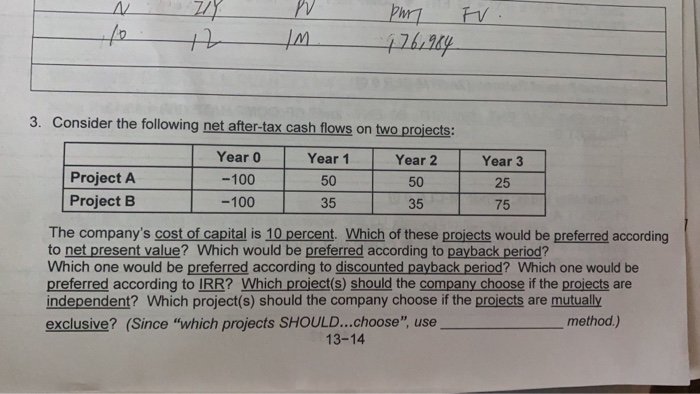

Question: FV. N / 79 2 par 176,984 IM. 3. Consider the following net after-tax cash flows on two projects: Year 0 Year 1 Year 2

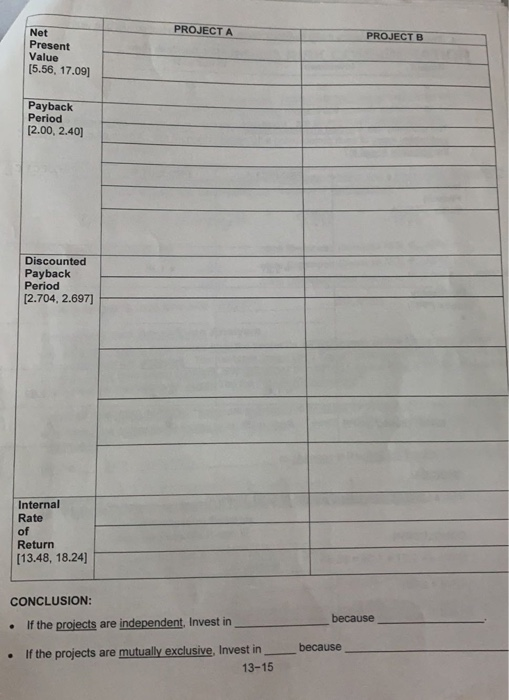

FV. N / 79 2 par 176,984 IM. 3. Consider the following net after-tax cash flows on two projects: Year 0 Year 1 Year 2 Project A -100 50 50 Project B -100 I 35 I 35 Year 3 25 75 The company's cost of capital is 10 percent. Which of these projects would be preferred according to net present value? Which would be preferred according to payback period? Which one would be preferred according to discounted payback period? Which one would be preferred according to IRR? Which project(s) should the company choose if the projects are independent? Which project(s) should the company choose if the projects are mutually! exclusive? (Since "which projects SHOULD...choose", use method.) 13-14 PROJECT A PROJECT B Net Present Value (5.56, 17.09] Payback Period [2.00 2.40] Discounted Payback Period [2.704, 2.697] Internal Rate of Return [13.48, 18.24] CONCLUSION: If the projects are independent, Invest in because _because If the projects are mutually exclusive, Invest in_ 13-15

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts