Question: Fund 1 - UK equity fund. Expected return = 10% per year. Volatility = 18% per year. Fund 2 - Global highly rated corporate bond

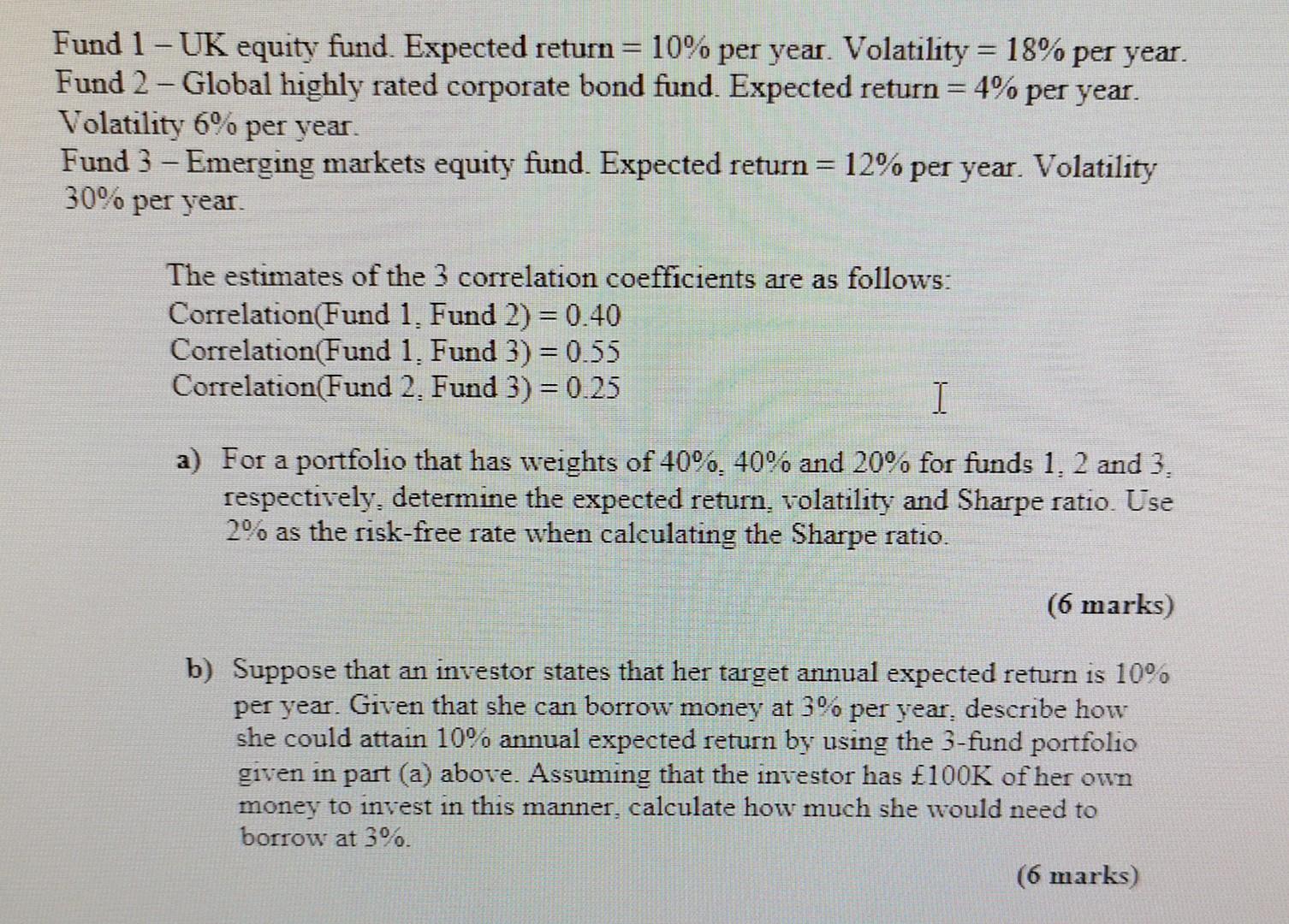

Fund 1 - UK equity fund. Expected return = 10% per year. Volatility = 18% per year. Fund 2 - Global highly rated corporate bond fund. Expected return = 4% per year. Volatility 6% per year Fund 3 - Emerging markets equity fund. Expected return 12% per year. Volatility 30% per year. The estimates of the 3 correlation coefficients are as follows: Correlation(Fund 1. Fund 2) = 0.40 Correlation(Fund 1. Fund 3) = 0.55 Correlation(Fund 2. Fund 3) = 0.25 I a) For a portfolio that has weights of 40%, 40% and 20% for funds 1, 2 and 3. respectively, determine the expected return, volatility and Sharpe ratio. Use 2% as the risk-free rate when calculating the Sharpe ratio. (6 marks) b) Suppose that an investor states that her target annual expected return is 10% per year. Given that she can borrow money at 3% per year, describe how she could attain 10% annual expected return by using the 3-fund portfolio given in part (a) above. Assuming that the investor has 100K of her own money to invest in this manner, calculate how much she would need to borrow at 3%. (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts