Question: full answer please 1,2,3,4 P8-1 Mid year acquisition, overvalued inventory, upstream sale of land On July 1, 2014. Adnan SAL acquired 75 percent of Rayan

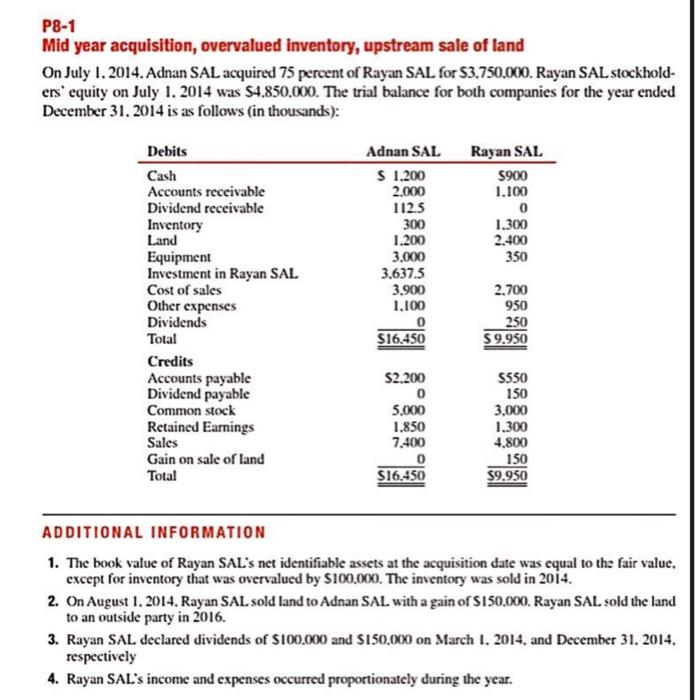

P8-1 Mid year acquisition, overvalued inventory, upstream sale of land On July 1, 2014. Adnan SAL acquired 75 percent of Rayan SAL for $3.750.000. Rayan SAL stockhold- ers' equity on July 1, 2014 was 54.850,000. The trial balance for both companies for the year ended December 31, 2014 is as follows (in thousands): Adnan SAL $ 1.200 2.000 112.5 300 1.200 3.000 3.637.5 3.900 1.100 Rayan SAL 5900 1.100 0 1.300 2.400 350 Debits Cash Accounts receivable Dividend receivable Inventory Land Equipment Investment in Rayan SAL Cost of sales Other expenses Dividends Total Credits Accounts payable Dividend payable Common stock Retained Earnings Sales Gain on sale of land Total 2.700 950 250 59.950 $16.450 S2.200 0 5.000 1.850 7.400 0 $16,450 $550 150 3.000 1.300 4.800 150 $9.950 ADDITIONAL INFORMATION 1. The book value of Rayan SAL's net identifiable assets at the acquisition date was equal to the fair value. except for inventory that was overvalued by $100.000. The inventory was sold in 2014. 2. On August 1. 2014. Rayan SAL sold land to Adnan SAL with a gain of S150.000. Rayan SAL sold the land to an outside party in 2016. 3. Rayan SAL declared dividends of $100.000 and $150,000 on March 1. 2014. and December 31, 2014. respectively 4. Rayan SAL's income and expenses occurred proportionately during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts