Question: From this partial advertisement: $96.69 per month for 60 months $4,300 used car cash price $50 down payment a. Calculate the amount financed. Amount financed

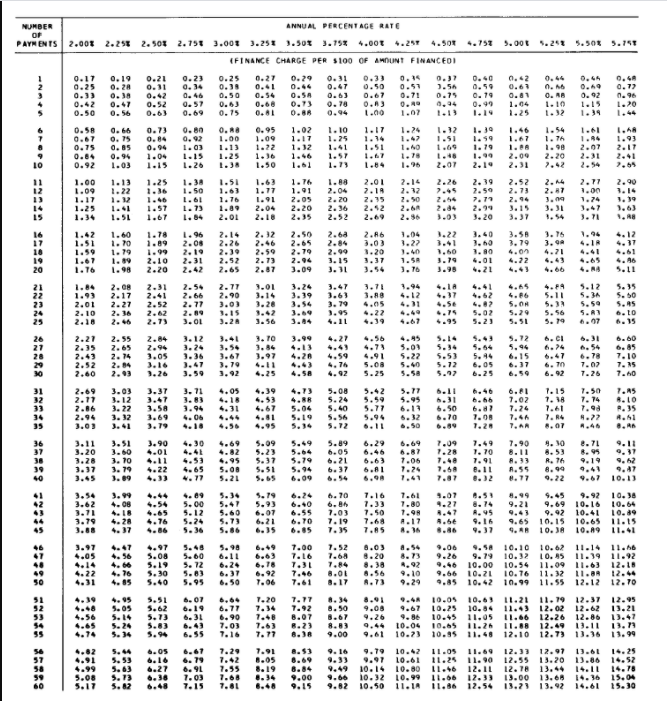

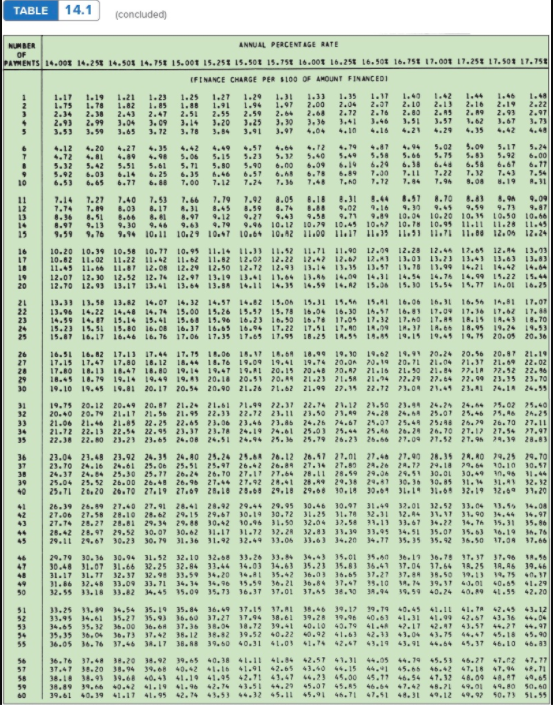

From this partial advertisement: $96.69 per month for 60 months $4,300 used car cash price $50 down payment a. Calculate the amount financed. Amount financed b. Calculate the finance charge. (Round your answer to the nearest cent.) Finance charge c. Calculate the deferred payment price. (Round your answer to the nearest cent.) Deferred payment price d. Calculate the APR by (Use Table 14.1 and Table 14.1(b)). (Round your answers to 2 decimal places.) APR between % and % e. Calculate monthly payment (by formula). (Round your answer to the nearest cent.) Monthly payment NUMBER or PAYN ENTS 2.000 2.258 2. 501 ANNUAL PERCENTAGE RATE 2.750 3.000 3.25 3.500 3.75% 4.000 4.25 4.500 (FINANCE CHARGE PER $100 OF AMOUNT FINANCEDI 4.757 5.00 5.250 5.500 5.751 0.16 0.21 0.31 0.37 0,62 0.63 0.4 0.33 0.50 0.41 0.17 0.25 0.33 0.42 0.50 0.19 0.28 0.38 0.47 0.56 0.23 0.34 0.46 0.57 0.69 0.25 0.30 0.50 0.3 0.31 0.47 0.63 0.78 0. 0.77 0.96 0.71 0.75 0.16 0. AR 0.79 0.52 0.63 0.60 0.81 0.5A 0.73 0.88 0.92 1.15 0.15 0.13 1.00 1.07 1.) 0.73 0.84 7 0.95 1.09 1.12 0.66 0.75 0.85 1.10 1.25 1.61 0.58 0.67 0.75 0.64 0.92 0.80 0.92 1.03 1.15 1.26 1. TA 0.88 1.00 1.13 1.25 1.02 1.17 1.12 1.46 1.14 1.51 1.59 1.79 2.07 2.17 1.36 1.04 1.15 1.03 10 1.50 2.20 7.42 1.84 2.01 2.09 2.31 2.19 7.65 1.00 1.09 1.25 1.36 11 12 2.77 2.44 2.90 1.51 1.63 1.22 2.14 2.12 1.50 1.61 1.73 2.87 1.16 1.91 2.05 2.20 2.35 2.52 2.73 2.96 2.01 2.18 2.15 2.12 2.60 1.77 1.91 2.04 2.10 2.39 2.59 7.73 2.99 3. 20 1.25 2.04 2. 20 2.36 2.52 1.57 1.67 2.04 3.31 15 1.51 2.01 2.36 3.37 3.71 2.14 2.60 1.78 1.89 1.22 16 17 10 4.12 3.75 3.9 1.42 1.51 1.59 1.67 1.16 1.60 1.10 1.79 1.69 1.98 3.79 1.96 2.00 2.19 2.31 2.42 2.16 3.03 1.20 2.12 2.46 2.50 2.73 2.87 2.50 2.65 2.79 2.94 3.09 1.22 1.40 2.26 2.30 2.52 2.65 4.41 3.60 3.60 1.80 4.01 4.21 2.99 3.15 3.11 1.60 3.79 2.10 2.20 4.22 4.49 4.65 20 3.76 5.11 3.01 3.24 3.39 3.88 21 22 23 24 25 4.12 2.08 2.17 2.27 2.36 2.46 2.77 2.90 3.0) 2.31 2.41 2.52 2.62 2.73 1.99 2.01 2.10 2.18 2.54 2.66 2.77 2.89 3.01 3.20 5.11 5.IN 3.79 3.95 4.86 5.OH 5.29 5.12 5.3 5.50 S.A3 4,02 5.07 5.23 5.95 5.50 5.45 6.10 6.15 4.22 3.28 3.04 3.12 3. TO 4.27 6. CI 27 28 2.27 2.35 2.49 2.52 2.60 2.55 2.65 2.14 2. 4 2.09 2.84 2.95 3.05 3.16 3.26 4.0 4.26 4.59 3.36 3. 47 4.79 4.91 5.08 5.25 5.01 5.22 5.40 5.50 5.54 5.44 6.05 5.53 5.12 5.97 5.72 5.44 6.15 6.37 6.47 6.70 6.60 6.85 7.10 7.15 7.40 4.11 4.25 7.07 7.26 3.37 4.05 4.39 31 32 33 3.71 3.83 3.03 3.12 3. 22 3. 12 5.77 9.95 6.11 6.32 1.15 1. 18 7.1 7.50 7.74 4.31 4.67 5.08 5.24 5.40 5.56 5.72 7. AS 8.10 2.35 5.04 5.19 5.77 5.96 2.69 2.17 2.86 2.94 3.03 3.11 3.20 6.41 7.02 7.24 7.4A 6.50 6.70 6.66 6.87 1.08 1.20 4.06 3.69 3.79 8. 07 3.51 36 37 4.30 4.41 .82 3.90 4.01 4.11 4.22 4.33 5.09 5.23 5.37 5.51 3.10 3. 79 3.89 39 40 5.89 6.05 6.21 6.37 3.37 3.45 4.65 4.77 5.79 5.94 6.09 5.00 5.21 41 6.40 3.54 3.62 3.71 3.79 3.88 9.99 4.08 4.18 4.28 5.00 5.12 5.24 5.36 5.41 5.80 5.19 5.93 6.07 6.21 6.35 6.70 6.86 7.03 7.19 7. 35 4.76 4.86 6.70 6.65 45 5.86 3.97 4.05 7.52 7.68 4. 47 4.56 4.66 4.76 4.85 40 49 50 4.97 5.08 5.19 5.30 5.40 5.90 6.11 6.24 5.00 5. 5.8) 5.95 7.00 7.16 7.31 7.46 7.61 6.29 6.69 7.09 7.49 7.90 9.10 8.71 9.11 6.87 7.28 7.70 8.53 8.95 6.63 1.05 7. 91 R. 16 6.61 7.60 8.11 A.55 8.99 8.12 8.77 9.22 9.67 10.13 1.16 7.61 8.50 8.99 9.92 10.38 7.33 1.80 4.27 9.21 9.69 10.16 10.64 7.50 1.98 9.43 9.92 10.41 10.89 7.68 1.17 8.5e 9.16 9.65 10.15 10.65 11.15 7.85 9.37 9.A 10.38 10.19 11.41 8.03 9.06 10.10 10.62 11.14 11.16 8.20 9.26 9.79 10.32 10.45 11.39 11.92 8.38 10.00 10.54 11.09 11.63 12.18 9.10 9.66 10.21 10.76 11.32 11.a 12.44 9.29 9.85 10.42 10.99 11.55 12.12 12.70 10.05 10.6) 11.21 11.79 12.37 12.95 9.67 10.25 10.04 11.3 12.02 12.62 13.21 9.B 10.45 11.05 11.66 12.26 12.86 11.47 10.04 10.65 11.2 11.88 12.49 13.11 13. 9.61 10.7) 10.95 11.48 12.10 12.73 11.36 13.99 9.79 10.42 11.05 11.69 12.33 12.97 13.61 14.25 10.61 11.25 11.90 12.55 13.20 13.86 14.52 10.14 10.80 11.46 12.11 12.78 13.44 14.78 10.32 10.99 12.33 13.00 13.68 15.04 10.50 11. IA 11.86 12.54 13.23 4.22 4.31 8.01 6.50 6.92 7.06 51 7.20 5.51 5.62 5.73 5.83 6.07 6.31 5.05 5.14 5.24 53 94 95 9.26 7.77 7.92 8.07 8.23 4.56 4.65 4.74 6.77 6.90 7.03 7.16 7.48 7.63 7.77 8.67 8.83 9.00 6.55 &.05 4.91 5.53 5.63 58 7.91 8.05 8.19 7.20 7.42 7.55 7.66 7.81 6.27 6.48 6.79 6.91 7.03 7.15 3.00 5.17 9.33 9.49 9.66 5.82 9.00 9.15 TABLE 14.1 (concluded 4.12 6.00 6.10 NUMBER ANNUAL PERCENTAGE RATE OF PAYMENTS 14.000 14.250 14.500 14.750 15.000 15.2515.500 15.750 16.00 16.250 16.500 16.750 17.000 17.250 17.500 17.750 EFINANCE CHARGE PER $100 OF AMOUNT FINANCEDI 1.17 1.19 1.21 1.23 1.25 1.27 1.29 1.31 1.3) 1.11 1.40 1.42 1.45 1.4 1.75 1.78 1.82 1.85 1.88 1.91 1.94 2.00 2.04 2.31 2.10 2.13 2.19 2.16 2.22 2.34 2.38 2.43 2. 47 2.51 2.55 2.59 2.64 2.60 2.72 2.16 2.60 2.45 2.9 2.99 2.99 2.93 3.04 3.09 2.97 3.14 3.20 3.25 3.30 3.36 3.51 3.57 1.62 3.75 3.99 3.65 3.72 3. To 3.84 3.97 4.04 4.18 4.28 4.29 4.35 4.42 4.48 4.20 4. To 4.87 4.94 5.02 9.09 5.IT 4.72 4.81 4.89 5.15 5.23 5.32 5.58 5.66 5.75 5.92 5.32 5.51 5.61 5.71 5.80 9.90 6.00 6.29 6.50 5.92 6.46 6.03 6.67 6.14 6.57 6.8 6.18 7.30 7.22 7.12 7.43 7.54 6.53 6.65 7.00 7.12 7.48 T.AD 7.12 7.96 8.00 8.19 8.31 7.14 1.27 7.40 7.53 7.66 7.19 7.92 8.05 8.18 8.31 8.57 8.70 8.81 9.00 7.74 1.89 8.03 8.17 8.50 9.02 9.16 9.30 9.59 9.73 9.87 8.36 8.51 8.61 8.97 9.12 9.27 9.71 9.13 9.89 10.04 10.20 10.35 10.50 10.66 9.19 9.98 10.12 10.79 10.43 10.97 10.78 10.95 11.11 11.28 11.45 15 9.59 9.76 9.16 10.11 10.29 10.47 10.61 10.A2 11.00 11.1 11.5 11.3 11.1 11.06 12.06 12.24 16 10.20 10.39 10.58 10.71 10.95 11.14 11.)) 11.52 11.11 11.9 17.09 12.212.4 12.5 12.4 13.03 L7 10.82 11.02 11.22 11.42 11.62 11.82 12.02 12.22 12.47 12.67 12.1 13.01 13.23 13.41 13.63 13.83 10 11.45 11.06 11.87 12.08 12.29 12.50 12.12 12.93 13.14 13.35 13.97 11.78 13.99 14.21 14.42 14.64 19 12.07 12.30 12.52 12.7 12.97 13.19 13.41 11.64 13. 14.00 14.11 14.54 14.76 14.9 15.22 15.44 20 12.70 12.93 13.17 13.41 13.64 13.88 14.11 14.35 14.59 14.A2 15.0 15.10 15.5 15.77 11.0i 16.25 21 13.33 13.58 13.82 14.07 14.32 14.57 14.62 15.00 15.31 15.56 15.41 16.06 16.1 16.56 14.81 17.07 22 13.96 14.22 14.48 14.74 15.00 15.26 15.57 19.78 10.04 16.30 11.57 16.11.09 11.16 17.62 17.00 14.59 14.87 15.14 15.41 15.68 19.96 16.23 16.50 16.76 11.09 17.32 17.0 17.04 18.15 11.43 18.70 15.1 15,31 160 16, 18.1 10.55 1.9 1.2 11.51 190 19 18 17 16 61 18, 95 1924 19, 15.67 16.17 16.46 16.76 17.06 17.35 17.63 17.95 18.25 11.59 19.85 19.15 19.45 19.75 20.09 20.36 16.5L 16.82 17.11 17.44 17.15 18.0 18.17 18.6 18.99 19.0 19.62 19.91 20.24 20.56 20.87 21.19 17.15 11.47 17.00 18.12 18.44 16.16 19.09 19.41 19.74 20.04 20.19 20.71 21.04 21.37 21.0 22.02 17.80 18.13 18.47 18.80 19.14 19.47 19.AL 20.15 20.48 20.47 21.16 21.50 21.84 77. IN 72.52 22.46 18.45 18.79 19.14 19.49 19.03 20.18 20.51 20. 21.23 21.58 21.4 22.29 27.64 22.9 23.5 23.70 30 19.10 19.45 19.0 20.17 20.54 20.90 21.26 71.62 21.99 27.5 22.72 73.04 21.45 23.11 24.14 24.55 31 19.75 20.12 20.49 20.7 21.24 21.011.99 22.11 22.74 21.12 21.50 23.44 24.2 24.4 25.02 25.40 20.40 20.79 21.11 21.56 21.9 22.33 22.72 23.11 23.50 73.49 24.28 24.14 25.01 25.46 79.46 21.25 33 21.06 21.4 21.85 22.25 22.65 23.06 23.45 23.8 24.26 74.67 25.01 25.44 25.48 25.79 26.70 27.11 21.72 22.13 22.54 22.95 23.37 23.78 24.19 24.01 25.03 25.44 25.48 20.24 26.70 21.17 27.54 27.97 22.38 22.80 23.23 23.65 24,08 24.51 24.9* 25.36 25.79 26.23 26.66 21.09 21.52 27.9 29.39 20.83 36 23.04 21.48 21.92 24.39 24.40 25.24 29.64 26.12 20.47 21.01 21.4 21.90 28.35 21.0 29.25 29.70 23.TO 24.16 24.61 25.06 25.5! 25.97 26.4226.84 27.14 27.89 24.26 28.77 24.12 79.64 10.10 30.57 24.37 24.04 25.30 25.71 20.24 26.70 27.11 77.64 28.11 28.59 29.0 29.51 30.01 30.49 10.96 11.44 25.04 25.5 26.00 26.48 26.96 27.4 27.92 28.1 28.19 29.38 29.87 30.36 30.85 11.14 25.11 26.20 26.70 27.19 27.09 28.10 25.68 29.10 29.08 90.14 30.64 31.131.69 32.19 12.69 19.20 31.41 12.12 41 26.39 26.99 21.40 27.91 28.41 28.92 29.44 29.5 30.46 10.07 31.49 32.01 32.52 33.04 13.55 14.00 27.06 27.58 28.10 28.62 29.15 29.67 30.19 30.72 31.25 11.78 2.31 12.44 31.17 31.90 34.44 34.97 27.74 28.27 28.81 29.34 29.88 30.42 10.96 31.50 32.04 32.58 21.11 33.67 34.22 34.7 35.31 35.86 28.42 28.97 29.52 30.07 30.62 21.17 31.72 32.28 32.83 33.39 33.5 34.51 35.07 35.6) 16.19 1.76 29.11 29.67 30.23 30.79 31.36 31.92 32.49 33.06 3.6) 34.20 34.77 35.35 35.92 36.50 17.04 17.66 29.79 30.36 30.94 31.52 32.10 32.68 33.26 33.84 34.) 35.01 35.40 36.11 38.78 11.37 37.96 38.56 47 30.48 31.07 31.66 32.25 32.86 33.44 14.03 14.63 35.23 35.83 36.41 17.04 17.04 18.25 18.46 39.46 31.17 31.77 32.37 2.98 33.5934.20 14.81 35.42 36.03 36.65 37.27 37.84 38.50 19.13 14.75 -0.17 4 31.86 32.48 33.09 33.71 34.34 34.96 15.59 36.21 36.84 37.47 99.10 3.74 39.3740.01 0.65 01.29 50 32.55 33.18 33.82 14.45 15.09 35.73 16.37 37.01 37.65 38.10 31.94 39.59 40.24 40.19 41.55 42.20 51 33.25 33.9 34.54 35.1935.84 16.49 17.15 17.81 38.6 39.17 19.19 40.4541.11 41.742.43 43.12 52 33.95 34.61 35.27 35.9) 36.60 37.27 17.94 38.61 39.28 19.96 53 34.65 35.32 35.00 36.69 37.36 38.04 18.72 39.41 40.0 49.79 41.44 42.17 42.47 43.57 44.27 44.97 40.63 41.31 41.99 42.57 43.36 36 35.35 36.04 36.7337.4238.1238.3239.52 0.22 40.92 41.63 42.13 +3.04 43.75 44.47 45.18 45.90 55 36.05 36.76 37.46 3.7 38.8 39.50 40.31 41.03 41.74 42.47 43.19 43.91 46.64 45.37 46.10 46.33 56 36.16 37.48 38.20 38.92 39.65 40.38 41.11 41.34 42.57 41.3144.05 44.79 45.53 46.27 47.62 47.77 57 37.47 38.20 38.94 39.68 40.42 1.16 41.9142.65 43.40 44.15 56 45.65 45.42 47.18 47.94 38.16 38.93 39.68 40.4) 41.19 41.95 42.71 41.47 44.23 45.00 45.17 46.54 41.32 48.09 48.47 49.65 6.71 99 38.89 39.66 0.42 41.19 41.96 42.74 43.51 44.29 45.07 45.5 46.64 47.42 48.7L 49.01 49.80 50.60 39.61 40.39 41.11 41.95 42.74 43.53 14.32 45.11 5.91 45.147.51 48.31 49.12 49.97 $0.73 51.55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts