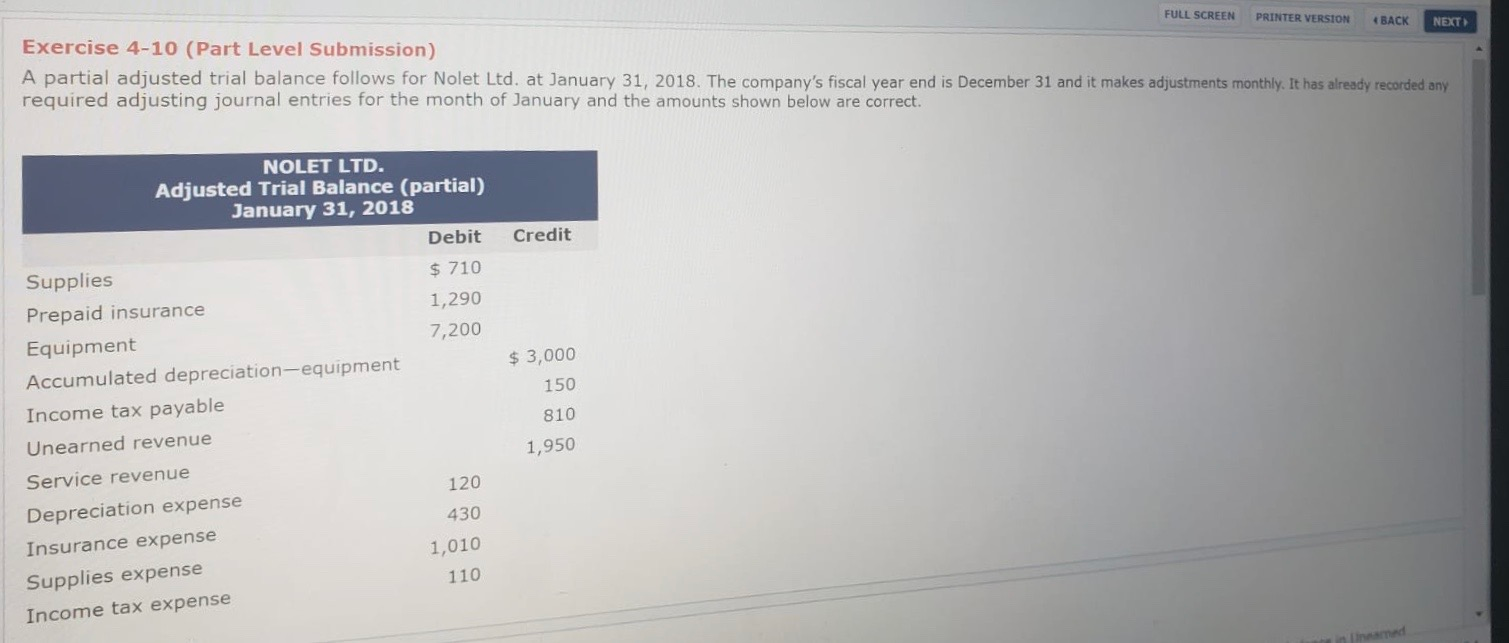

Question: FULL SCREEN PRINTER VERSION BACK NEXT Exercise 4-10 (Part Level Submission) A partial adjusted trial balance follows for Nolet Ltd. at January 31, 2018. The

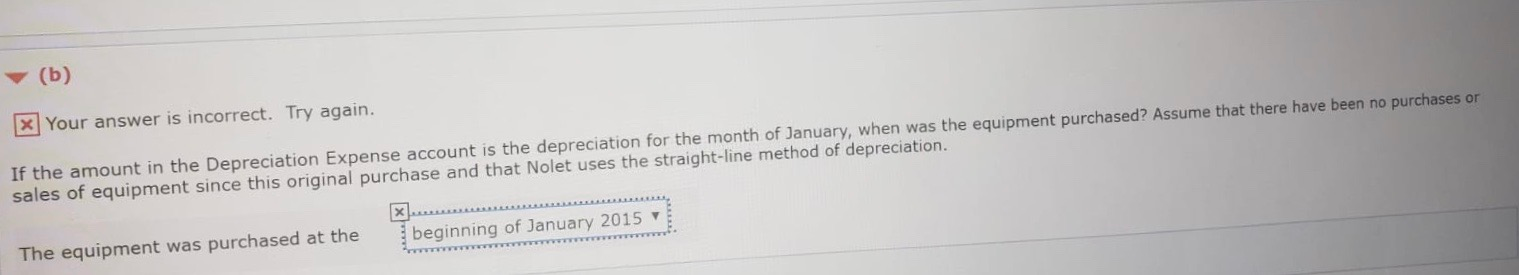

FULL SCREEN PRINTER VERSION BACK NEXT Exercise 4-10 (Part Level Submission) A partial adjusted trial balance follows for Nolet Ltd. at January 31, 2018. The company's fiscal year end is December 31 and it makes adjustments monthly. It has already recorded any required adjusting journal entries for the month of January and the amounts shown below are correct. Credit NOLET LTD. Adjusted Trial Balance (partial) January 31, 2018 Debit Supplies $ 710 Prepaid insurance 1,290 Equipment 7,200 Accumulated depreciation-equipment Income tax payable Unearned revenue Service revenue 120 Depreciation expense 430 Insurance expense 1,010 Supplies expense 110 Income tax expense $ 3,000 150 810 1,950 (b) x Your answer is incorrect. Try again. If the amount in the Depreciation Expense account is the depreciation for the month of January, when was the equipment purchased? Assume that there have been no purchases or sales of equipment since this original purchase and that Nolet uses the straight-line method of depreciation. The equipment was purchased at the beginning of January 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts