Question: FW/activity/question- Help Save & E Submit Required information The following information applies to the questions displayed below) On September 30, 2019, Leeds LTD. acquired a

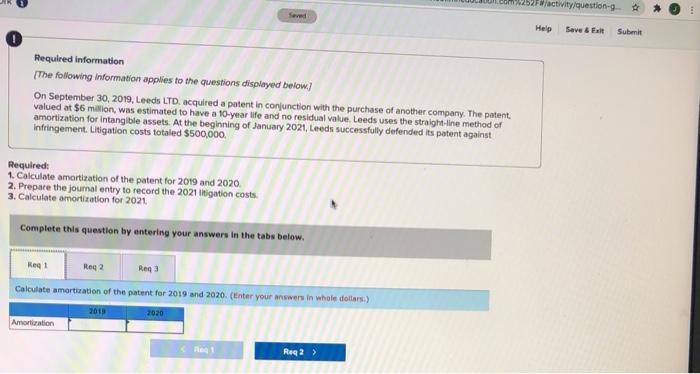

FW/activity/question- Help Save & E Submit Required information The following information applies to the questions displayed below) On September 30, 2019, Leeds LTD. acquired a potent in conjunction with the purchase of another company. The potent. valued at $6 million, was estimated to have a 10-year life and no residual value Leeds uses the straight-line method of amortization for intangible assets. At the beginning of January 2021, Leeds successfully defended its patent against Infringement. Litigation costs totaled $500,000 Required: 1. Calculate amortization of the patent for 2019 and 2020 2. Prepare the journal entry to record the 2021 litigation costs 3. Calculate amortization for 2021 Complete this question by entering your answers in the tabs below. Reg 1 Reg2 Req3 Calculate amortuation of the patent for 2019 and 2020. (Enter your wers in whole dollars:) 2019 2020 Amortization Reg Req2 >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts