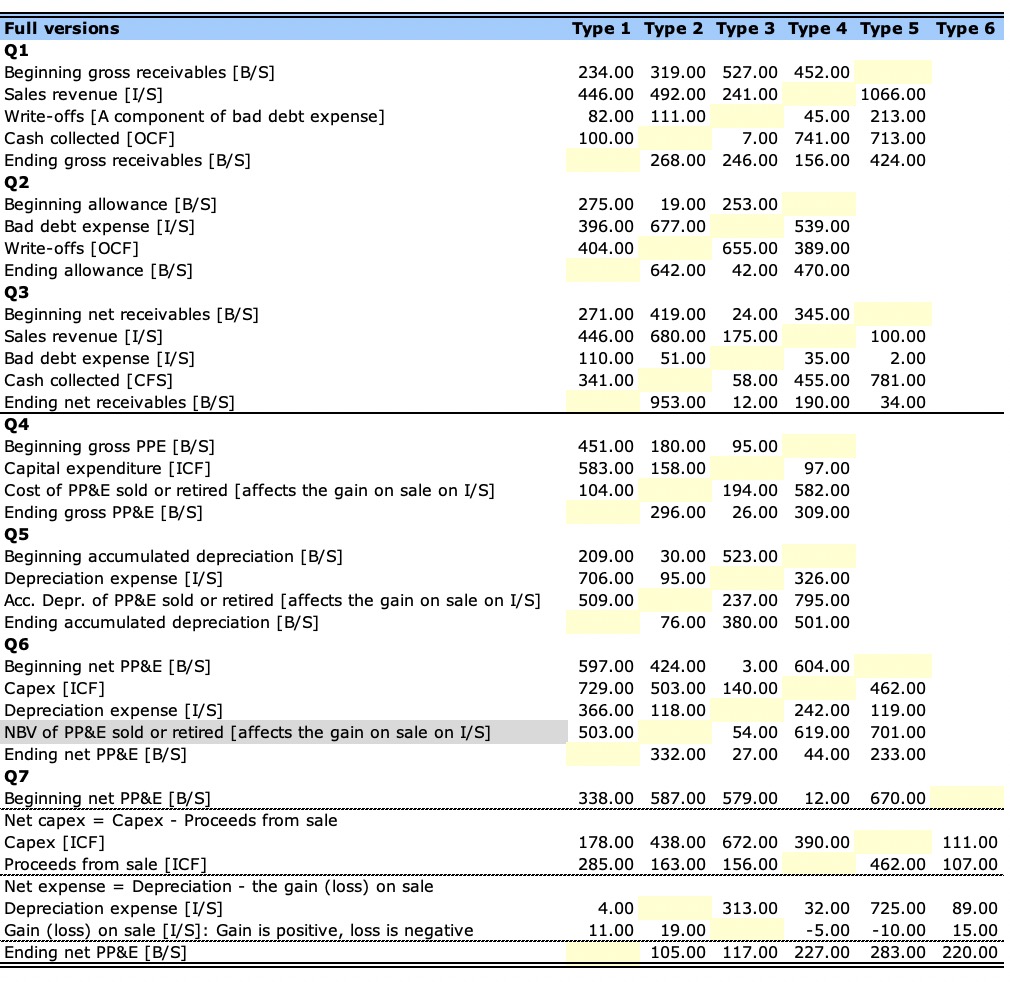

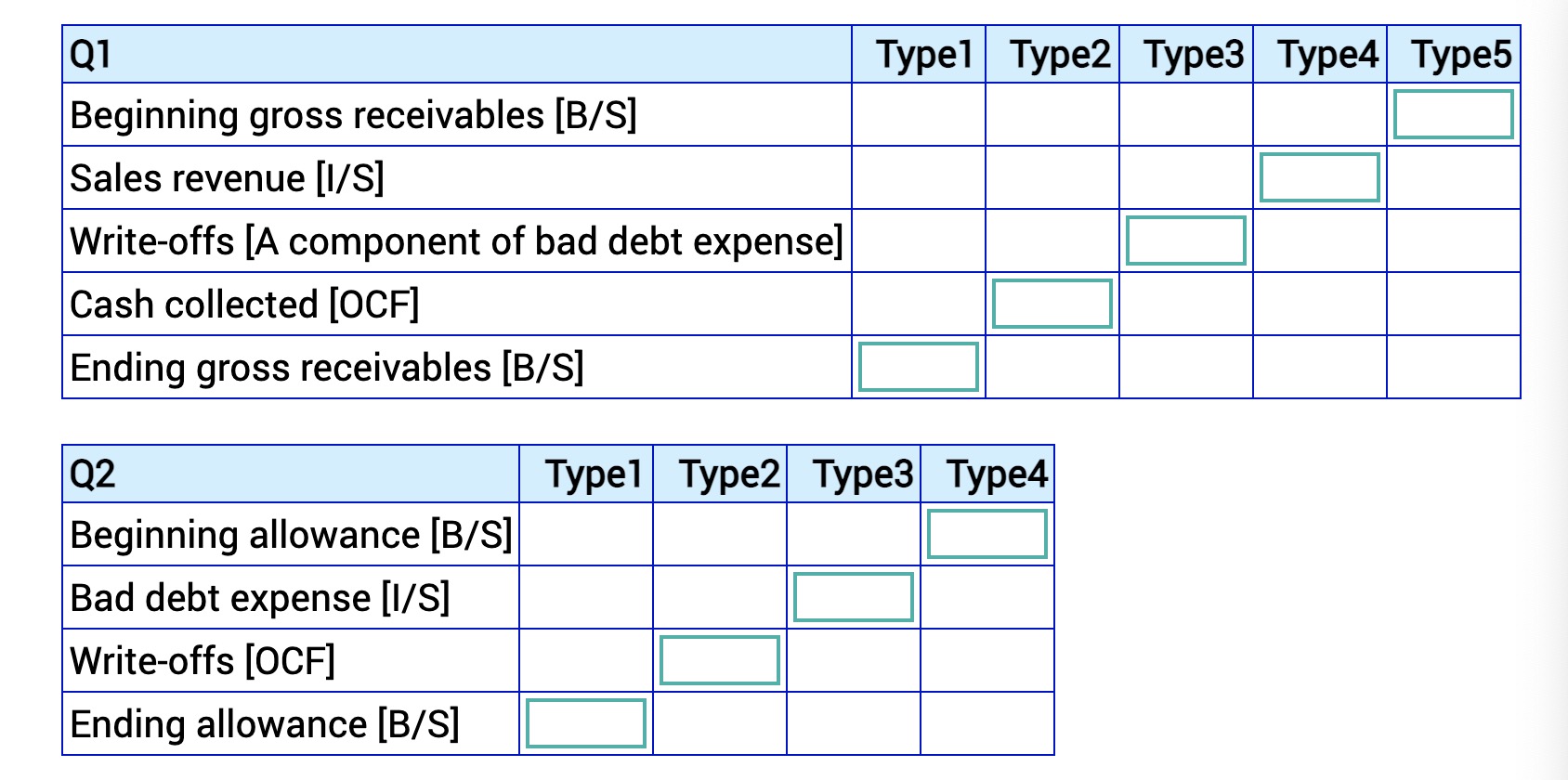

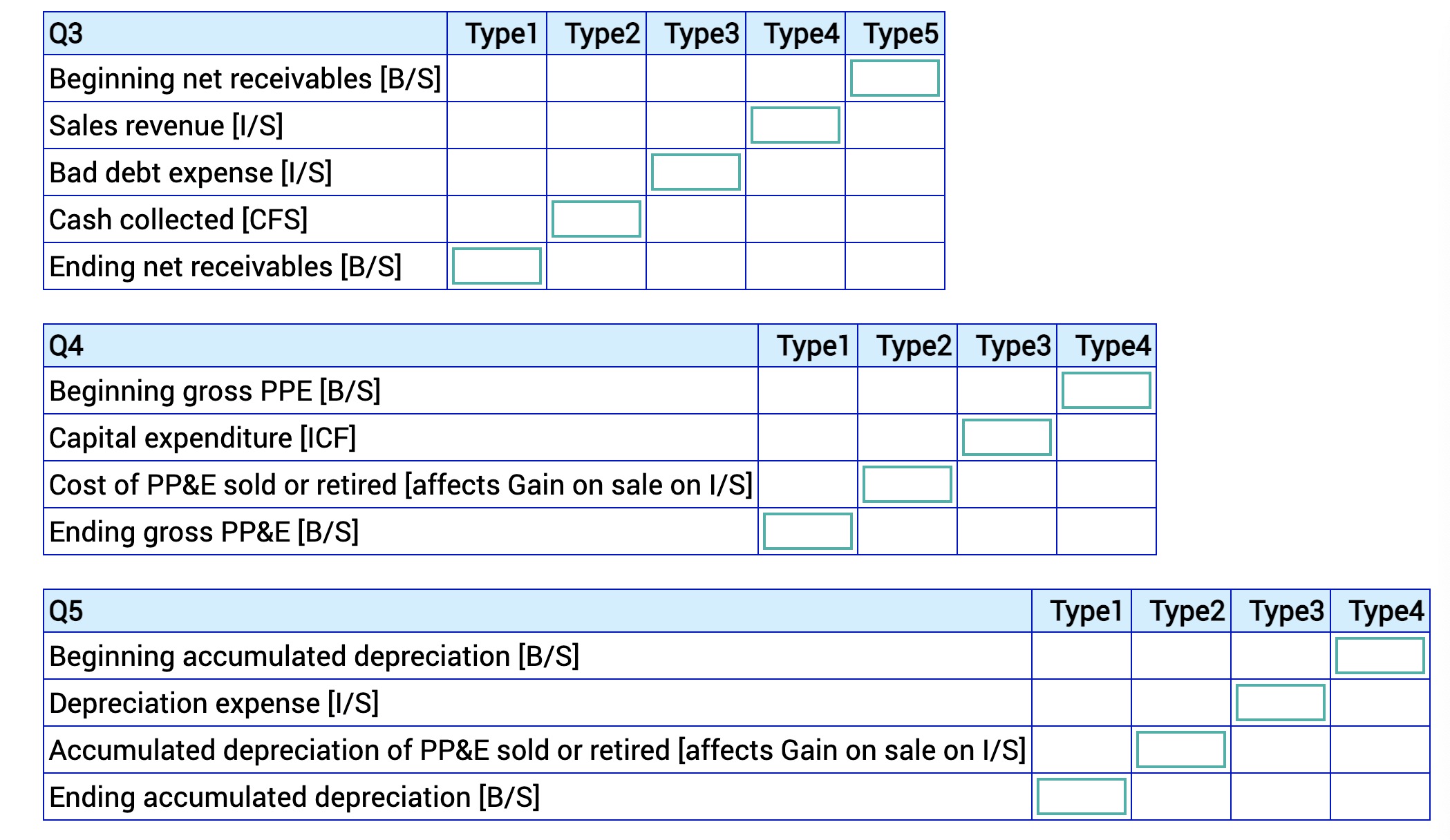

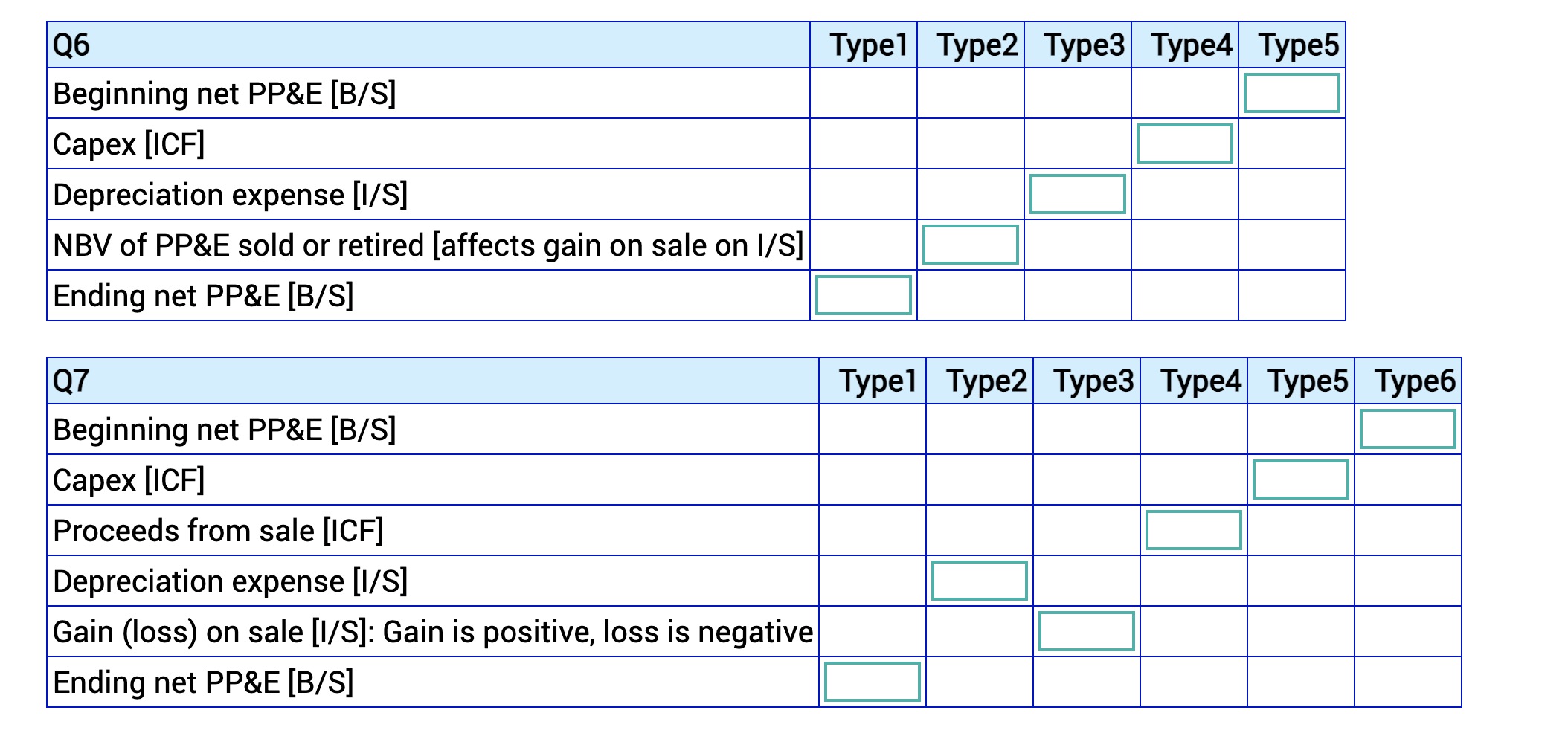

Question: Full versions Type 1 Type 2 Type 3 Type 4 Type 5 Type 6 Q1 Beginning gross receivables [B/S] 234.00 319.00 527.00 452.00 Sales revenue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock