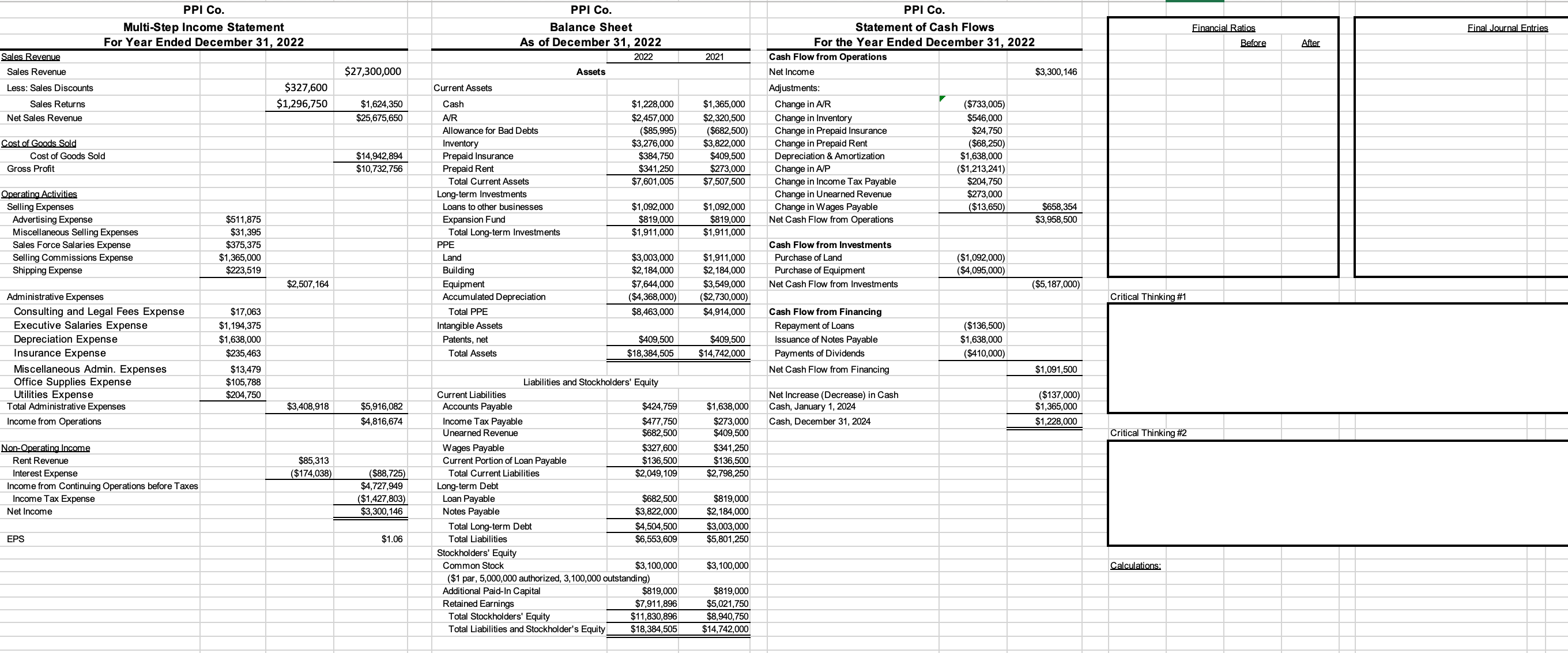

Question: FSR Part 1 . PPI Co . PPI has already completed most of the necessary transactions for the current year ( see below ) .

FSR Part PPI Co

PPI has already completed most of the necessary transactions for the current year see belowHowever they have neglected to include several key pieces of information. Throughout thesemester you will be adding and incorporating this additional information to complete thecompanys financial report. PPIs tax rate is

PPI's management is afraid that an error was made when calculating ending inventory and COGS forthe year. They would like you to go back through the inventory calculations to correct any possiblemistakesPPI uses the Dollar Value LIFO system for calculating inventory. The price index for is andthe price indices for and were and respectively. If PPI had purchased its inventory at the end of it would have cost the company$ If the company had purchased its on December it would have cost thecompany $ If the company had purchased all of the items still inventory on December on December it would have cost the company $

PPIs management would like to know the effect of your adjustment, if any, on the following ratios:

Inventory Turnover

Current Ratio

ROA

Calculations:

Make the appropriate journal entries, if any, to correct the reported values of inventory and COGS including any necessary changes to income tax expense

Make any necessary changes to the financial statements.

Critical Thinking:

Calculate each of the required ratios using the original values before any changes and theupdated values after your changes

How do you think market analysts will react to the correction to inventory? Do you thinkthey will downgrade their recommendation from buy to hold or sell? Why or why not?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock