Question: Fund Performance Between 1999 and 2008, the returns on Microfund averaged 4% a year. In his 2008 discussion of performance, the fund president noted that

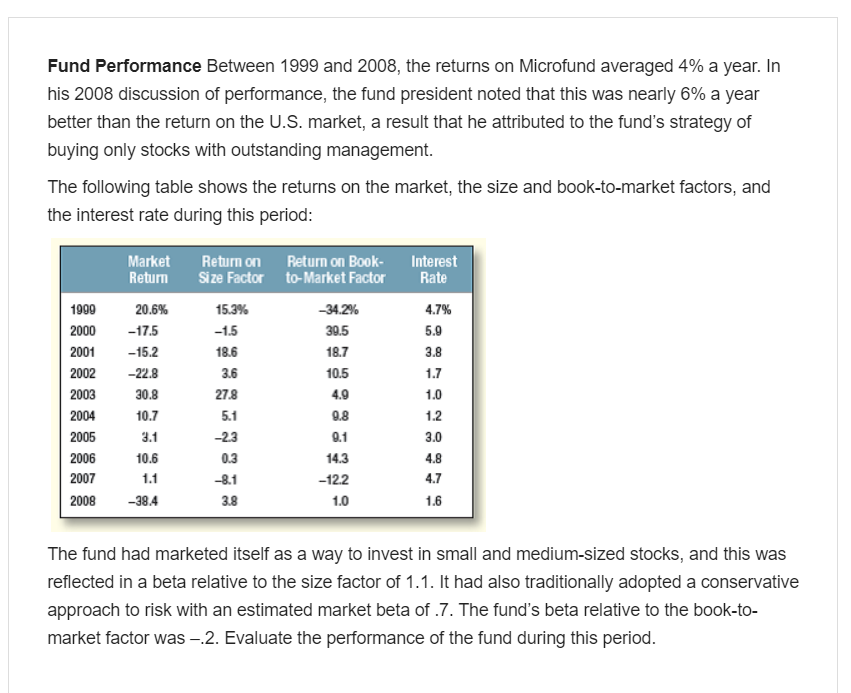

Fund Performance Between 1999 and 2008, the returns on Microfund averaged 4% a year. In his 2008 discussion of performance, the fund president noted that this was nearly 6% a year better than the return on the U.S. market, a result that he attributed to the fund's strategy of buying only stocks with outstanding management. The following table shows the returns on the market, the size and book-to-market factors, and the interest rate during this period: Market Return Interest Rate Return on Return on Book- Size Factor to-Market Factor 15.3% -34.2% -1.5 30.5 18.6 18.7 4.7% 5.9 3.8 1.7 3.6 20.6% -17.5 -15.2 -22.8 30.8 10.7 3.1 10.6 1.1 10.5 4.9 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 1.0 9.8 27.8 5.1 -23 0.3 0.1 1.2 3.0 4.8 4.7 1.6 14.3 -12.2 1.0 -8.1 -38.4 3.8 The fund had marketed itself as a way to invest in small and medium-sized stocks, and this was reflected in a beta relative to the size factor of 1.1. It had also traditionally adopted a conservative approach to risk with an estimated market beta of.7. The fund's beta relative to the book-to- market factor was .2. Evaluate the performance of the fund during this period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts