Question: From your reading, recall that in structural model, company equity is similar to a call option on the company's assets with a strlke price equal

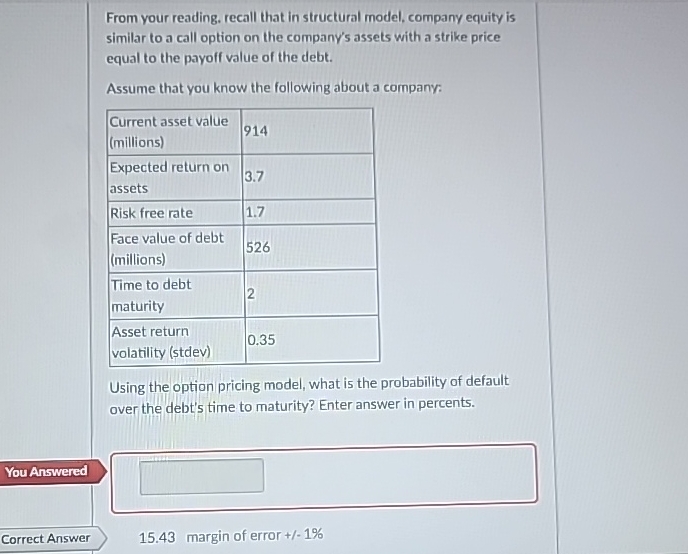

From your reading, recall that in structural model, company equity is similar to a call option on the company's assets with a strlke price equal to the payoff value of the debt.

Assume that you know the following about a company:

tabletableCurrent asset valuemillionstableExpected return onassetsRisk free rate,tableFace value of debtmillionstableTime to debtmaturitytableAsset returnvolatility stdev

Using the option pricing model, what is the probability of default over the debt's time to maturity? Enter answer in percents.correct answer is

margin of error

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock