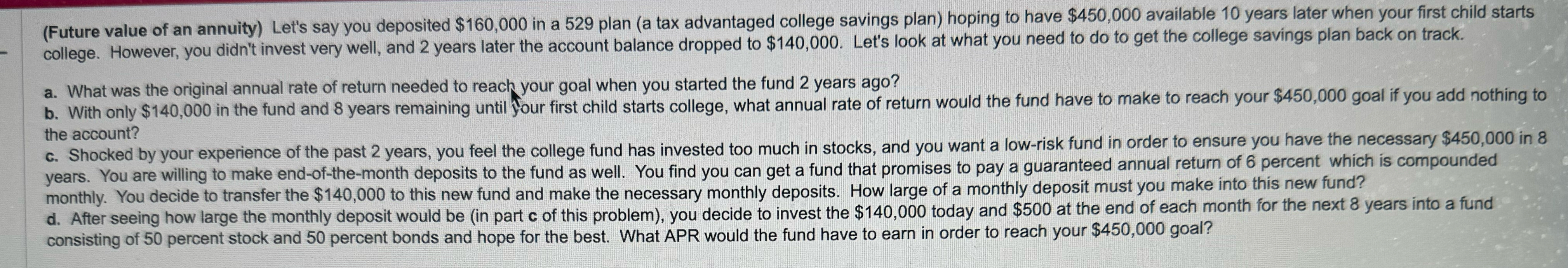

Question: ( Future value of an annuity ) Let's say you deposited $ 1 6 0 , 0 0 0 in a 5 2 9 plan

Future value of an annuity Let's say you deposited $ in a plan a tax advantaged college savings plan hoping to have $ available years later when your first child starts college. However, you didn't invest very well, and years later the account balance dropped to $ Let's look at what you need to do to get the college savings plan back on track.

a What was the original annual rate of return needed to reach your goal when you started the fund years ago? the account?

c Shocked by your experience of the past years, you feel the college fund has invested too much in stocks, and you want a lowrisk fund in order to ensure you have the necessary $ in years. You are willing to make endofthemonth deposits to the fund as well. You find you can get a fund that promises to pay a guaranteed annual return of percent which is compounded monthly. You decide to transfer the $ to this new fund and make the necessary monthly deposits. How large of a monthly deposit must you make into this new fund?

d After seeing how large the monthly deposit would be in part c of this problem you decide to invest the $ today and $ at the end of each month for the next years into a fund consisting of percent stock and percent bonds and hope for the best. What APR would the fund have to earn in order to reach your $ goal?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock