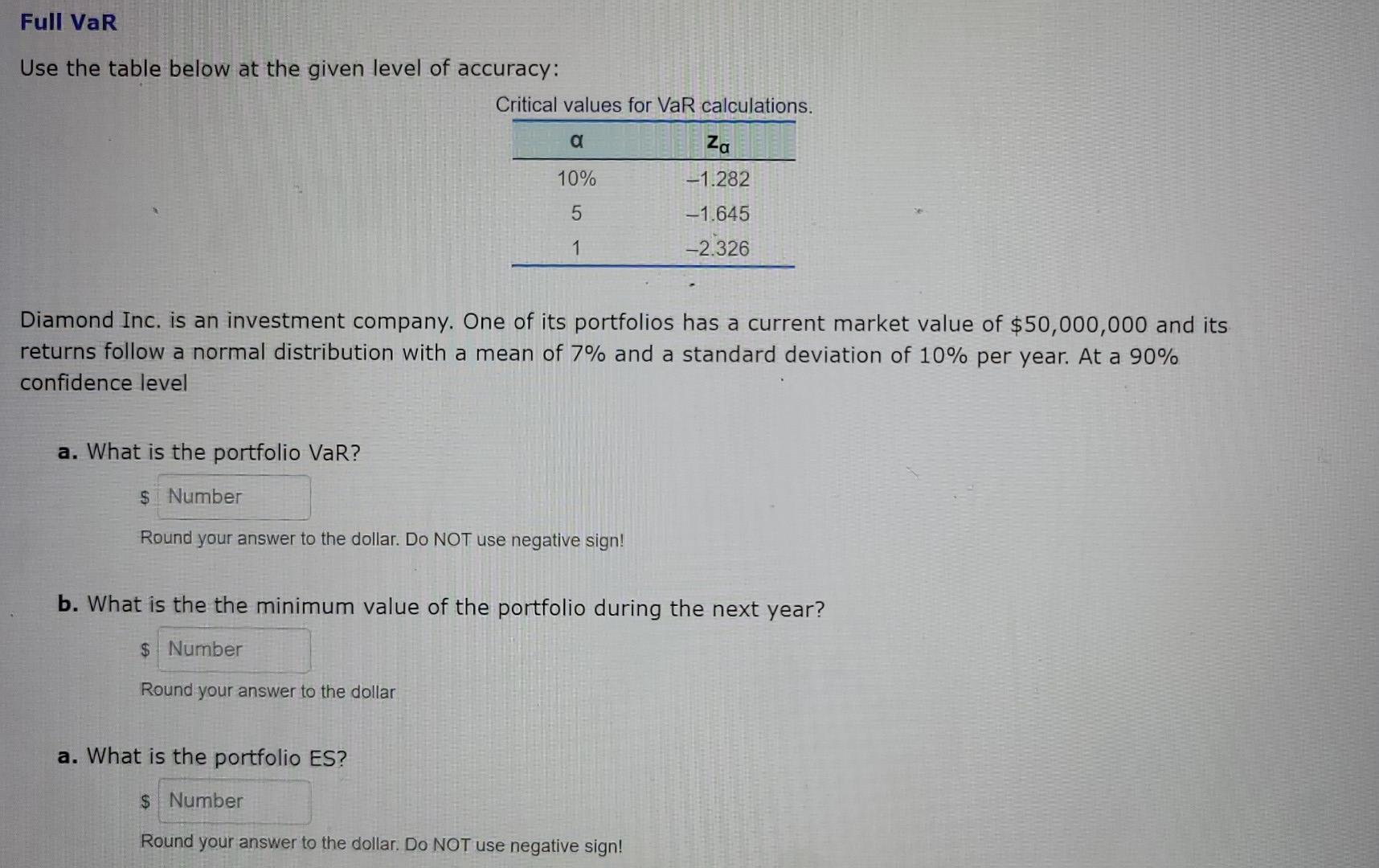

Question: Full VaR Use the table below at the given level of accuracy: Critical values for VaR calculations. a Za 10% -1.282 5 -1.645 1 -2.326

Full VaR Use the table below at the given level of accuracy: Critical values for VaR calculations. a Za 10% -1.282 5 -1.645 1 -2.326 Diamond Inc. is an investment company. One of its portfolios has a current market value of $50,000,000 and its returns follow a normal distribution with a mean of 7% and a standard deviation of 10% per year. At a 90% confidence level a. What is the portfolio Var? $ Number Round your answer to the dollar. Do NOT use negative sign! b. What is the the minimum value of the portfolio during the next year? $ Number Round your answer to the dollar a. What is the portfolio ES? $ Number Round your answer to the dollar. Do NOT use negative sign! Full VaR Use the table below at the given level of accuracy: Critical values for VaR calculations. a Za 10% -1.282 5 -1.645 1 -2.326 Diamond Inc. is an investment company. One of its portfolios has a current market value of $50,000,000 and its returns follow a normal distribution with a mean of 7% and a standard deviation of 10% per year. At a 90% confidence level a. What is the portfolio Var? $ Number Round your answer to the dollar. Do NOT use negative sign! b. What is the the minimum value of the portfolio during the next year? $ Number Round your answer to the dollar a. What is the portfolio ES? $ Number Round your answer to the dollar. Do NOT use negative sign

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts