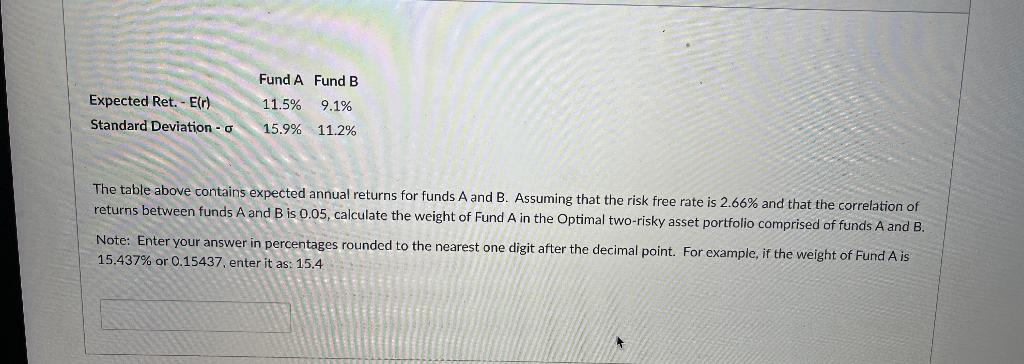

Question: Fund A Fund B Expected Ret. - E(r) Standard Deviation - 11.5% 15.9% 9.1% 11.2% The table above contains expected annual returns for funds A

Fund A Fund B Expected Ret. - E(r) Standard Deviation - 11.5% 15.9% 9.1% 11.2% The table above contains expected annual returns for funds A and B. Assuming that the risk free rate is 2.66% and that the correlation of returns between funds A and B is 0.05, calculate the weight of Fund A in the Optimal two-risky asset portfolio comprised of funds A and B. Note: Enter your answer in percentages rounded to the nearest one digit after the decimal point. For example, if the weight of Fund Als 15.437% or 0.15437. enter it as: 15.4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts