Question: FULL ANSWER NEEDED PROPERLY AND FAST then will give a thumbs up Keith Williams and Brian Adams were students when they formed a partnership several

FULL ANSWER NEEDED PROPERLY AND FAST then will give a thumbs up

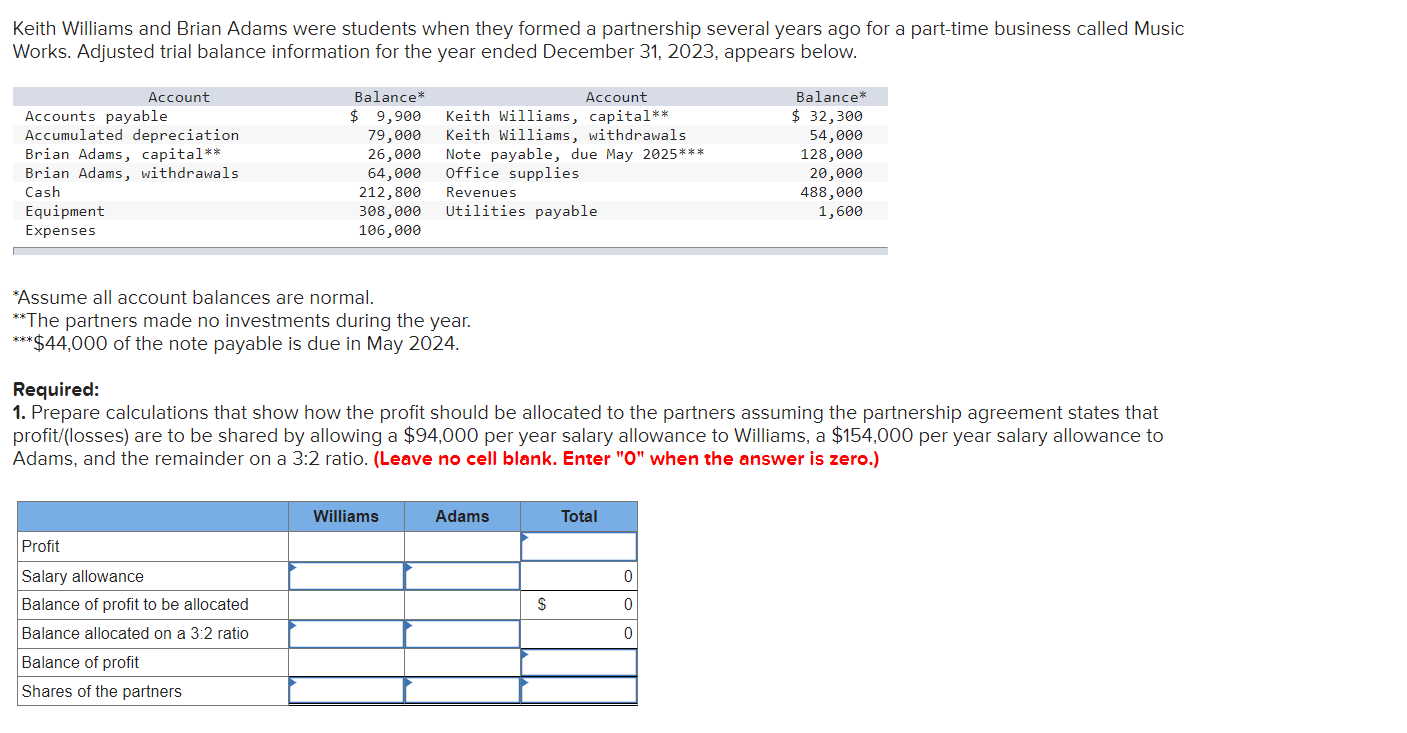

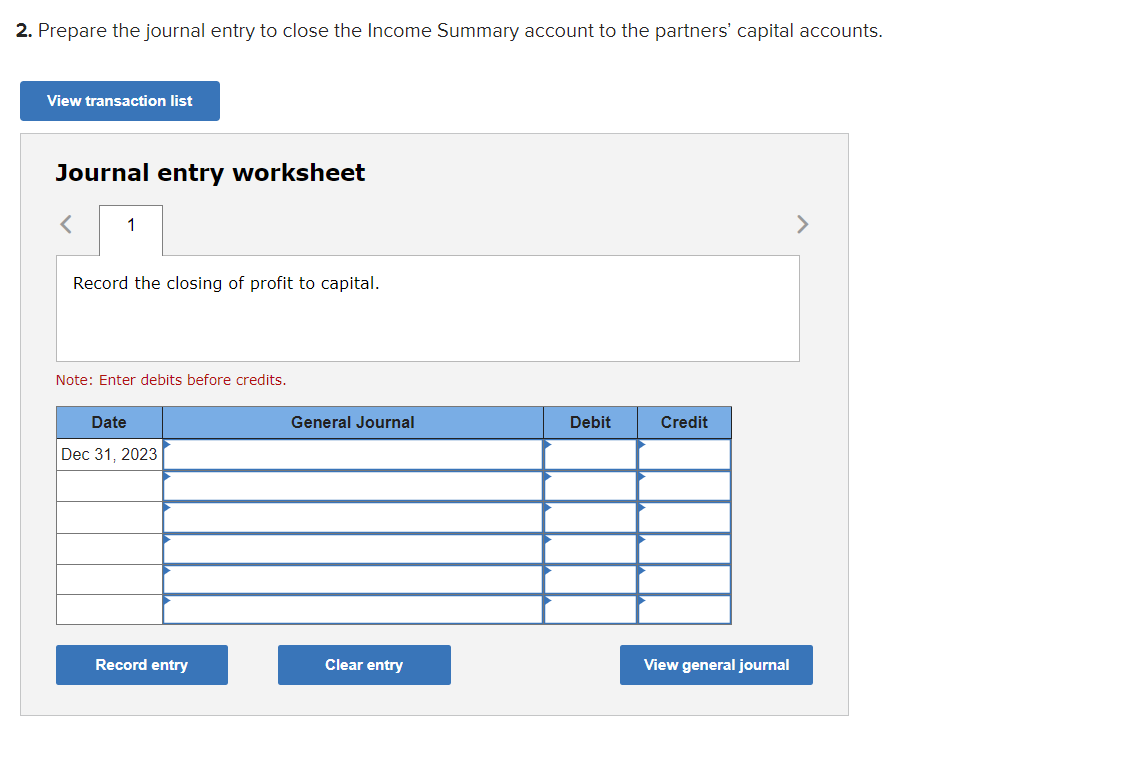

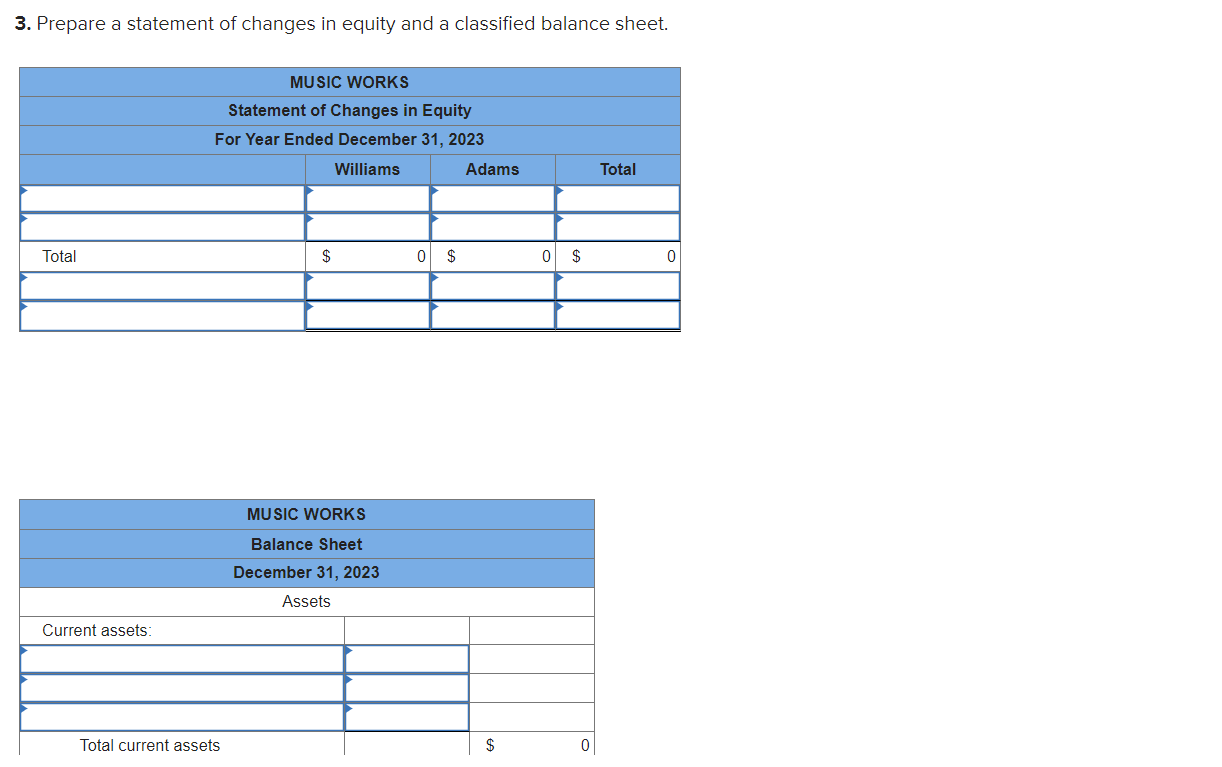

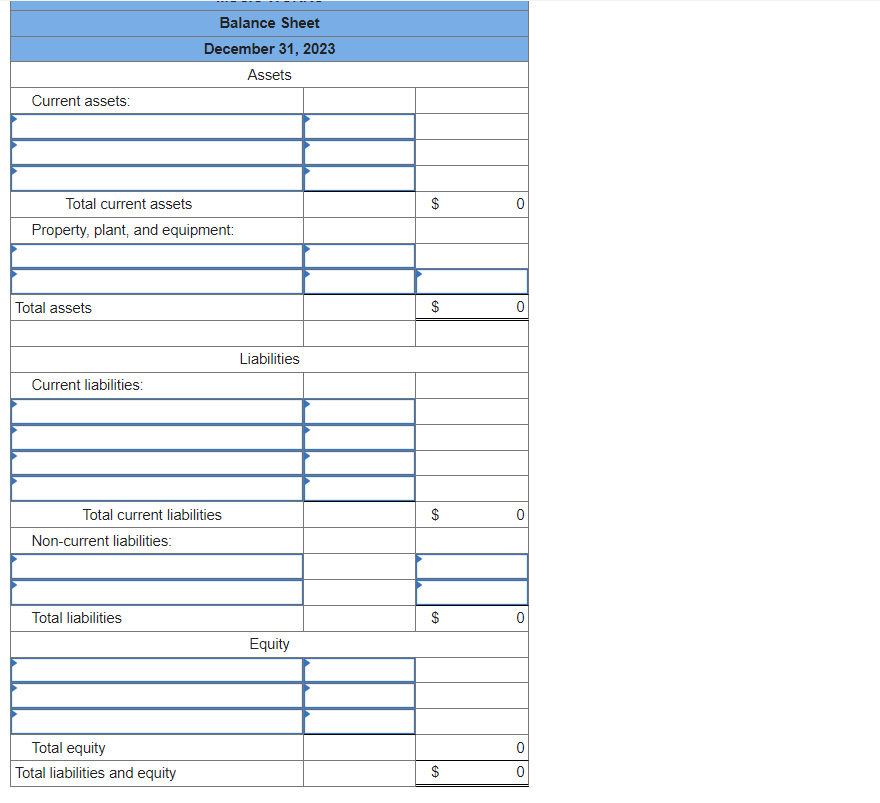

Keith Williams and Brian Adams were students when they formed a partnership several years ago for a part-time business called Music Works. Adjusted trial balance information for the year ended December 31, 2023, appears below. *Assume all account balances are normal. **The partners made no investments during the year. $4,000 of the note payable is due in May 2024. Required: 1. Prepare calculations that show how the profit should be allocated to the partners assuming the partnership agreement states that profit/(losses) are to be shared by allowing a $94,000 per year salary allowance to Williams, a $154,000 per year salary allowance to Adams, and the remainder on a 3:2 ratio. (Leave no cell blank. Enter "0" when the answer is zero.) 2. Prepare the journal entry to close the Income Summary account to the partners' capital accounts. Journal entry worksheet Note: Enter debits before credits. 3. Prepare a statement of changes in equity and a classified balance sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts