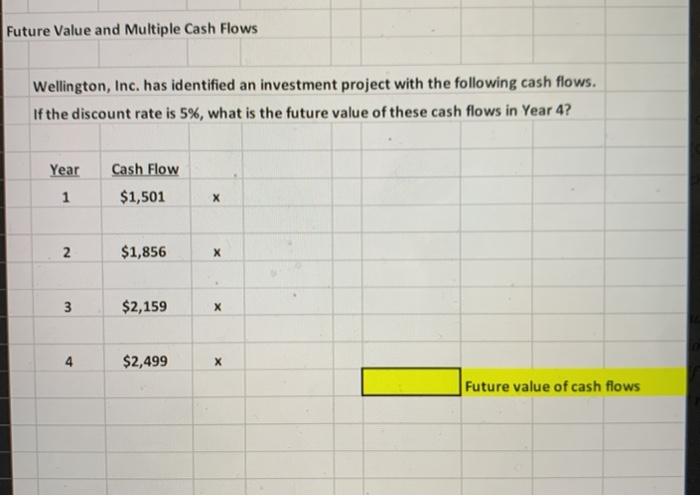

Question: Future Value and Multiple Cash Flows Wellington, Inc. has identified an investment project with the following cash flows. If the discount rate is 5%, what

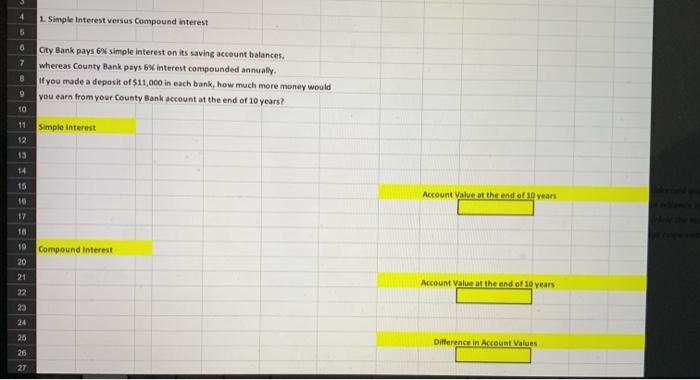

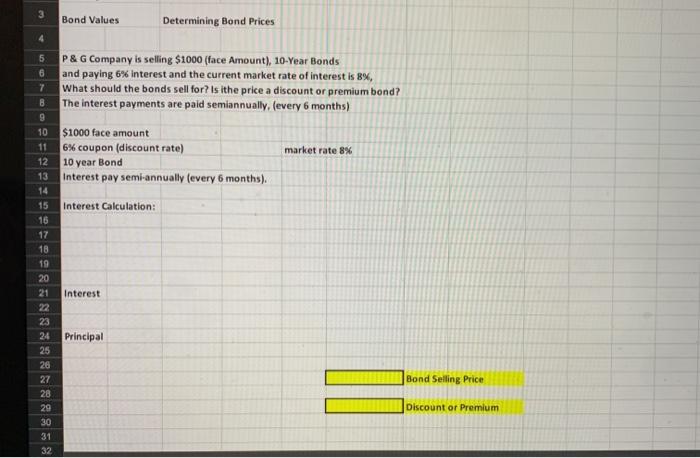

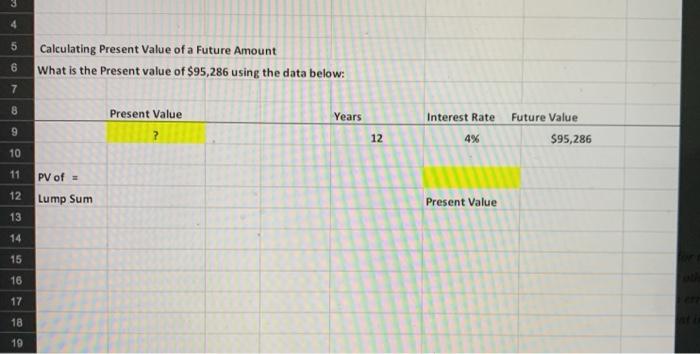

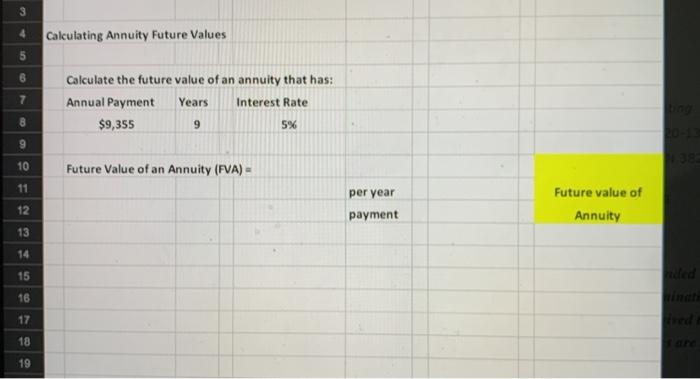

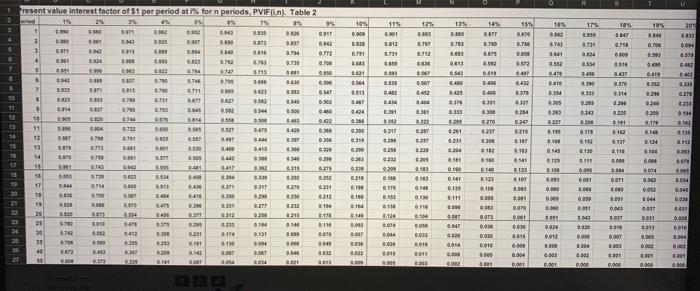

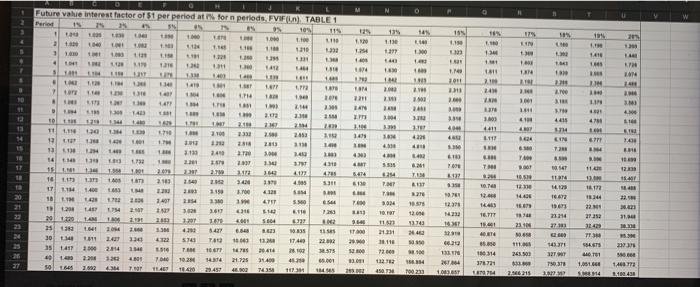

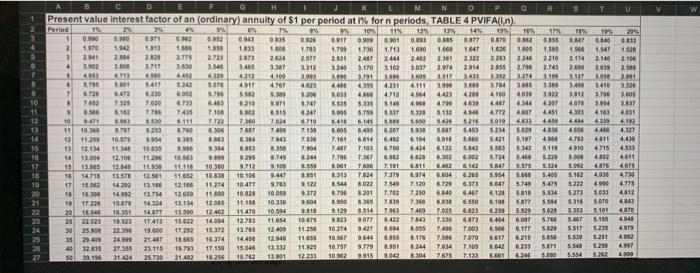

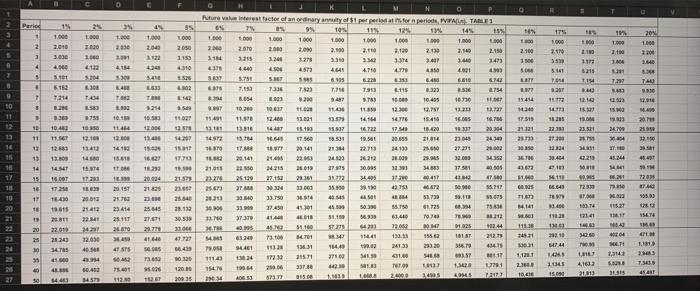

Future Value and Multiple Cash Flows Wellington, Inc. has identified an investment project with the following cash flows. If the discount rate is 5%, what is the future value of these cash flows in Year 4? Year Cash Flow $1,501 1 2. $1,856 X 3 $2,159 X 4 $2,499 Future value of cash flows 1. Simple Interest versus Compound interest City Bank pays 6% simple interest on its saving account balances, whereas County Bank pays 6% interest compounded annually. If you made a deposit of $11,000 in each bank, how much more money would you earn from your County Bank account at the end of 10 years? 9 10 11 Simple Interest 12 13 14 15 Account Value at the end of 10 years 10 17 Compound Interest 20 21 Account Value at the end of 10 years Difference in Account Values 26 27 3 Bond Values Determining Bond Prices P& G Company is selling $1000 (face Amount), 10-Year Bonds and paying 6% interest and the current market rate of interest is 8%, What should the bonds sell for? Is ithe price a discount or premium bond? The interest payments are paid semiannually. (every 6 months) $1000 face amount 6% coupon (discount rate) 10 year Bond Interest pay semi-annually (every 6 months) market rate 8% Interest Calculation: 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Interest Principal Bond Selling Price Discount or Premium 4 5 Calculating Present Value of a Future Amount What is the Present value of $95,286 using the data below: 6 7 8 Years Interest Rate Future Value Present Value ? 9 12 $95,286 10 11 PV of - Lump Sum 12 Present Value 13 14 15 16 17 18 19 3 4 Calculating Annuity Future Values 6 7 Calculate the future value of an annuity that has: Annual Payment Years Interest Rate $9,355 9 5% 8 9 10 Future Value of an Annuity (FVA) 11 per year 12 Future value of Annuity payment 13 14 15 16 17 18 19 0 NE WE 15 16% B. 175 1.85 we 10% 0.000 0.826 B.SI 9.00 ENE 15 GO 0.718 0.00 19% a 14 0.700 ATT 0.100 ES 0.02 0.0 0.754 355 TH 20% 9.833 BON 8.33 0.432 2.731 CEWE 8641 IMB SEE 0.63 LETS PS 092 9.49 CESO 0.535 3.04 3.54 0.48 70 133 0:20 456 4.79 12 0.00 DET OSOT 0.450 0.404 . 122 0.28T 0.40 6.435 38 2.552 DAN 0.40 0144 3.35 B. 376 HY . 2.300 0.291 10 0.131 0218 10 0314 36 0.221 11 6391 33 564 2013 0.461 0.434 0.000 0.350 31 0.220 0.23 FEE 040 311 0:31 0270 2 200 PERO NI 317 resent value Interest factor of S1 per period at I forn periods, PVIF). Table 2 19 79 9% 0.22 0.34 33 0.820 0.8T 2001 0.07 0803 ATT 0.34 0772 0024 5 0.700 142 . 1113 0.50 79 74 1.70 7 . TO 6111 . 0.41 13 OTE TH &T 0.00 9 0.7 TO DS 3.00 . MS 0.35 B. 463 11 . 0.02 722 OST 0.08 842 02 12 BAT 701 1.65 0:55 0.48 0.48 3 0:34 13 LT UT 0410 0:45 36 14 . 6.61 EST 43 6.14 . 8315 21 8.45 11 14 . 14 . OBIT 6220 6.494 1418 0.29 250 ST 6475 EN 331 0.27 2.1 20 8.456 T! 1912 3 3.121 16 116 10 1.300 3.174 11 2200 . 356 10 30 200 . 0.06 3.341 E BOM 0.341 28 6161 0221 6.199 13 AO 6.23 0.250 0.78 19 3.130 11 CH ST G. 0.001 204 2.981 0.134 NO TI 00 0.10 1 96 LE PET 0209 3 9305 2.1 9.00 14 CEO 0.14 4123 0001 E4 0.21 . 180 2164 142 EL 1.100 03 0.00 . 10T 9.00 2001 DOTO 0.00 3.111 . 0.071 . 0.05 DO 003 BON 0.05 0.01 O NO ELEE B.153 6:13 124 094 2044 1.000 16 6. 0.05 0.010 2002 02 0.64 Gas 0001 2013 0.005 0.000 19 0.000 O DE 3 HT 007 M 0.000 0.000 a 0:02 HO COTE 0.012 1.000 0.003 100 DOTO 100 0.004 B. LAND 0.00 2004 03 0.000 0.000 002 E COTO 2001 OD O tes MUI Future value interest factor of St per period at forn periods, FVF). TABLE 1 Perit 19 ON 10 114 . 10 2 1.000 LE . 1.18 18 118 210 1332 30 1 11 . 1395 22 10 12 444 10 79 IN 1.0 1.10 13 17 100 LE 114 WE I RE 1.TE 1.40 TE HE 1.NO e ! NOT T. 142 11 . LIN 1811 21 24 PP 1419 14 LP UM 110 THE ar TAN 1 4.PH BE 10 2.79 W HT 221 13 ME 3401 WE 1.41 1901 2:41 HE 14 19 20 NYE 2.300 2.5 1 1.601 11 410 34 3:31 3.0 482 4788 4 L1 1.110 404 ti 2.00 17 12 14 200 2015 LE 23 1113 RE HOP 4220 48 2013 31 24 STT HE SH PETE 4.418 174 EIN 7.33 8. ST E NE R! 1624 8. 760 13 22 it ti PE INT LET 18 240 2570 mit 401 11 12. 5.535 824 100 TM 900 40 425 311 7130 THE 2 2.1 AN . 2.183 5.414 1 SEE 417 4.35 SM 50 toe 100 1.400 13 1954 101 AT 1 UM 1. 1994 2 2130 ST 12.00 LI ME LOTE NE 3 21 2014 3.88 1207 TE IT 1114 10 20 1200 35 30 30 14 35 7411 1.43 2162 1190 20 26 10 847 Tata 16 13 120 ATIT 110 5664 13 123 11.40 1669 18 120 TON 13 9. 100 30M 10.PT 11 12 14 16.TTT TE DAN 16 311 2.500 16 001 8. 12:37 23 1997 18.575 12 13.143 24 13 23214 31. ZES SCE 1 11 1824 22 27352 1141 TT STS 10.01 1,0518 14 1.3 HOT T SEST 2:36 HD H Set 2114 40. 8. 1014 154 20 CODE 51 TH 102 1840 132 30414 1.400 IT 4 28.12 41 11731 10 265.00 1514 7040 40 ESTS DO DO WATEL 14 32TT 70318 POTE 3262 34 23.01 72.00 132 13 450738 21725 46 292 5. 1408773 1,1143 SENE 14 2930 1233 376771 9714 100T 2006 15 EWERT D W NE SED D 18 THE ED 06 17 155 4.50 2210 2743 19 3 02 MY 1.564 2.114 2010 SEES 10 PERT 1451 BIP 37 OUT ES NOP Present value interest factor of an (ordinary) annuity of $1 per period at i% forn periods, TABLE 4 PVIFA(n) 4 TS 0.90 59 99 10% 11% 134 14 129 15% 0.90 6:02 0.943 0.935 0026 17 1970 0.900 . . ORTO 1.15 0.862 1942 199 1833 100 1.733 3 24 1.750 1.736 166 2.029 1847 2.14 2.775 1.620 1.00 2723 263 2994 4 2.IT 2.000 2001 2411 1444 243 2361 2322 2.783 2.246 3.00 1.711 2.600 31540 3.465 987 2312 10 4 3.170 3.100 3.031 2.74 2014 25 27 4.71 4 4.53 4129 4211 4100 3903 3. 1. 360 5242 3:17 349) 41 32 3214 1601 5.070 4767 40 4400 4355 4.331 4111 3.000 371 365 1 8120 5472 230 6002 STA 2 199 $200 5.03 45 4712 4864 4433 4.200 160 4.03 To 7030 6.733 6.483 210 STI STAT 5.500 495 46 3 4487 4344 71 7.100 6011 6.247 S7 1537 480P 10 412 30 12.722 7:30 7034 6710 5.145 1. 160 S428 5019 4 103 10 . 0.253 76 06 7.301 7.490 7.130 BOS 6.435 6.207 SER 5.453 12 11.30 5214 1078 9.95 2.300 34 T T. 7.161 614 842 1 18 8.86 3:41 15 5.17 12.14 11.340 10035 16 3853 35 7,104 7.103 750 13.004 12 14 6424 3.342 SA 1344 12.100 11.20 10.45 . 9.295 8.745 1.244 7.30 PE C 60 15 6302 C002 724 5.400 11.30 11.110 10 380 9.712 9.105 3.50 3001 T. 7.18 6.11 L2 142 547 5.575 15 14718 53.578 11.653 1083 10.100 9.441 8051 33 7.524 7379 6.974 0.004 0.266 5.954 5.6 17 15 14.20 12.16 12.166 11214 10477 8.73 122 8.544 8023 7.549 7. 120 8.720 6373 6.042 5.749 18 10.30 14093 114 12.650 11.00 10.820 10050 173 8.750 3.201 7.700 7.250 840 6.467 6.120 SRB 17220 15.678 14324 12.114 12.05 11.15 10.336 3.604 950 36 7838 7.366 1938 6.550 610 5.87 20 13.048 18.351 14.071 13 50 12.462 11.470 1054 041 3120 8.514 7,963 7469 7.025 8.623 6.250 5.929 25 22.023 19.12 17.413 15.022 14004 12.753 11.654 10.675 823 9.077 8.432 7843 7.330 8873 6.464 6.097 30 25.500 22350 19.000 17 282 15. 32 13.TES 12.400 11 350 10 214 9427 8.055 7496 7000 6.10 0177 29 419 24.996 21.457 18565 19.374 14.458 12.04 11.055 10.567 0644 8174 7.580 7.00 617 6.215 40 32.836 27.355 23.115 19.793 17.150 15.646 13.333 115 10.757 3.779 6244 7.634 7.105 6.642 50 25.730 21.482 19244 115.72 13.801 12233 10.802 9.915 9.042 3304 7.575 7.133 6.661 624 3:40 3312 4078 4313 4414 480 43 4.910 3.00 5.012 5.162 5.222 16 ENT PECS 2015 6.840 1.54 1.82 2.140 2106 2839 2585 304 2001 3410 9320 3. cos 3914 2337 4611 41 41 4.48 4.327 4611 4419 433 4.800 4611 4578 LOTS 47 4.775 4.312 OTO 4141 $100 4370 1.135 4948 5216 4919 5.251 42 5.258 4 5.252 4.999 415 15 16 1 13 10 220 5324 5.400 5.478 ti 5.534 5.279 0657 COS 51584 16 5353 20 21 22 23 21 25 28 S. 5.828 SSBE ISER 5517 5.30 5548 5.54 000S Period NE SG 56 100 10 1.000 20% 1.000 GT 204 1.000 2010 3.030 4.60 23 121 000 2.050 1159 1.800 2.100 1500 1.000 2.57 3:52 5.141 1.10 1.04 123 SET COT 1.000 1110 1:13 SH 1144 BA 12.140 WEB 9 300 LCHE 4310 3526 02 142 WE TO . 940 4633 T 8.30 1.454 LE 7214 2.241 11172 OG het UN 3 14 SO 11 . 11 HIE 17519 9.36 10.45 10. 130 13.00 136 23:21 21 15 123 24.10 04 . 11 750 10.10 12.10 13.412 14 144 EL PL SE 12.00 1413 18.01 Future Valuerst actor of any of performerede, VVFALLA. TABLE ES TOS 115 124 134 1.00 000 145 15 1.000 1000 1.600 1000 1.000 1600 1.500 2.1 2.670 2009 200 2.190 2.120 2130 2150 14 3215 134 3.278 3.40 1.3 1493 43 4.400 450 4871 464 4710 47 40 5.75 5. 8.400 5.810 7.153 7336 7323 T. 7313 115 323 2514 17 8.554 3 200 1487 3.133 95.000 10495 10730 10.200 10 ST ta 14 11 12.30 2. 123 52.400 13631 13.57 141 SU 15 416 16.00 16.74 13.181 13818 14487 11.10 15.95 16.722 17.40 1420 10.30 20.304 14 16.45 17.500 58.531 19.500 20.858 23 21045 2434 16.89 14133 23.60 27.221 2008 16 21.00 223 24123 26212 21.00 32.00 34215 2019 30.095 32393 2013 17981 27.11 2011 312 34495 1700 25.673 TA 3024 33.000 35 427 0672 17 2023 23.750 14 5173 93.113 3.075 31 17.450 41101 45.00 5030 58.70 1725 34 75.834 13 37 379 41 1010 58.15 10 2012 40.105 4 51.100 97131 4783 20 01.25 545 3.240 73.100 TO 1842 SM 13:33 155. 101 ST 212.79 7.05 461 112 13 24133 29320 356.79 36.34 12 21591 27100 41. 546 ST 2017 154 29.06 3370 42 50 TETO 1.10 7781 20 573 015 L 2.400 SOS CLES DEO IT 20141 10205 22:31 17.30 10.034 23.414 1 11 66.641 13 13.00 162 ST SER SOG HER IZD BIO 14MT 18 58 SIBLE WETE BETH 43.2 1144 G. 15 HT 1291 17 10 TE 2015 2004 21 720 PA 995.00 OVDE RRUP 2013 21412 . 125 1407 15 TU 18 21529 2362 25540 28.130 30.533 30 47.721 435 330 120.00 09:35 T2 F. 03.14 T. 14141 152 13815 23414 20 21 17 18 ts 20 25 25.645 1.ETI 11 3.4 1912 2.1 15ETE RO TM 2010 113.30 3421 ONG 12:00 FOTO 1.11 45 2201 21.243 34. TAS 1 GO GEN 14.463 et de SOS 3. 09 MALTI 2,3141 ws IR 43 $0.42 1.10.1 2. 10. 12.44 1465 11345 15 TM 1,01 41633 21813 75. 112 7.33 4. RT HII SUPE GER SHOP 06

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts