of Capital 3) Compute WACC

From this given scenario, Can I create an analysis to :

1) Compute Cost of Equity

2) Compute Debt Cost of Capital

3) Compute WACC (Weighted Average Cost of Capital)

4) Compute Incremental Cash flows

5) Depreciation Treatment

6) Inflation analysis on decision

7) Sensitivity Analysis of decision

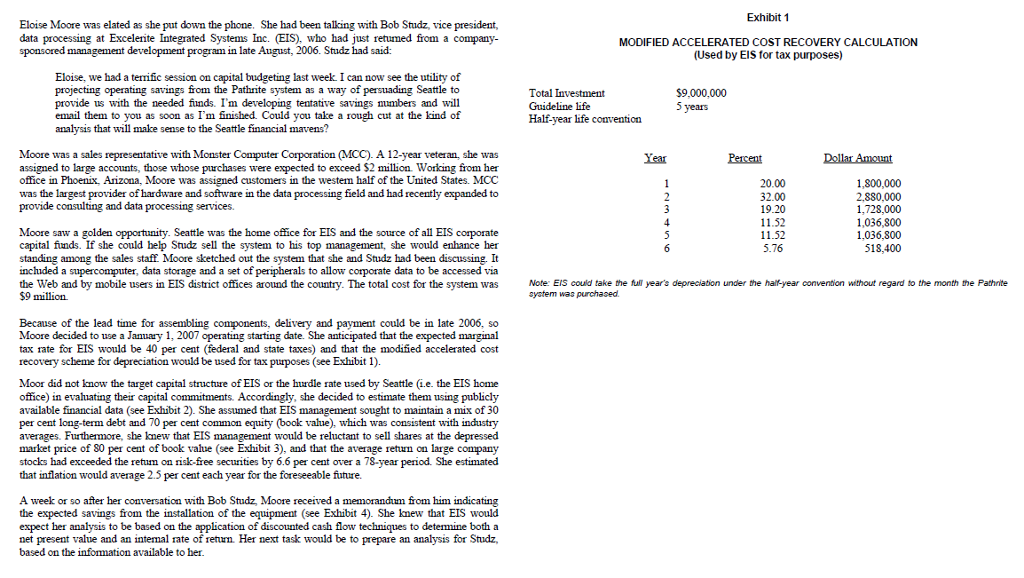

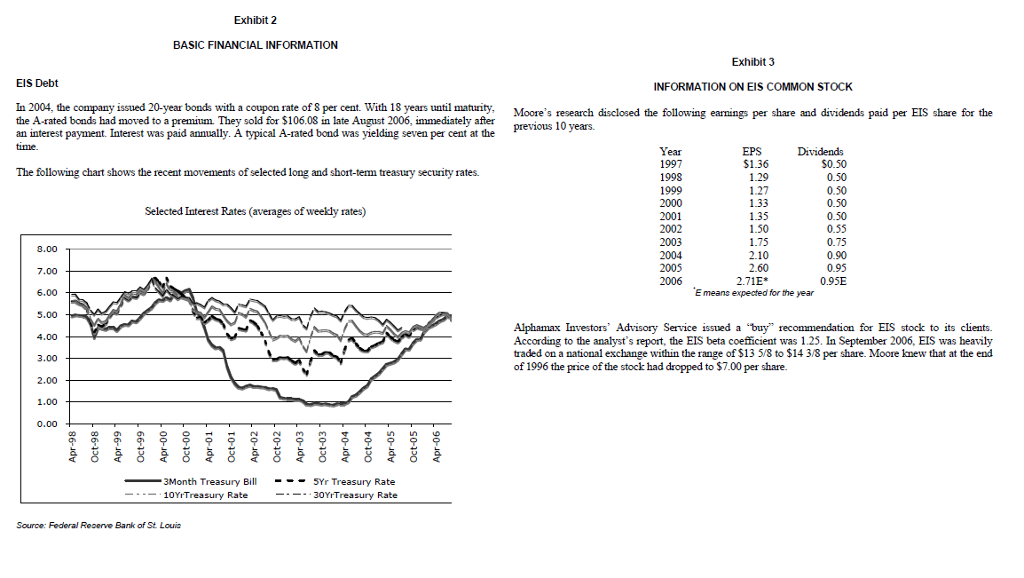

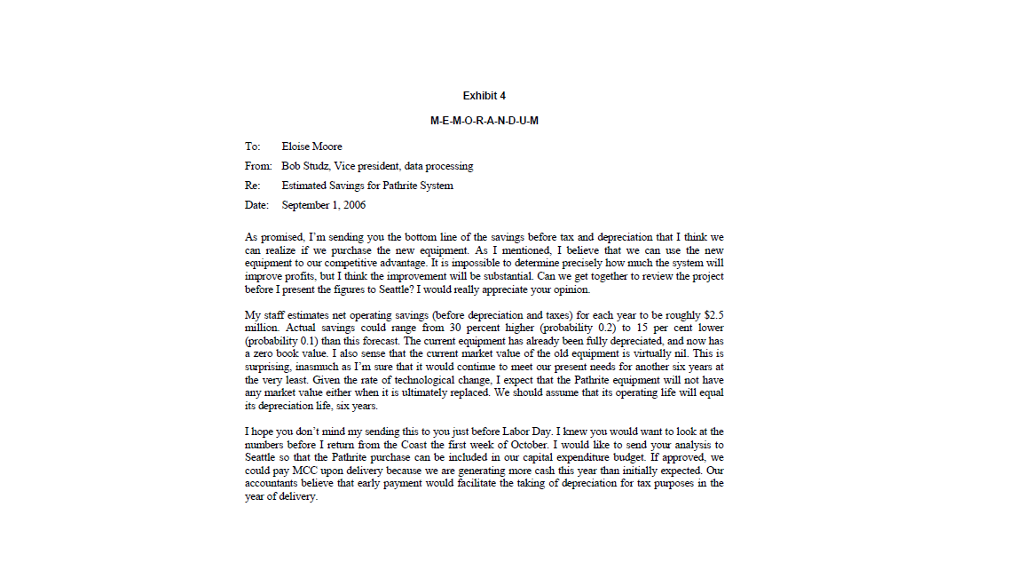

Exhibit 1 Eloise Moore was elated as she put down the phone. She had been talking with Bob Studz, vice president, data processing at Excelerite Integrated Systems Inc. (EIS), who had just retumed from a company- sponsored management development program in late August, 2006. Studz had said: MODIFIED ACCELERATED COST RECOVERY CALCULATION (Used by ElS for tax purposes) Eloise, we had a terrific session on capital budgeting last week I can now see the utility of projecting operating savings from the Pathrite system as a way of persuading Seattle to provide us with the needed fiunds. I'm developing tentative savings mumbers and will email them to you as soon as I'm finished. Could you take a rough cut at the kind of analysis that will make sense to the Seattle financial mavens? Total Investment Guideline life Half-year life convention 9,000,000 5 years Moore was a sales representative with Monster Computer Corporation (MCC). A 12-year veteran, she was assigned to large accounts, those whose purchases were expected to exceed $2 million. Working from her office in Phoenix, Arizona, Moore was assigned customers in the westem half of the United States. MCC was the largest provider of hardware and software in the data processing field and had recently expanded to provide consulting and data processing services. Year Percent 20.00 32.00 19.20 11.52 11.52 5.76 1,800,000 2.880,000 1,728,000 1,036,800 1,036,800 518,400 Moore saw a golden opportunity. Seattle was the home office for EIS and the source of all EIS corporate capital funds. If she could help Studz sell the system to his top management, she would enhance her standing among the sales staff Moore sketched out the system that she and Studz had been discussing. It inchided a supercomputer, data storage and a set of peripherals to allow corporate data to be accessed via the Web and by mobile users in EIS district offices around the country. The total cost for the system was Note: EIS could take the fulyears depreciaon under the half-year convention withot regard to the month he Pathrite $9 million cyatem was purchaced Because of the lead time for assembling components, delivery and payment could be in late 2006, so Moore decided to use a January 1, 2007 operating starting date. She anticipated that the expected marginal tax rate for EIS would be 40 per cent (federal and state taxes) and that the modified accelerated cost recovery scheme for depreciation would be used for tax purposes (see Exhibit 1) Moor did not lnow the target capital structure of EIS or the hurdle rate used by Seattle(ie. the EIS home office) in evahiating their capital commitments. Accordingly, she decided to estimate them using publicly available financial data (see Exhibit 2). She assumed that EIS management sought to maintain a mix of 30 per cent long-term debt and 70 per cent common equity (book vahue), which was consistent with industry averages. Furthermore, she knew that EIS management would be reluctant to sell shares at the depressed market price of 80 per cent of book value (see Exhibit 3), and that the average return on large company stocks had exceeded the retum on risk-free securities by 6.6 per cent over a 7S-year period. She estimated that inflation would average 2.3 per cent each year for the foreseeable fiuture. A week or so after her conversation with Bob Studz, Moore received a memorandum from him indicating the expected savings from the installation of the equipment (see Exhibit 4). She knew that EIS would expect her analysis to be based on the application of discounted cash flow techniques to determine both a net present value and an intemal rate of return Her next task would be to prepare an analysis for Studz, based on the infonmation available to her. Exhibit 1 Eloise Moore was elated as she put down the phone. She had been talking with Bob Studz, vice president, data processing at Excelerite Integrated Systems Inc. (EIS), who had just retumed from a company- sponsored management development program in late August, 2006. Studz had said: MODIFIED ACCELERATED COST RECOVERY CALCULATION (Used by ElS for tax purposes) Eloise, we had a terrific session on capital budgeting last week I can now see the utility of projecting operating savings from the Pathrite system as a way of persuading Seattle to provide us with the needed fiunds. I'm developing tentative savings mumbers and will email them to you as soon as I'm finished. Could you take a rough cut at the kind of analysis that will make sense to the Seattle financial mavens? Total Investment Guideline life Half-year life convention 9,000,000 5 years Moore was a sales representative with Monster Computer Corporation (MCC). A 12-year veteran, she was assigned to large accounts, those whose purchases were expected to exceed $2 million. Working from her office in Phoenix, Arizona, Moore was assigned customers in the westem half of the United States. MCC was the largest provider of hardware and software in the data processing field and had recently expanded to provide consulting and data processing services. Year Percent 20.00 32.00 19.20 11.52 11.52 5.76 1,800,000 2.880,000 1,728,000 1,036,800 1,036,800 518,400 Moore saw a golden opportunity. Seattle was the home office for EIS and the source of all EIS corporate capital funds. If she could help Studz sell the system to his top management, she would enhance her standing among the sales staff Moore sketched out the system that she and Studz had been discussing. It inchided a supercomputer, data storage and a set of peripherals to allow corporate data to be accessed via the Web and by mobile users in EIS district offices around the country. The total cost for the system was Note: EIS could take the fulyears depreciaon under the half-year convention withot regard to the month he Pathrite $9 million cyatem was purchaced Because of the lead time for assembling components, delivery and payment could be in late 2006, so Moore decided to use a January 1, 2007 operating starting date. She anticipated that the expected marginal tax rate for EIS would be 40 per cent (federal and state taxes) and that the modified accelerated cost recovery scheme for depreciation would be used for tax purposes (see Exhibit 1) Moor did not lnow the target capital structure of EIS or the hurdle rate used by Seattle(ie. the EIS home office) in evahiating their capital commitments. Accordingly, she decided to estimate them using publicly available financial data (see Exhibit 2). She assumed that EIS management sought to maintain a mix of 30 per cent long-term debt and 70 per cent common equity (book vahue), which was consistent with industry averages. Furthermore, she knew that EIS management would be reluctant to sell shares at the depressed market price of 80 per cent of book value (see Exhibit 3), and that the average return on large company stocks had exceeded the retum on risk-free securities by 6.6 per cent over a 7S-year period. She estimated that inflation would average 2.3 per cent each year for the foreseeable fiuture. A week or so after her conversation with Bob Studz, Moore received a memorandum from him indicating the expected savings from the installation of the equipment (see Exhibit 4). She knew that EIS would expect her analysis to be based on the application of discounted cash flow techniques to determine both a net present value and an intemal rate of return Her next task would be to prepare an analysis for Studz, based on the infonmation available to her

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts