Question: Fun Resort ( Pty ) Ltd is considering adding a new high tech exercise machine to its facilities. The company identified two possible machines that

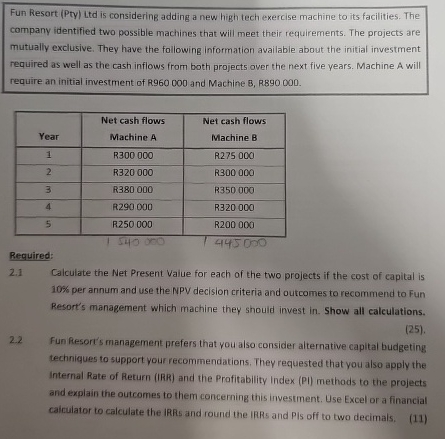

Fun Resort Pty Ltd is considering adding a new high tech exercise machine to its facilities. The company identified two possible machines that will meet their requirements. The projects are mutually exclusive. They have the following information available about the initial investment required as well as the cash inflows from both projects over the next five years. Machine A will require an initial investment of R and Machine B R

tableYearNet cash flows Machine ANet cash flows Machine BRRRRRRRRRR

Required:

Calculate the Net Present Value for each of the two projects if the cost of capital is per annum and use the NPV decision criteria and outcomes to recommend to Fun Resort's management which machine they should invest in Show all calculations.

Fun Resort's management prefers that you also consider aiternative capltal budgeting techniques to support your recommendations. They requested that you also apply the Internal Rate of Return IRR and the Profitability Index PI methods to the projects and explain the outcomes to them concerning this investment. Use Excel or a financial calculator to calculate the IRRs and round the IRRs and PIs off to two decimals.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock