Question: fulfill the marks stated, calculation workings required. Besides, calculation must be rounded up to the nearest 2 decimal points a) JT Limited is a manufacturing

fulfill the marks stated, calculation workings required. Besides, calculation must be rounded up to the nearest 2 decimal points

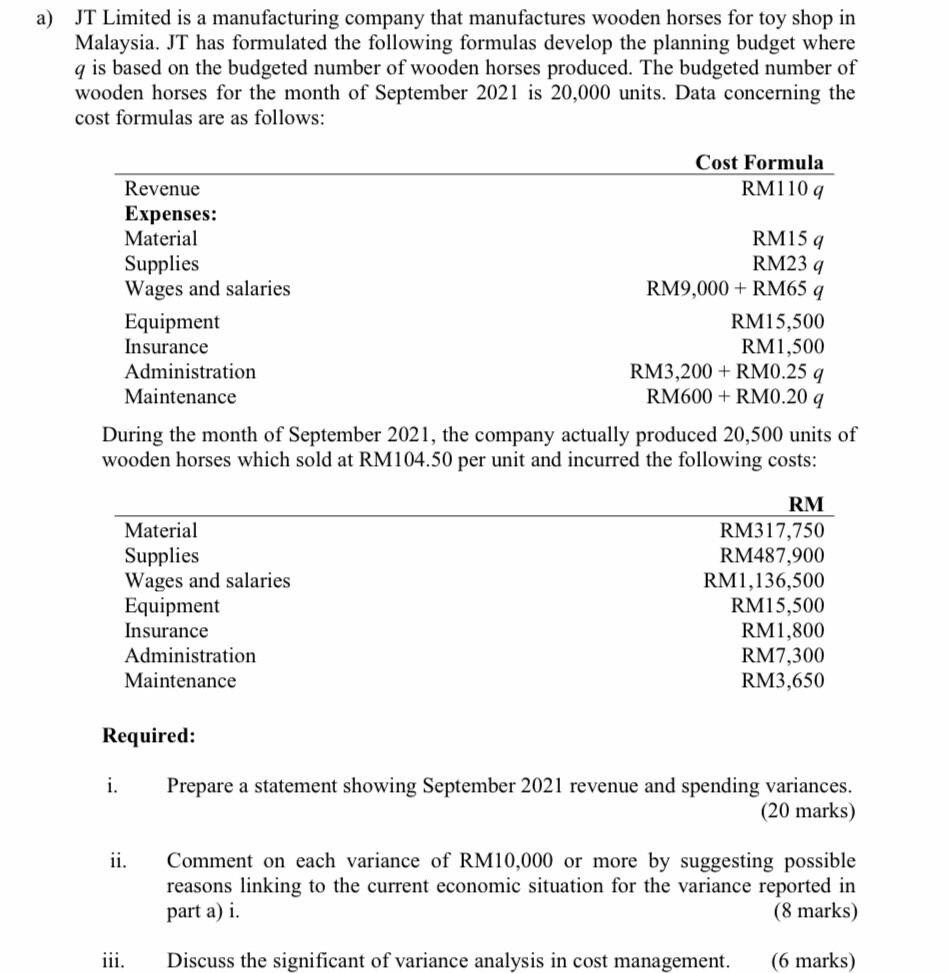

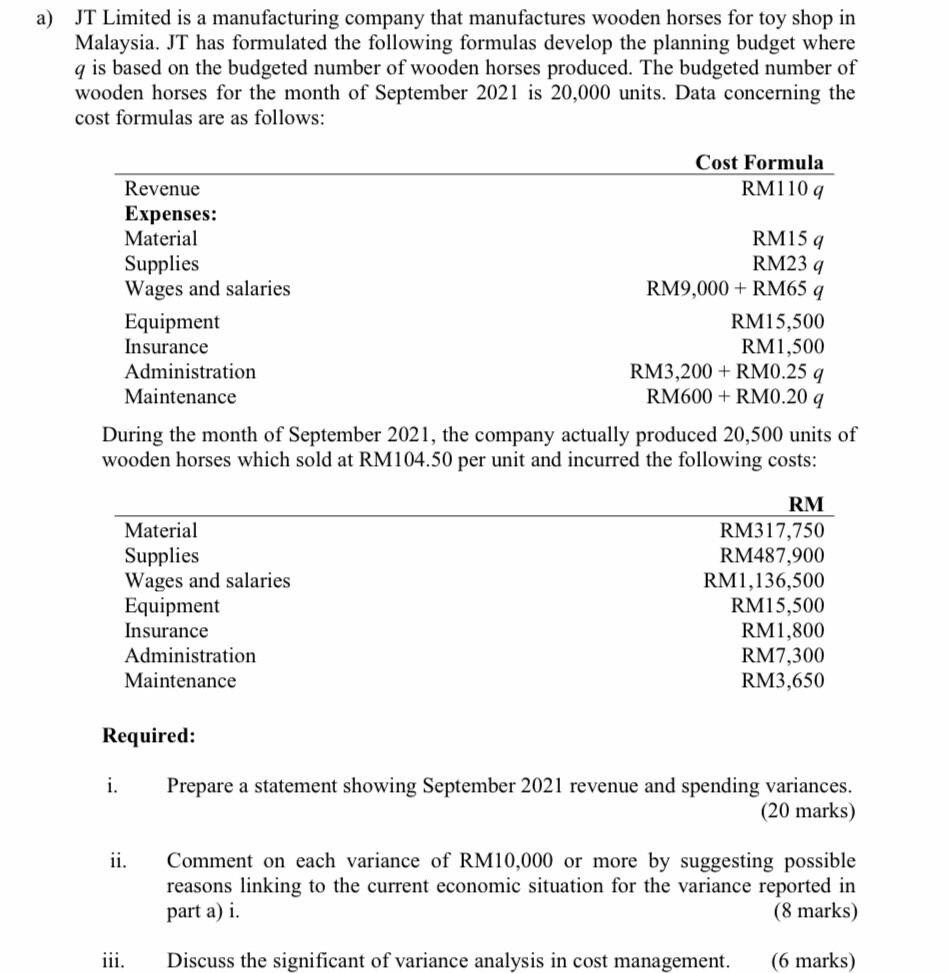

a) JT Limited is a manufacturing company that manufactures wooden horses for toy shop in Malaysia. JT has formulated the following formulas develop the planning budget where q is based on the budgeted number of wooden horses produced. The budgeted number of wooden horses for the month of September 2021 is 20,000 units. Data concerning the cost formulas are as follows: Cost Formula RM1109 Revenue Expenses: Material Supplies Wages and salaries Equipment Insurance Administration Maintenance RM159 RM23 4 RM9,000 + RM65 9 RM15,500 RM1,500 RM3,200 + RM0.25 9 RM600 + RM0.20 9 During the month of September 2021, the company actually produced 20,500 units of wooden horses which sold at RM104.50 per unit and incurred the following costs: Material Supplies Wages and salaries Equipment Insurance Administration Maintenance RM RM317,750 RM487,900 RM1,136,500 RM15,500 RM1,800 RM7,300 RM3,650 Required: i. Prepare a statement showing September 2021 revenue and spending variances. (20 marks) ii. Comment on each variance of RM10,000 or more by suggesting possible reasons linking to the current economic situation for the variance reported in (8 marks) part a) i. iii. Discuss the significant of variance analysis in cost management. (6 marks)