Question: Fruit Computer Company makes special fruit themed computers. Each unit sells for $400. Fruit Computer Company produces and sells 12,700 units per year. They

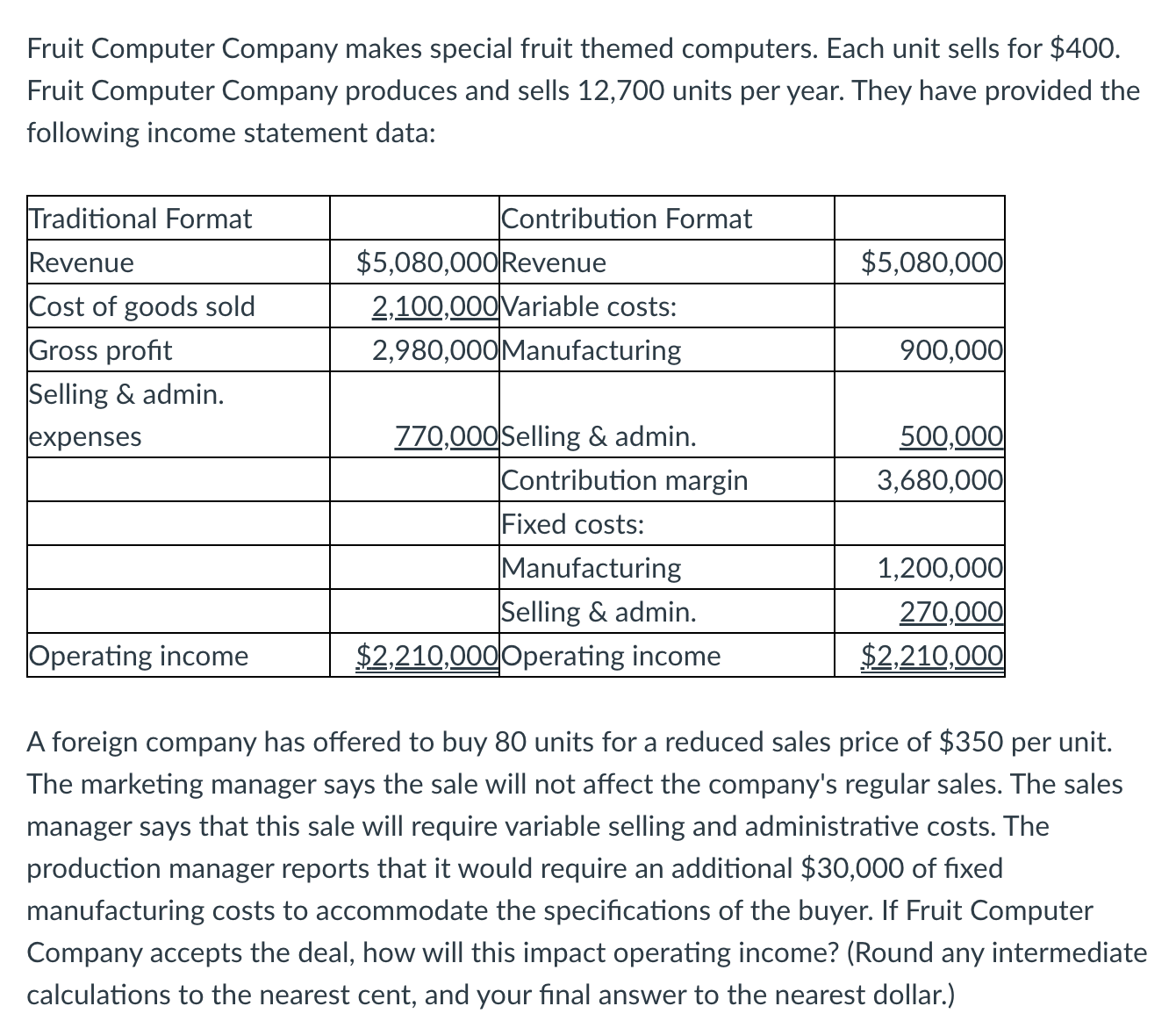

Fruit Computer Company makes special fruit themed computers. Each unit sells for $400. Fruit Computer Company produces and sells 12,700 units per year. They have provided the following income statement data: Traditional Format Contribution Format Revenue $5,080,000 Revenue $5,080,000 Cost of goods sold 2,100,000 Variable costs: Gross profit 2,980,000 Manufacturing 900,000 Selling & admin. expenses 770,000 Selling & admin. 500,000 Contribution margin 3,680,000 Fixed costs: Manufacturing 1,200,000 Selling & admin. 270,000 Operating income $2,210,000 Operating income $2,210,000 A foreign company has offered to buy 80 units for a reduced sales price of $350 per unit. The marketing manager says the sale will not affect the company's regular sales. The sales manager says that this sale will require variable selling and administrative costs. The production manager reports that it would require an additional $30,000 of fixed manufacturing costs to accommodate the specifications of the buyer. If Fruit Computer Company accepts the deal, how will this impact operating income? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

To determine the impact on operating income we need to calculate the incremental r... View full answer

Get step-by-step solutions from verified subject matter experts