Question: fund and are given the choice or two share classes. Class U shares charge a fee as a percentage of the initial investment upfront. Class

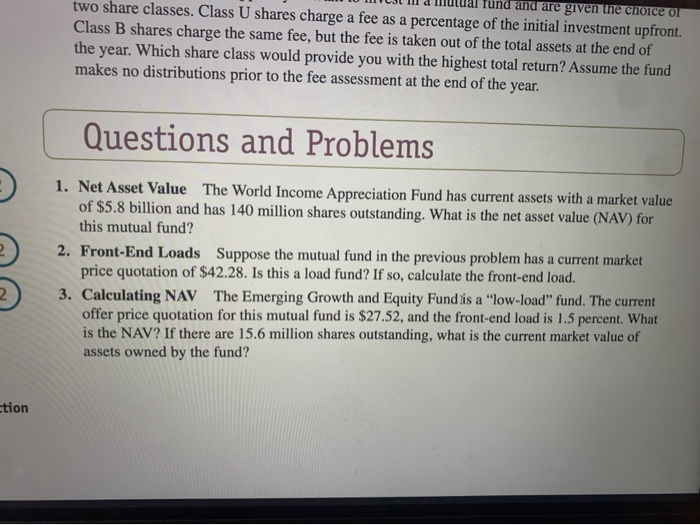

fund and are given the choice or two share classes. Class U shares charge a fee as a percentage of the initial investment upfront. Class B shares charge the same fee, but the fee is taken out of the total assets at the end of the year. Which share class would provide you with the highest total return? Assume the fund makes no distributions prior to the fee assessment at the end of the year. Questions and Problems 1. Net Asset Value The World Income Appreciation Fund has current assets with a market value of $5.8 billion and has 140 million shares outstanding. What is the net asset value (NAV) for this mutual fund? 2. Front-End Loads Suppose the mutual fund in the previous problem has a current market price quotation of $42.28. Is this a load fund? If so, calculate the front-end load. 3. Calculating NAV The Emerging Growth and Equity Fund is a "low-load" fund. The current offer price quotation for this mutual fund is $27.52, and the front-end load is 1.5 percent. What is the NAV? If there are 15.6 million shares outstanding, what is the current market value of assets owned by the fund? ction

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts