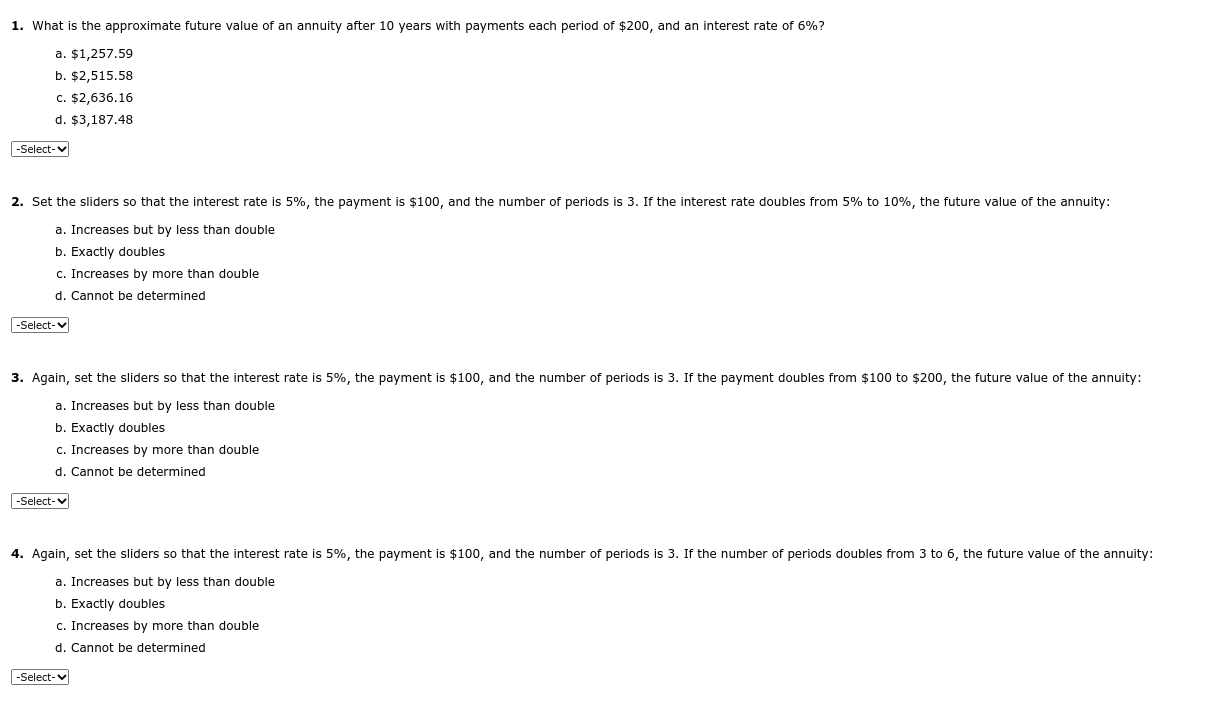

Question: FVAN = PMT ((1+1)^-1) = $100[{+0.050)-1)] = - $315.25 Future Value of Annuity 500 400 $315.25 $300.00 300 200 100 0 1 2 3 Period

![FVAN = PMT ((1+1)^-1) = $100[{+0.050)-1)] = - $315.25 Future Value](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fa38c32d1cd_56266fa38c2bac4e.jpg)

FVAN = PMT ((1+1)^-1) = $100[{+0.050)-1)] = - $315.25 Future Value of Annuity 500 400 $315.25 $300.00 300 200 100 0 1 2 3 Period Int = 5 5 10 PMT = 100 200 400 N = 3 5 10 15 1. What is the approximate future value of an annuity after 10 years with payments each period of $200, and an interest rate of 6%? a. $1,257.59 b. $2,515.58 c. $2,636.16 d. $3,187.48 -Select- 2. Set the sliders so that the interest rate is 5%, the payment is $100, and the number of periods is 3. If the interest rate doubles from 5% to 10%, the future value of the annuity: a. Increases but by less than double b. Exactly doubles c. Increases by more than double d. Cannot be determined -Select- 3. Again, set the sliders so that the interest rate is 5%, the payment is $100, and the number of periods is 3. If the payment doubles from $100 to $200, the future value of the annuity: a. Increases but by less than double b. Exactly doubles c. Increases by more than double d. Cannot be determined -Select- 4. Again, set the sliders so that the interest rate is 5%, the payment is $100, and the number of periods is 3. If the number of periods doubles from 3 to 6, the future value of the annuity: a. Increases but by less than double b. Exactly doubles C. Increases by more than double d. Cannot be determined -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts