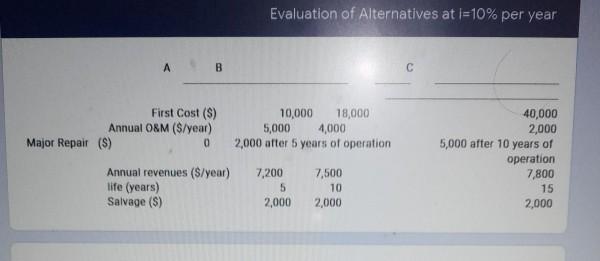

Question: ^ from this given solve Evaluation of Alternatives at i=10% per year A B First Cost ($) 10,000 18,000 Annual O&M (S/year) 5,000 4,000 Major

^ from this given solve

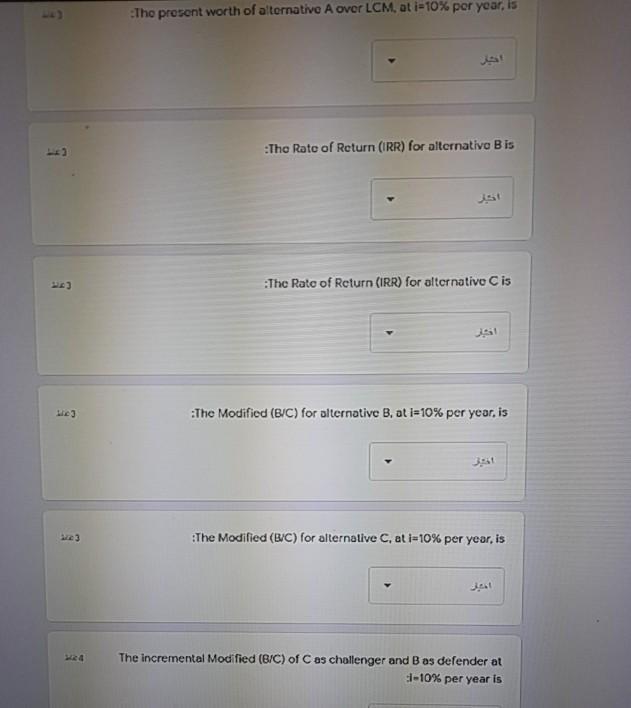

Evaluation of Alternatives at i=10% per year A B First Cost ($) 10,000 18,000 Annual O&M (S/year) 5,000 4,000 Major Repair (s) 0 2,000 after 5 years of operation Annual revenues (S/year) 7,200 7,500 life (years) 5 10 Salvage (S) 2,000 2,000 40,000 2,000 5,000 after 10 years of operation 7,800 15 2,000 The present worth of alternative A over LCM, at i=10% per year, is LE The Rate of Return (IRR) for alternative B is :The Rate of Return (IRR) for alternative C is :The Modified (BIC) for alternative B, at i=10% per year, is The Modified (B/C) for alternative C. at i-10% per year, is The incremental Modified (B/C) of C as challenger and B as defender at 1-10% per year is

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts