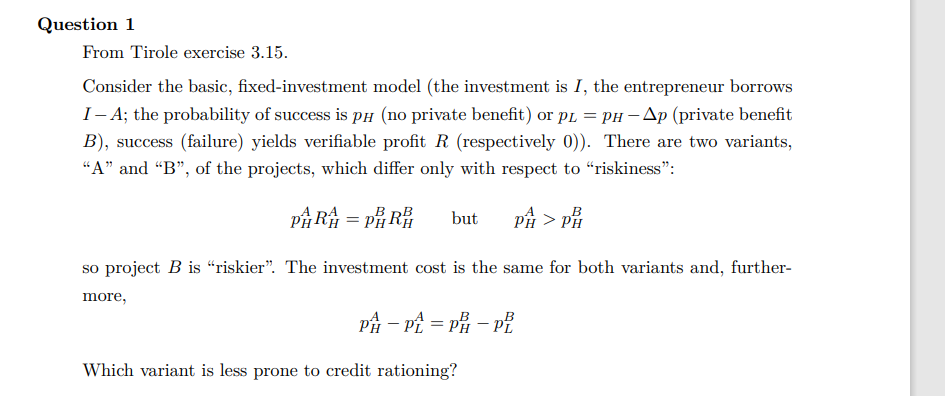

Question: From Tirole exercise 3 . 1 5 . Consider the basic, fixed - investment model ( the investment is I, the entrepreneur borrows I A;

From Tirole exercise

Consider the basic, fixedinvestment model the investment is I, the entrepreneur borrows

I A; the probability of success is pH no private benefit or pL pH p private benefit

B success failure yields verifiable profit R respectively There are two variants,

A and B of the projects, which differ only with respect to riskiness:

p

A

HR

A

H p

B

HR

B

H but p

A

H pB

H

so project B is riskier The investment cost is the same for both variants and, furthermore,

p

A

H p

A

L p

B

H p

B

L

Which variant is less prone to credit rationing?Question

From Tirole exercise

Consider the basic, fixedinvestment model the investment is I, the entrepreneur borrows

; the probability of success is no private benefit or private benefit

success failure yields verifiable profit respectively There are two variants,

A and B of the projects, which differ only with respect to "riskiness":

but

so project is "riskier". The investment cost is the same for both variants and, further

more,

Which variant is less prone to credit rationing?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock