Question: furmola and steps 1929 Neda - Protected View - Saved to this PC- n View . Layout References Mailings Review Help Duations 8 points Chapter

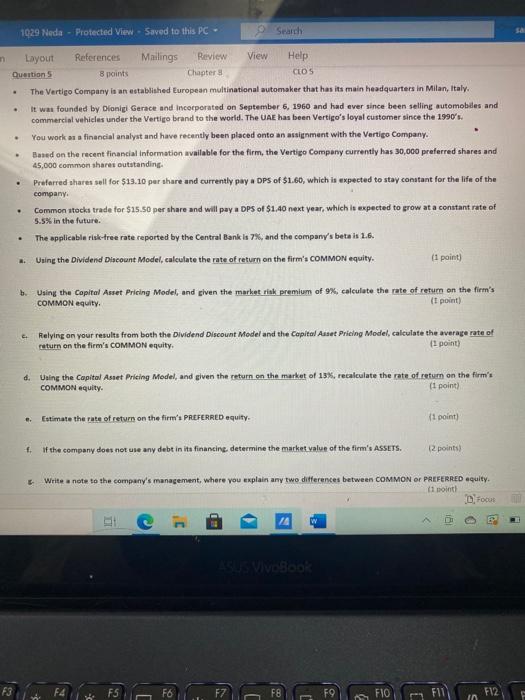

1929 Neda - Protected View - Saved to this PC- n View . Layout References Mailings Review Help Duations 8 points Chapter CEOS The Vertigo Company is an established European multinational automaker that has its main headquarters in Milan, Italy It was founded by Dionigi Gerace and Incorporated on September 6, 1960 and had ever since been selling automobiles and commercial vehicles under the Vertigo brand to the world. The UAE has been Vertigo's loyal customer since the 1990's. You work as a financial analyst and have recently been placed onto an assignment with the Vertigo Company. Based on the recent financial Information available for the firm, the Vertigo Company currently has 30,000 preferred shares and 45,000 common shares outstanding Preferred shares sell for $13.10 per share and currently pay a DPS of $1.60, which is expected to stay constant for the life of the company Common stocks trade for $15.50 per share and will pay DPs of $1.40 next year, which is expected to prow at a constant rate of 5.5% in the future The applicable risk-free rate reported by the Central Bank la 7%, and the company's beta 11.6. Using the Dividend Discount Model, calculate the rate of return on the firm's COMMON equity. (1 point) - . . b. Using the Capital Asset Pricing Model, and given the market riak premium of 9%, calculate the rate of return on the firm's COMMON equity (1 point) Relying on your results from both the Dividend Discount Model and the Capital Asset Pricing Model, calculate the average rate of return on the firm's COMMON equity. (1 point) d. Using the Capital Asset Prieing Model, and given the return on the market of 15%, recalculate the rate of return on the firm's COMMON equity. 1 point) e. Estimate the cutest return on the firm': PREFERRED quity. (1 point) f if the company does not use any debt in its financing, determine the market value of the firm's Assers. 12 points) E Write a note to the company's management, where you explain any two differences between COMMON OR PREFERRED equity. 11 mointi Focus le ED C .. F3 F7 F8 F9 FIO FIL F12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts