Question: g 2 9 . LO . 1 , 2 , 5 Harper is considering three alternative investments of $ 1 0 , 0 0 0

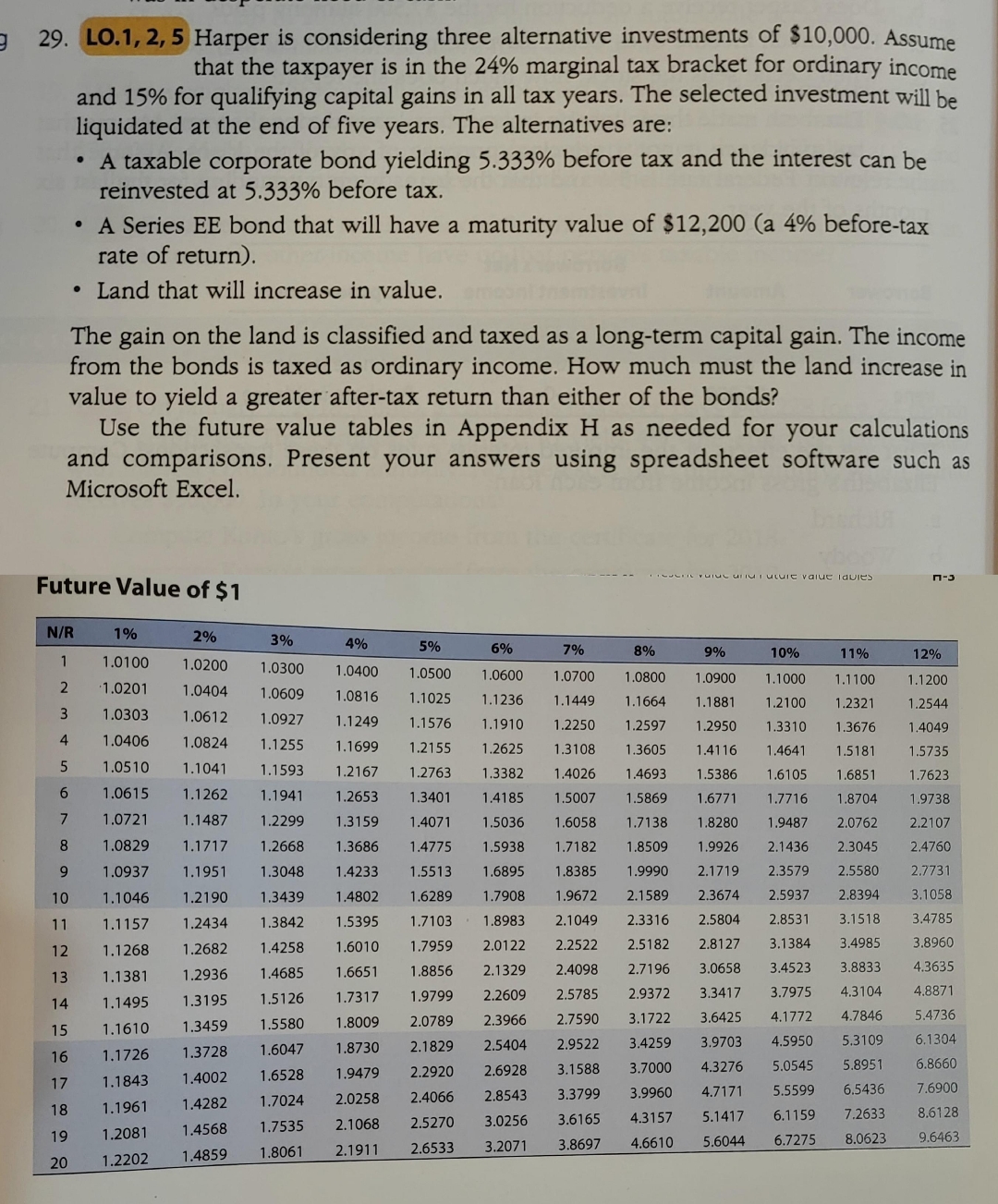

g LO Harper is considering three alternative investments of $ Assumethat the taxpayer is in the marginal tax bracket for ordinary incomeand for qualifying capital gains in all tax years. The selected investment will beliquidated at the end of five years. The alternatives are:NRFuture Value of$Use the future value tables in Appendix H as needed for your calculationsand comparisons. Presernt your answers using spreadsheet software such asMicrosoft Excel A taxable corporate bond yielding before tax and the interest can bereinvested at before tax. A Series EE bond that will have a maturity value of $a beforetaxrate of return Land that will increase in value.The gain on the land is classified and taxed as a longterm capital gain. The incomefrom the bonds is taxed as ordinary income. How much must the land increase invalue to yield a greater aftertax return than either of the bonds?vaue lduie

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock