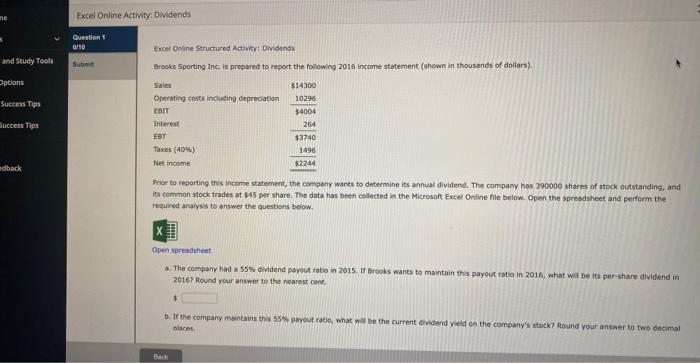

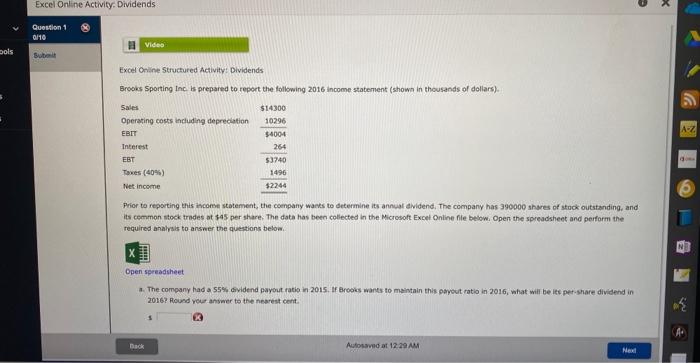

Question: Fxcel Online Acthity Dwidends Eicel Onine Structured Activity: DWidends Ercoks Sporting inc. is prepared to report the folowing 2016 income statement (shown in thousands of

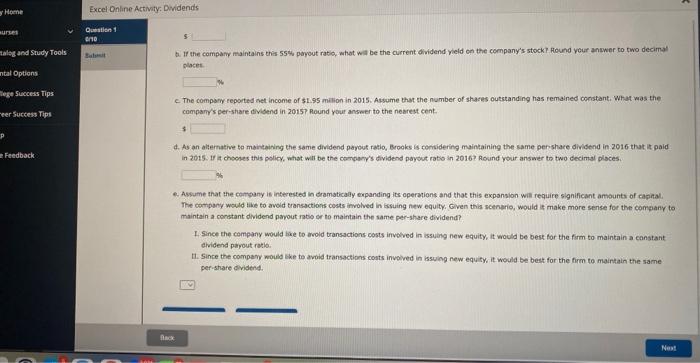

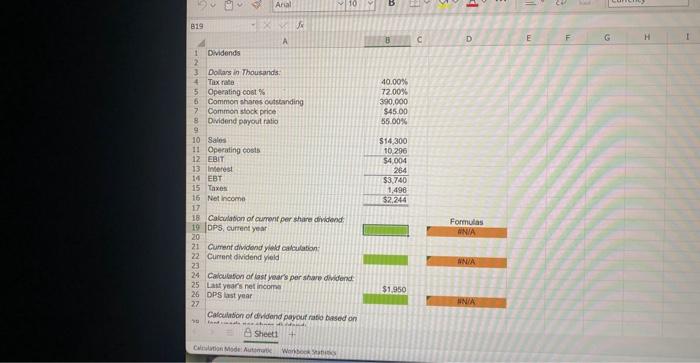

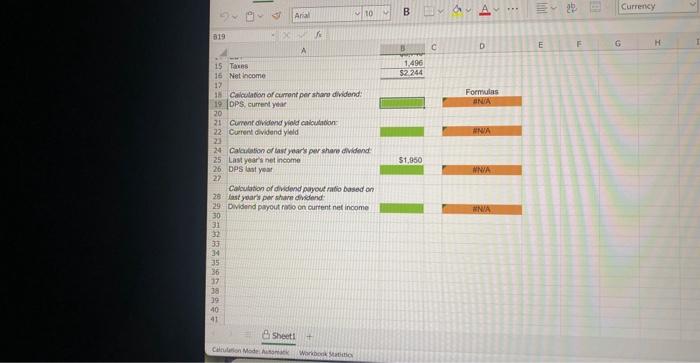

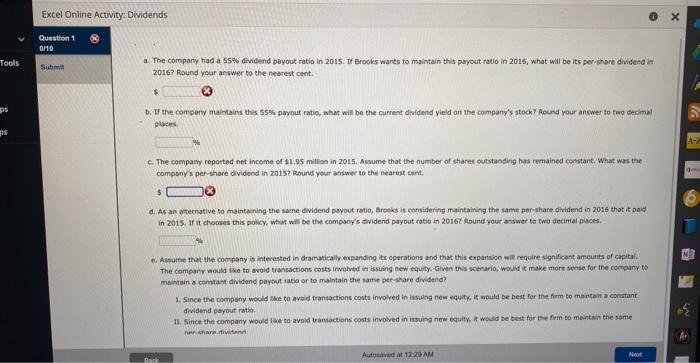

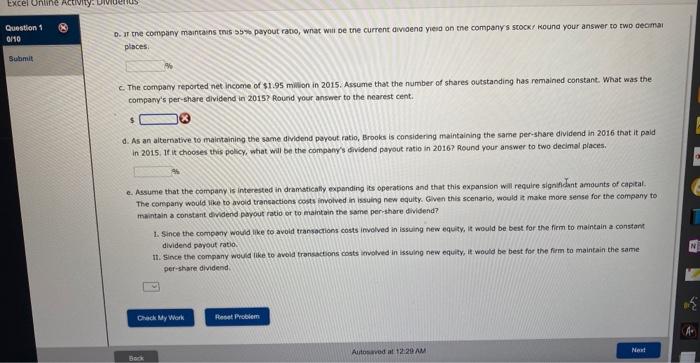

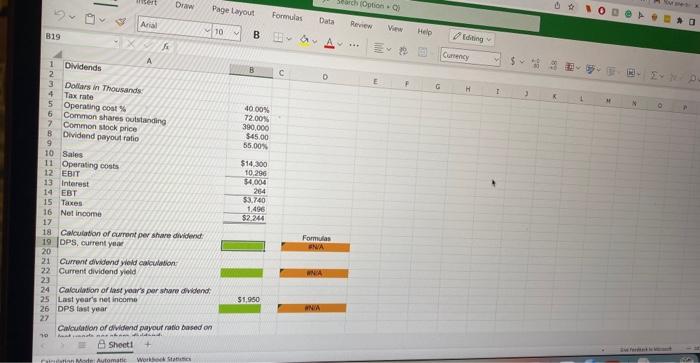

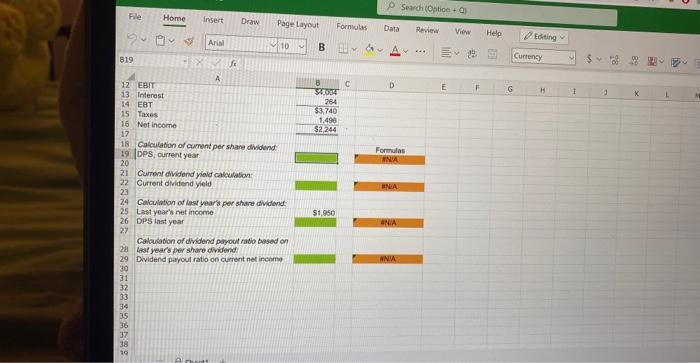

Fxcel Online Acthity Dwidends Eicel Onine Structured Activity: DWidends Ercoks Sporting inc. is prepared to report the folowing 2016 income statement (shown in thousands of dollars). Frior to reporting this income statement, the company wants to determine its annual dividend. The compacy has 390000 shares of stock outstanding, and its cemmon stock trades at 445 per share. The data has been cellected in the Microsoft Excel Online file below. Open the spresdsheet and perform the required analysis to enswer the questions below. Open spreadsheet. a. The company had a 55% dividend pwyout ratio in 2015. If Brooks wants to maintain this payout ratio in 2016 , what wer be its per-share dividend in 2016? Round your answer to the nearest cent. b. If the company maineains this 55 wh parout ratio, what wal be the current cividend yield on the company's stock? Round your answer to tho decimal olaces. Calculation of dridond payouf rato based on Excel Cnille Structured Activity: Dividends Brooks Sporting Inc is prepared to repert the following 2016 income statement (shown in thousands of dollars). Prior to reporting thts iscoms statement, the coenpany wants to determine its annual dividend. The company has 390000 shares of stnok outstanding. and its cemmon stock trades at 545 per share, The data has been collected in the Microsoft. Excet Online file below. Open the spreadsheet and perform the required analysis to ansmer the questions below. Open spreadsheet a. The company had a 55\% cividend payout ratio in 2015. If Erooks wants to meintain this payout ratio in 2016 , what will be ite per-share dividend in 2016 ? Pound yeur answer to the nearest cent. a. The company had a 55% devidend payout ratio in 2015 . If Brooks wants to malntain this payout ratio in 2016 , what will be its per-ishare dividend in 2016? Round yoar answer to the nearest cent. b. If the company maintains this 55% payout ratio, ahar will be the current dividend yield on the company's stock? Round your answer to tav decimal ploces, c. The compamy reported net income of 41.95 million in 2015 . Assume that the number of shares outstanding has remained constant. What was the company's per-share dividend in 20157 Round your ahiswer to the nearest cent. d. As an atternative to maintaining the same dividend pyrout ratio, Arooks is considering maintaining the same per-ahare dividend in 2016 thot it pald in 2015. If it chooses this policy, what will be the company's dividend payout ratio in 2016 ? Round your answer to two decimal piaces. A. Assume that the company is interested in dramasically expanding its cperations and that this expansion wil require signifcont amounts of capital The compary would like to avoid transactions costs involved in issuing bew equity, Given this scenaelo, would it make more sense for the company bo msimain a constant dridend paybut ratio or to maintain the same per-share dividend? 1. Since the company would lke to avold transactions costs involved in issuing new equify, if apuld be best for the firm to mantein a constant dividend payout ratio. II. Since the company would tave to avold teansactions costs involved in issuing inew equity, it would be best for the frm to maintain the same Fineritharn itheterint; places. c. The company reported net incoene of $1.95 minon in 2015 . Assume that the number of shares outstanding has remained constant. What was the company's per-share dividend in 2015? Pound your answer to the nearest cent. d. As an alternative to maintaining the same dividend payout ratio, Brooks is considening maintaining the same per-share dividend in 2016 that it paid in 2015. If it chooses this pelicy, what will be the company's dividend payout ratio in 2016? Round your answer to two decimal places. c. Assume that the company is interested in dramatically expanding its operations and that this expansion will require significant amounts of capital. The company would like to avoid transactions costs imvolved in issuing new equity. Given this scenario, would it make more sense for the company to maintain a constant evvalend payout ratio or to maintain the same per-share dividend? L Since the compeny wosld like to avoid transoctions costs involved in issuing new equity, it would be best for the firm to maintain a constare dividend poyout ratio: Th. Since the company would like to avola transactons costs ievolved in issulng new equity, if would be best for the firm to maintain the same per-ishsre dividend, 18 Calculation of cumnt per shave dividend: DPS, current year. 20 21 Current dividond yitid cabulation: 22 Current dividend yield 23 24 Calculation of last yoar's par shore divdend: 25 Last years net income DPS tast year Cabutition of sividend payout rasio based on A sheet1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts