Question: (Future value) Sarah Wiggum would like to make a single lump-sum investment and have $2.4 million at the time of her retirement in 32 years.

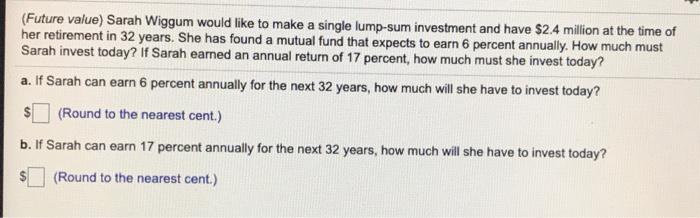

(Future value) Sarah Wiggum would like to make a single lump-sum investment and have $2.4 million at the time of her retirement in 32 years. She has found a mutual fund that expects to earn 6 percent annually. How much must Sarah invest today? If Sarah earned an annual return of 17 percent, how much must she invest today? a. If Sarah can earn 6 percent annually for the next 32 years, how much will she have to invest today? (Round to the nearest cent.) b. If Sarah can earn 17 percent annually for the next 32 years, how much will she have to invest today? (Round to the nearest cent.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts