Question: (Futures Margin call) You took a long position in 10 Eurodllar futures contracts (June 2014 delivery) on 1/13/2012 at the price indicated below. You met

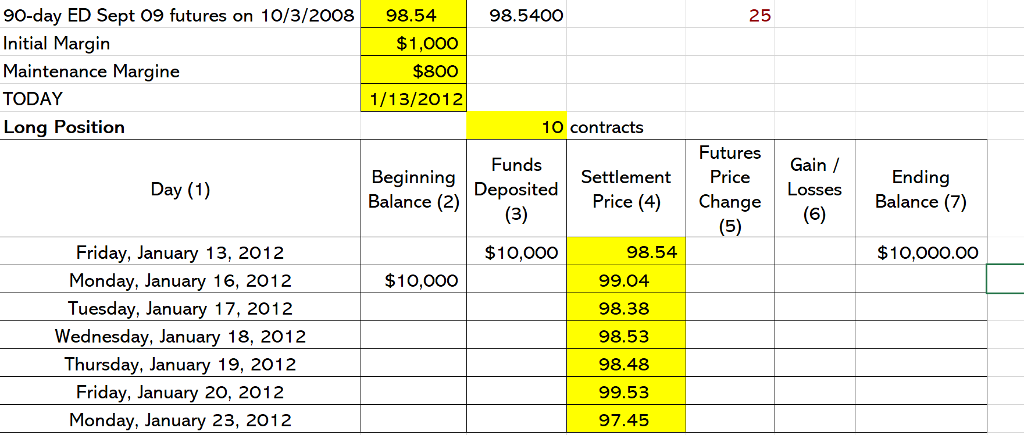

(Futures Margin call) You took a long position in 10 Eurodllar futures contracts (June 2014 delivery) on 1/13/2012 at the price indicated below. You met all margin calls, and did not withdraw any excess margin. All ED futures have a 90-day maturity and a notional principal of $1 million regardless of the delivery month. When the ED futures price increases by 1 basis point (98.35 to 98.36, for example), one long ED futures position gains $25, and one short ED futures position loses $25.

A. Complete table 1 and provide an explanation of any fund deposited.

B. How much is your total gain by the end of 1/23/2012?

90-day ED Sept 09 futures on 10/3/2008 Initial Margin Maintenance Margine TODAY Long Position 98.54 98.5400O 25 $1,000 $800 1/13/2012 1O contracts Futures Gain I Funds Beginning Deposited Price (4)Change(6) Balance (2) Settlement Price Ending Balance (7) Day (1) osses Friday, January 13, 2012 Monday, January 16, 2012 Tuesday, January 17, 2012 Wednesday, January 18, 2012 Thursday, January 19, 2012 Friday, January 20, 2012 Monday, January 23, 2012 $10,000 98.54 $10,000.00 $10,000 99.04 98.38 98.53 98.48 99.53 97.45

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts