Question: full procedure please 2. Liar Key Corp made last year $ 600 million in FCF to the firm (that is before debt payments but after

full procedure please

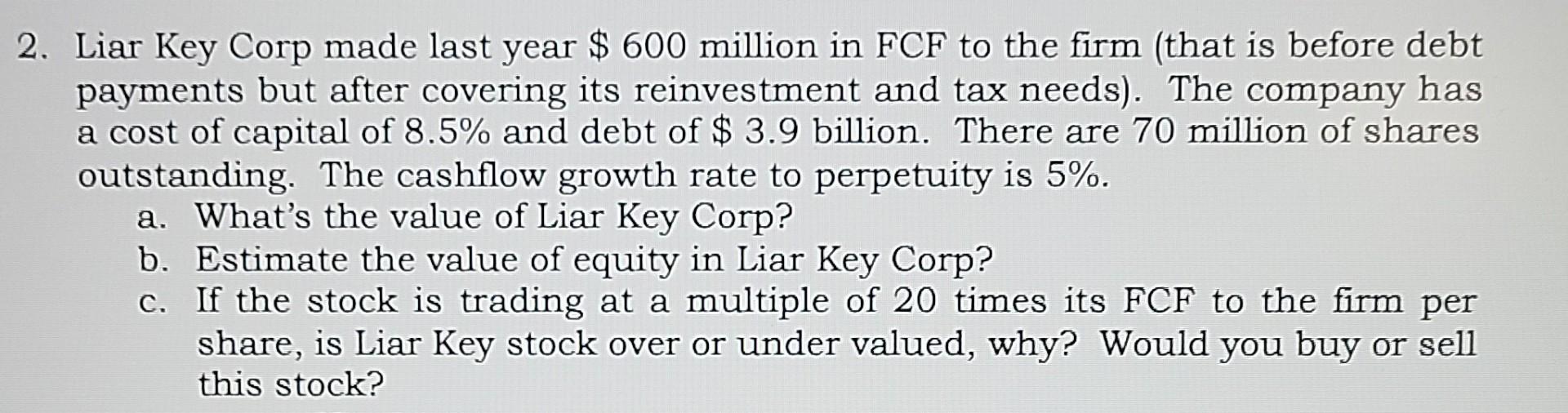

2. Liar Key Corp made last year $ 600 million in FCF to the firm (that is before debt payments but after covering its reinvestment and tax needs). The company has a cost of capital of 8.5% and debt of $ 3.9 billion. There are 70 million of shares outstanding. The cashflow growth rate to perpetuity is 5%. a. What's the value of Liar Key Corp? b. Estimate the value of equity in Liar Key Corp? c. If the stock is trading at a multiple of 20 times its FCF to the firm per share, is Liar Key stock over or under valued, why? Would you buy or sell this stock

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock