Question: FSR Part 2 . PPI Co . : Acquiring and Disposing of PPE On December 1 5 th , PPI's management was approached by a

FSR Part PPI Co: Acquiring and Disposing of PPE

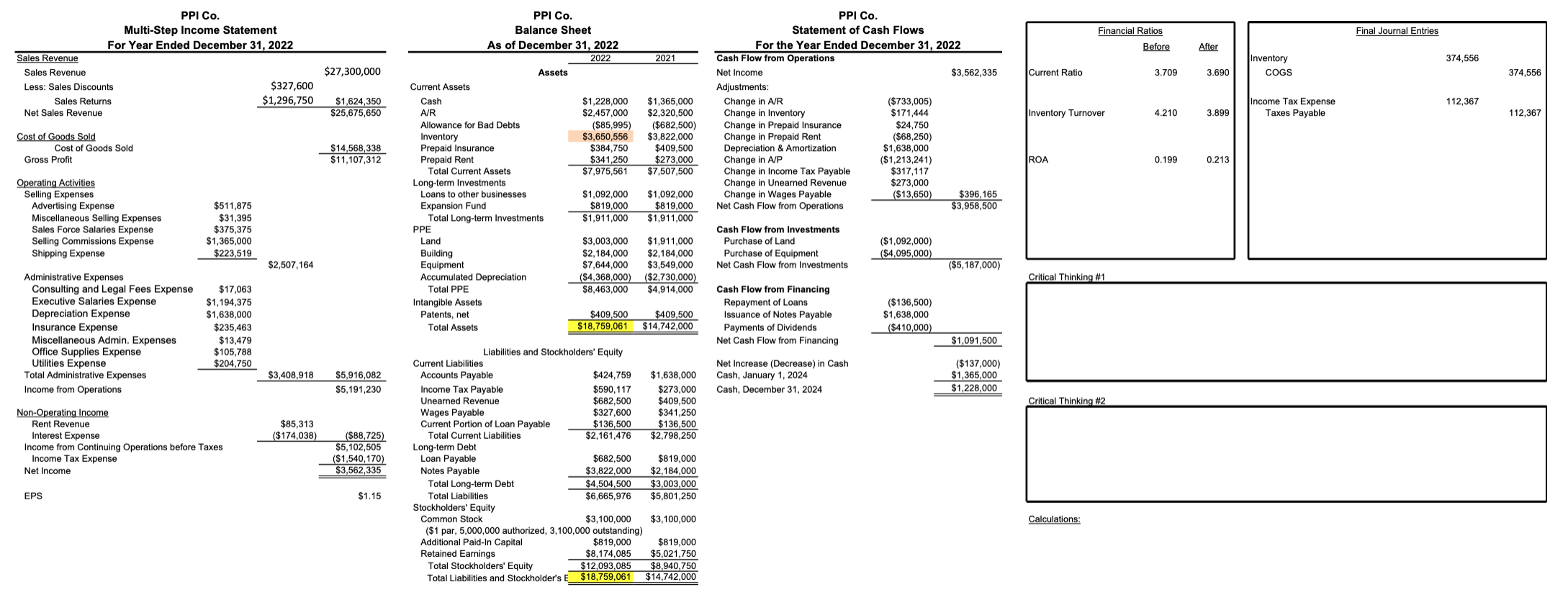

On December th PPI's management was approached by a vendor offering them a chance purchase aspecialized set of assets for only $ The set includes two machines, one that retails for$ and one that retails for $ a custom conveyor belt that the vendor estimates has aretail value of $ and a small storage facility with an estimated market value of $ Thevendor has offered PPI this deal because the company that ordered the units one PPI's competitorshas declared bankruptcy.

To make room for the new equipment, PPI has decided to sell off an old, cumbersome piece ofequipment that will be replaced by the new machines. The old equipment was originally purchased for$ and has been fully depreciated to its estimated salvage value of $ PPI's salesdepartment was able to sell the old machine for $ a pretty good deal considering the change inproduction methods and the improvements in technology.

Although the deal was completed on December th no journal entries have yet been recorded.Before you start, you should know that PPI's finance team has decided to round all percentages usedfor assigning values to assets to decimal places. If the rounding doesn't add up to theadjustment should be made to the facility.

PPIs management would like to know the effect of your adjustment, if any, on the following ratios:

Inventory Turnover

Current Ratio

ROA

Calculations

Make the appropriate journal entries, if any, to correct the reported values of inventory and COGS including any necessary changes to income tax expense

Make any necessary changes to the financial statements.

Critical Thinking:

Calculate each of the required ratios using the original values before any changes and theupdated values after your changes

How do you think the stock analysts following PPI will react to this change in PPE? If youwere the CEO having to explain the decision to analysts, what could you say to eitheraleviate their concerns or improve their outlook for the company?

Help would be appreciated.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock