Question: FUTA is 0 . 6 % on the first $ 7 , 0 0 0 of income and SUTA is 5 . 4 % also

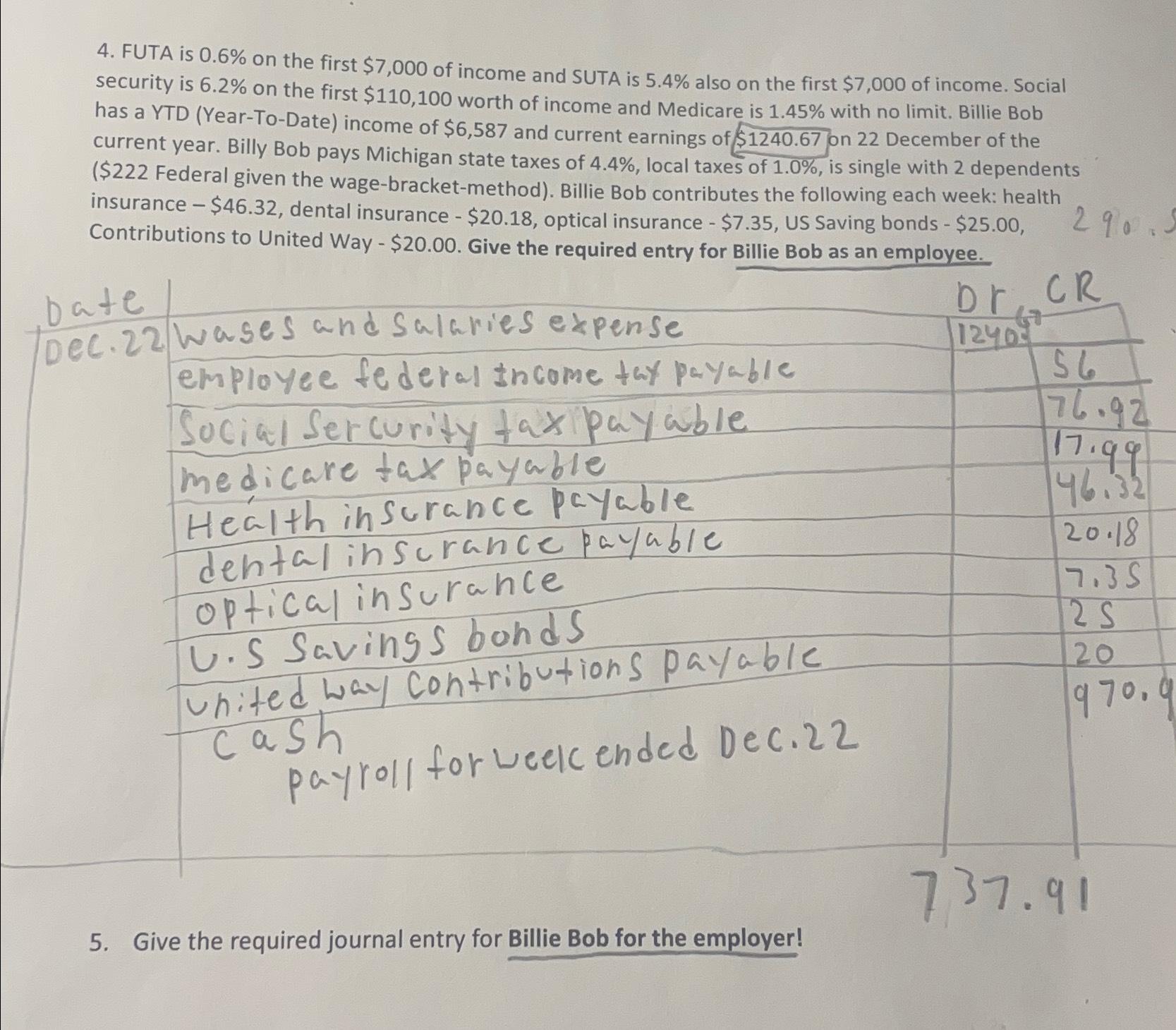

FUTA is on the first $ of income and SUTA is also on the first $ of income. Social security is on the first $ worth of income and Medicare is with no limit Billie Bob has a YTD YearToDate income of $ and current earnings of $ on December of the current year. Billy Bob pays Michigan state taxes of local taxes of is single with dependents $ Federal given the wagebracketmethod Billie Bob contributes the following each week: health insurance $ dental insurance $ optical insurance $ US Saving bonds $ Contributions to United Way $ Give the required entry for Billie Bob as an employee.

Give the required journal entry for Billie Bob for the employer!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock