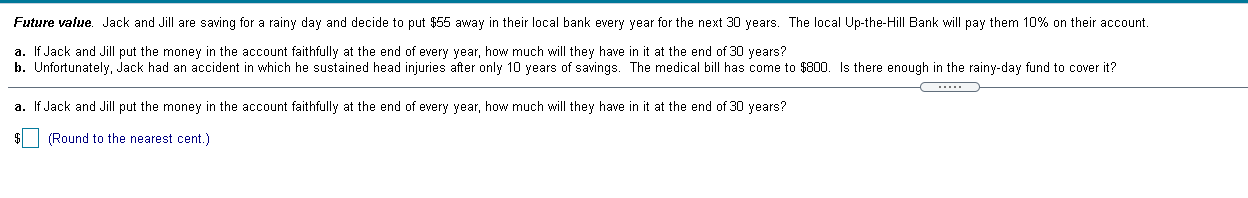

Question: Future value. Jack and Jill are saving for a rainy day and decide to put $55 away in their local bank every year for the

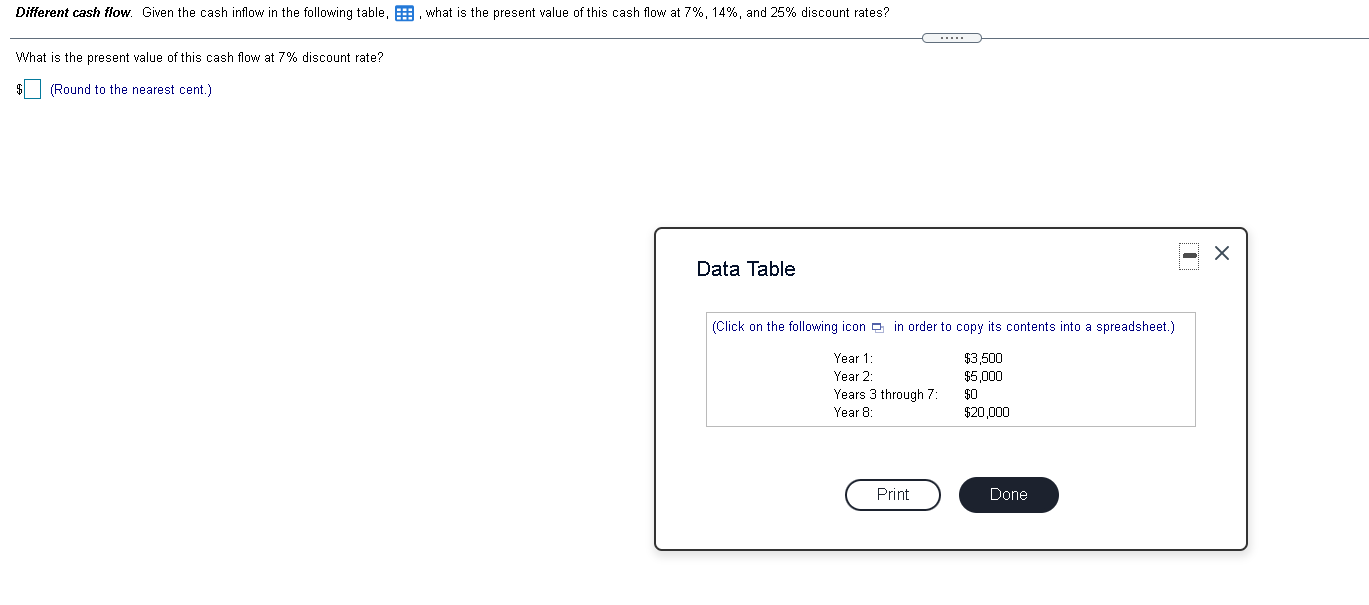

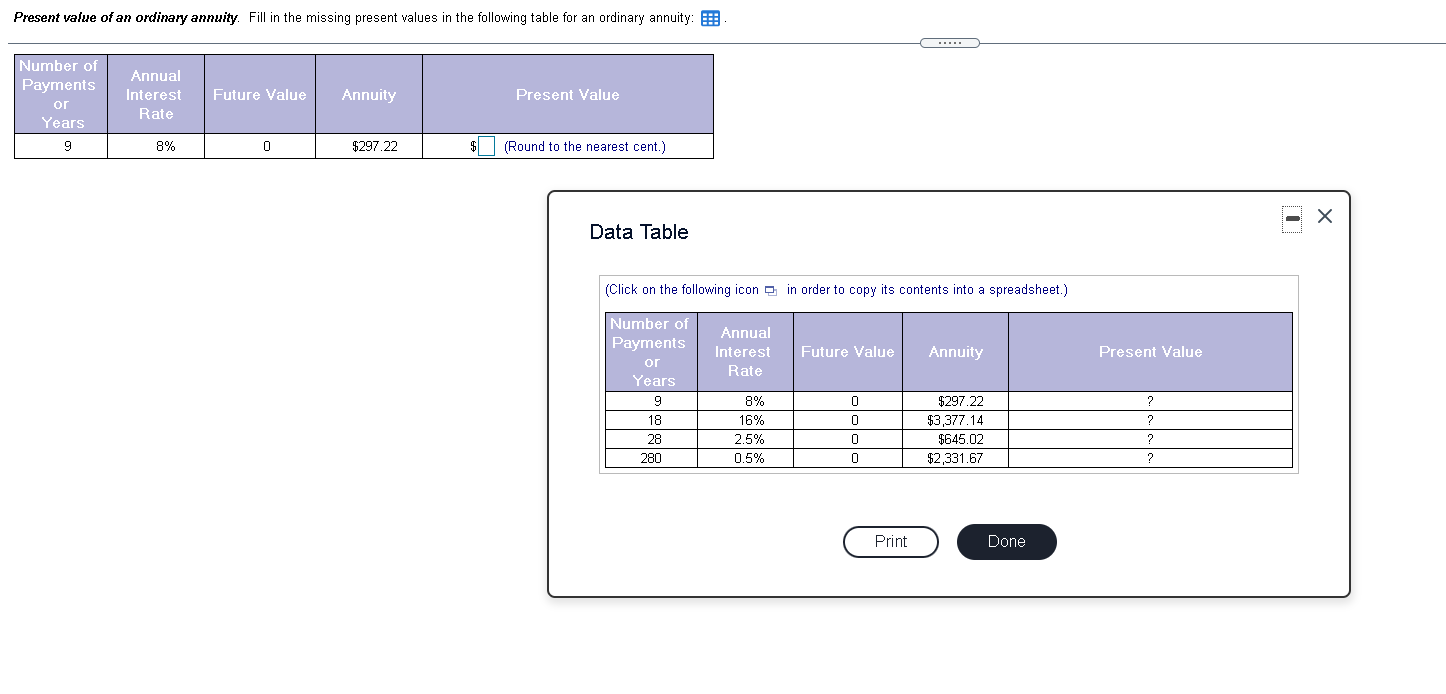

Future value. Jack and Jill are saving for a rainy day and decide to put $55 away in their local bank every year for the next 30 years. The local Up-the-Hill Bank will pay them 10% on their account. a. If Jack and Jill put the money in the account faithfully at the end of every year, how much will they have in it at the end of 30 years? b. Unfortunately, Jack had an accident in which he sustained head injuries after only 10 years of savings. The medical bill has come to $800. Is there enough in the rainy-day fund to cover it? a. If Jack and Jill put the money in the account faithfully at the end of every year, how much will they have in it at the end of 30 years? $ (Round to the nearest cent.) Different cash flow. Given the cash inflow in the following table, e. what is the present value of this cash flow at 7%, 14%, and 25% discount rates? What is the present value of this cash flow at 7% discount rate? $(Round to the nearest cent.) Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Year 1: Year 2 Years 3 through 7 Year 8 $3,500 $5,000 $0 $20,000 Print Done Present value of an ordinary annuity. Fill in the missing present values in the following table for an ordinary annuity: 5 Annual Interest Rate Future Value Number of Payments or Years 9 Annuity Present Value 8% 0 $297.22 $(Round to the nearest cent.) T Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Annual Interest Rate Future Value Annuity Present Value Number of Payments or Years 9 18 28 280 8% 16% 2.5% 0.5% 0 0 0 $297.22 $3,377.14 $645.02 $2,331.67 ? ? ? ? Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts