Question: Future Focus Inc. is considering two projects and must do one of them. Project Arequires an investment of $35.000. Estimated annual receipts for 5 years

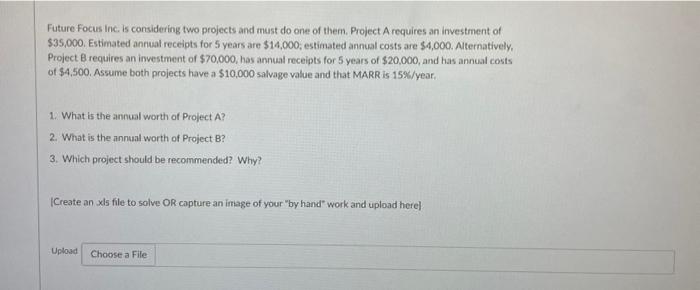

Future Focus Inc. is considering two projects and must do one of them. Project Arequires an investment of $35.000. Estimated annual receipts for 5 years are $14,000, estimated annual costs are $4,000. Alternatively, Project B requires an investment of $70,000, has annual receipts for 5 years of $20,000, and has annual costs of $4,500. Assume both projects have a $10,000 salvage value and that MARR is 15%/year, 1. What is the annual worth of Project A? 2. What is the annual worth of Project B? 3. Which project should be recommended? Why? Create an xls file to solve OR capture an image of your "by hand work and upload here) Upload Choose a File

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts