Question: fuizzes / 5 5 7 1 9 0 3 / take No , since the stock prices can be predicted with certainty. Yes, since no

fuizzestake

No since the stock prices can be predicted with certainty.

Yes, since no actors will be able to take advantage of any profit opportunities when stock prices move under a random walk.

Question

pts

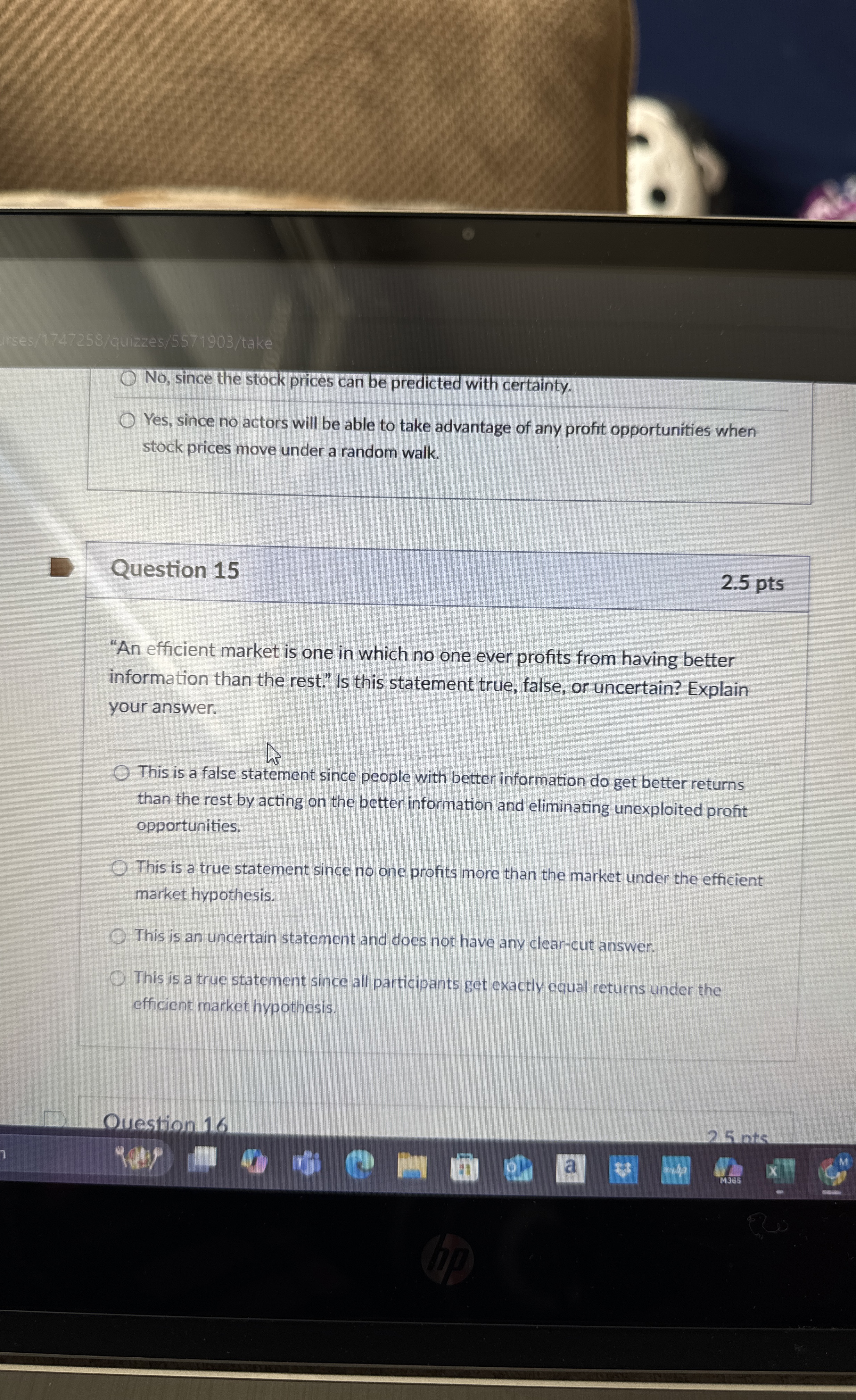

An efficient market is one in which no one ever profits from having better information than the rest." Is this statement true, false, or uncertain? Explain your answer.

This is a false statement since people with better information do get better returns than the rest by acting on the better information and eliminating unexploited profit opportunities.

This is a true statement since no one profits more than the market under the efficient market hypothesis.

This is an uncertain statement and does not have any clearcut answer.

This is a true statement since all participants get exactly equal returns under the efficient market hypothesis.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock