Question: Full question is posted as described. PLEASE PROVIDE RIGHT ANSWER This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5

Full question is posted as described. PLEASE PROVIDE RIGHT ANSWER

This Excel worksheet relates to the Dickson Company example that is summarized in Exhibit 2-5

Selling Price in example is $4348.75

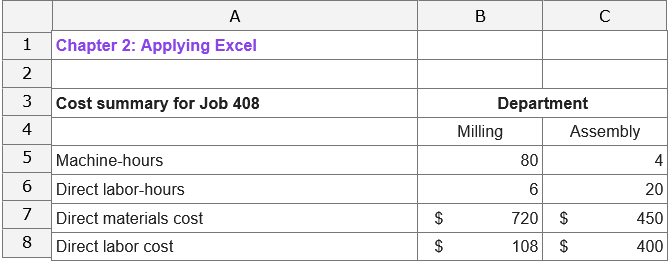

1. Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other data the same as in the original example. Consider a new job, Job 408, with the following characteristics:

In your worksheet, enter this new data in the cells for Job 407.

2. What is the new selling price for Job 408? (Round your final answer to 2 decimal places.)

3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machine-hours in the Assembly Department increases from 3,000 machine-hours to 4,000 machine-hours? (Round your final answer to 2 decimal places.)

4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 40,000 direct labor-hours? (Round your final answer to 2 decimal places.)

1 2 3 4 5 6 7 8 A Chapter 2: Applying Excel Cost summary for Job 408 Machine-hours Direct labor-hours Direct materials cost Direct labor cost $ $ B Department 80 6 720 $ 108 $ Milling Assembly 4 20 450 400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts