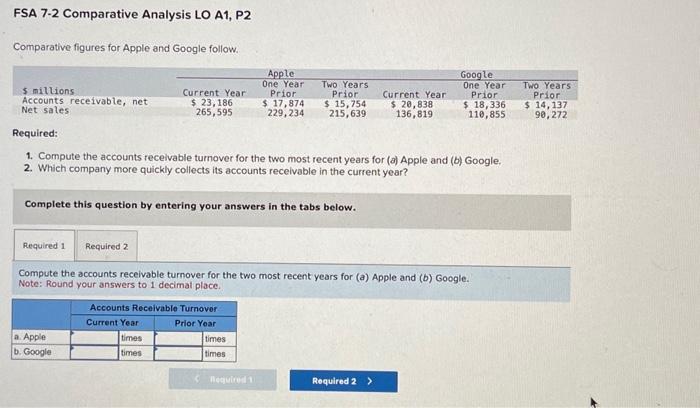

Question: FSA 7-2 Comparative Analysis LO A1, P2 Comparative figures for Apple and Google follow. Required: 1. Compute the accounts receivable turnover for the two most

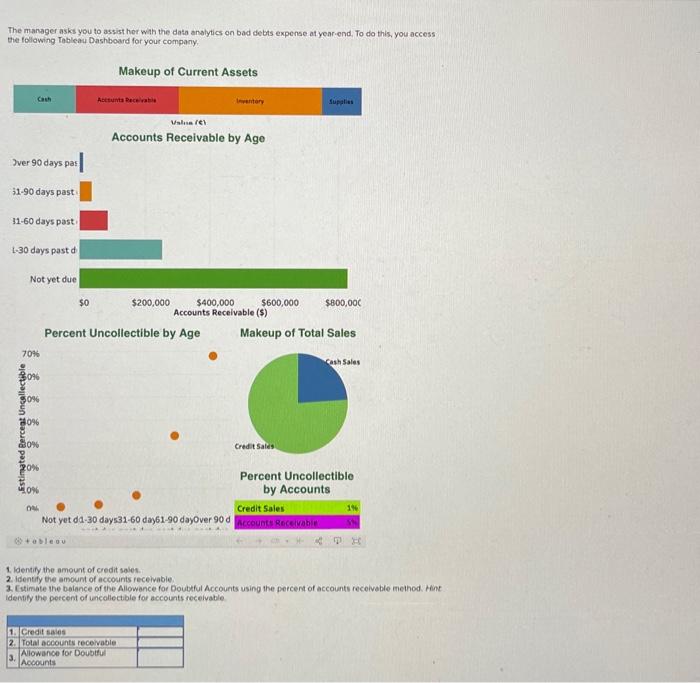

FSA 7-2 Comparative Analysis LO A1, P2 Comparative figures for Apple and Google follow. Required: 1. Compute the accounts receivable turnover for the two most recent years for (a) Apple and (b) Google. 2. Which company more quickly collects its accounts receivable in the current year? Complete this question by entering your answers in the tabs below. Compute the accounts receivable turnover for the two most recent years for (a) Apple and (b) Google. Note: Round your answers to 1 decimal place. 1. Compute the accounts recelvable turnover for the two most recent years for (a) Apple and (b) Google. 2. Which company more quickly collects its accounts receivable in the current year? Complete this question by entering your answers in the tabs below. Which company more quickly collects its accounts receivable in the current year? Which company more quickly collects its accounts receivable in the current year? The manager asks you to assist her with the data analytics on bad debts expense at year.end, To do this, you access the follawing Tableau Dashboard for your company. Makeup of Current Assets 1. identify the ampunt of credit soles. 2. Identify the amount of accounts receivable. 3. Estimate the balance of the Allowance for Doubtul Accounts using the percent of accounts receivable method. Hint identy the percent of uncellectible for accounts recelvable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts