Question: FULL SOLUTION TO QUESTION 1 AND 2 PLEASE! Question 1 A $15000 bond redeemable at par on February 24, 2016 is purchased on February 27,

FULL SOLUTION TO QUESTION 1 AND 2 PLEASE!

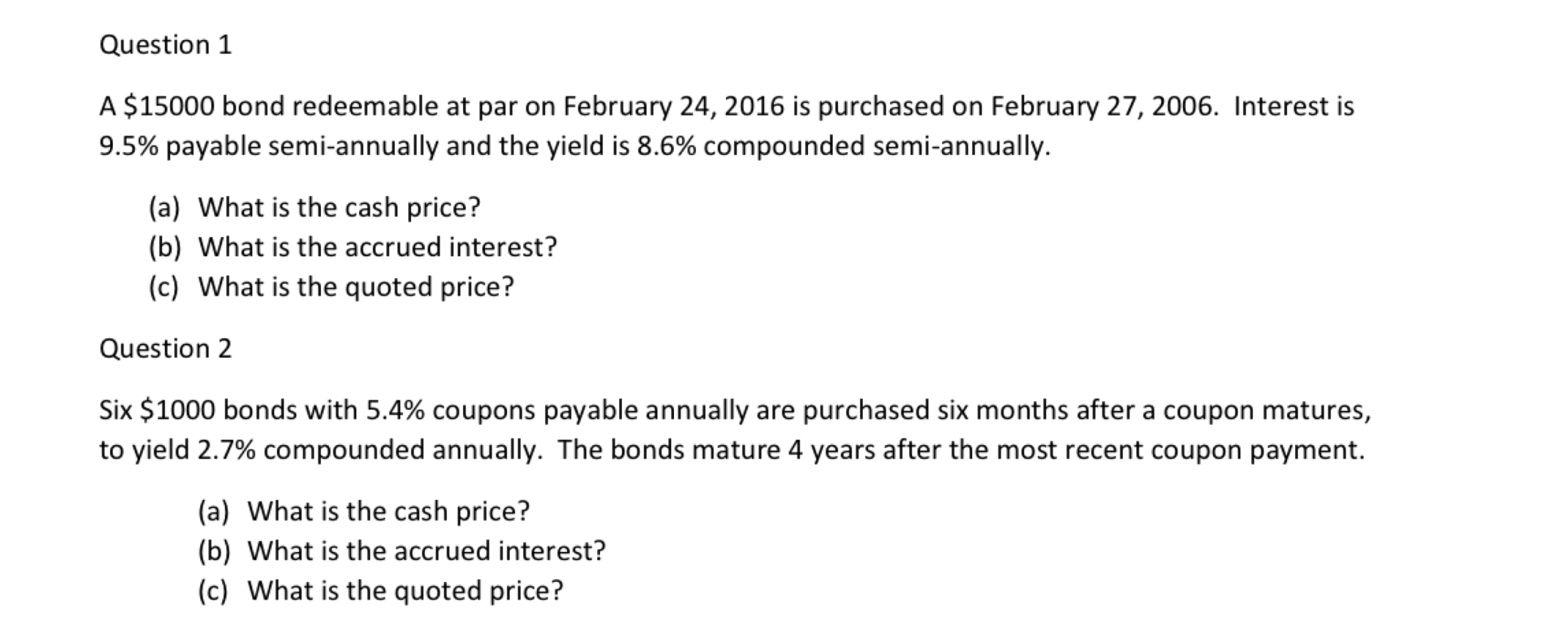

Question 1 A $15000 bond redeemable at par on February 24, 2016 is purchased on February 27, 2006. Interest is 9.5% payable semi-annually and the yield is 8.6% compounded semi-annually. (a) What is the cash price? (b) What is the accrued interest? (c) What is the quoted price? Question 2 Six $1000 bonds with 5.4% coupons payable annually are purchased six months after a coupon matures, to yield 2.7% compounded annually. The bonds mature 4 years after the most recent coupon payment. (a) What is the cash price? (b) What is the accrued interest? (c) What is the quoted price? Question 1 A $15000 bond redeemable at par on February 24, 2016 is purchased on February 27, 2006. Interest is 9.5% payable semi-annually and the yield is 8.6% compounded semi-annually. (a) What is the cash price? (b) What is the accrued interest? (c) What is the quoted price? Question 2 Six $1000 bonds with 5.4% coupons payable annually are purchased six months after a coupon matures, to yield 2.7% compounded annually. The bonds mature 4 years after the most recent coupon payment. (a) What is the cash price? (b) What is the accrued interest? (c) What is the quoted price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts