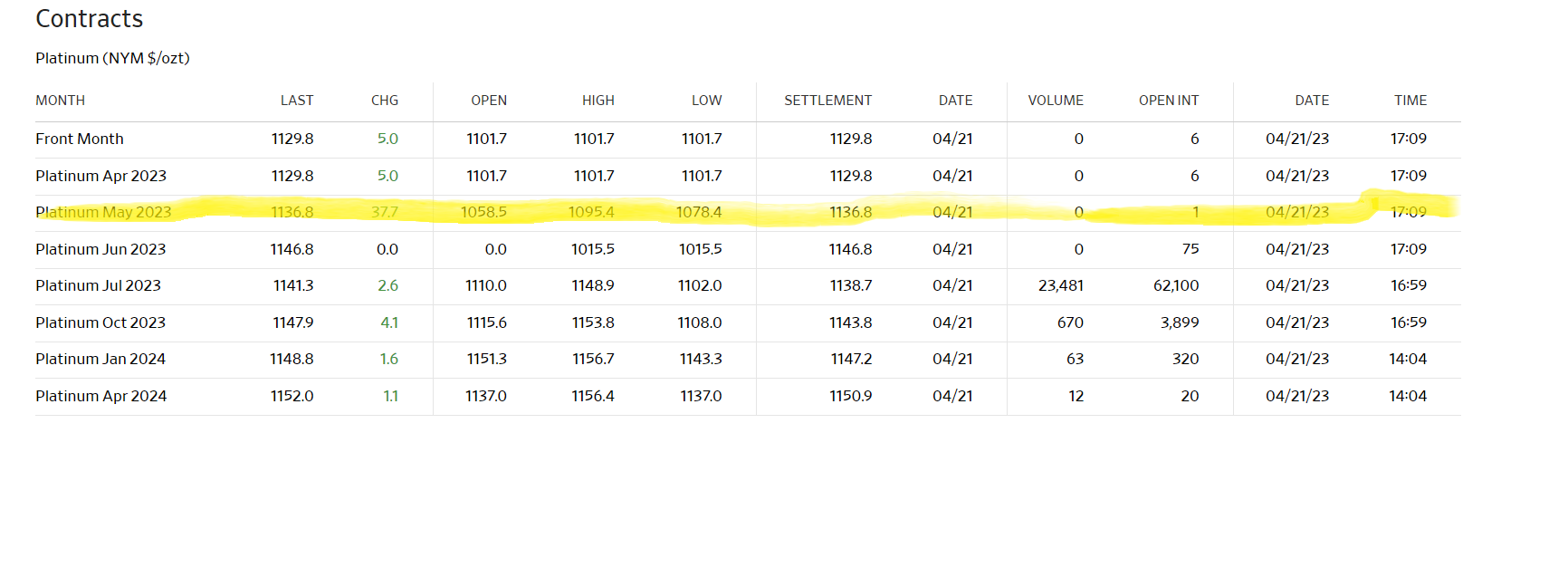

Question: Future Contracts Using the above information, Answer the below questions: 1) Assuming a 10% initial margin, how much money do you need to buy one

Future Contracts

Using the above information, Answer the below questions:

1) Assuming a 10% initial margin, how much money do you need to buy one contract? (Assume 500 units in one contract)

2) Assume that the underlying assets market price goes up by 10% before the delivery/settlement date and the contract price also goes up by 8% as a result. Compute your profit if you sell the contract at that price before delivery?

3) Assume that instead of the contract price going up, it went down before the delivery date. If the maintenance margin is 70% of the initial margin, find out the contract price below which a margin call would be issued from the exchange?

Platinum May 2023 QUOTES \& COMPANIES PLK23 (U.S.: Nymex) Platinum (NYM \$/ozt) Platinum May 2023 QUOTES \& COMPANIES PLK23 (U.S.: Nymex) Platinum (NYM \$/ozt)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts