Question: g and h is optional Activity One A tender has been issued for the design and construction of an offshore wind farm located 25km off

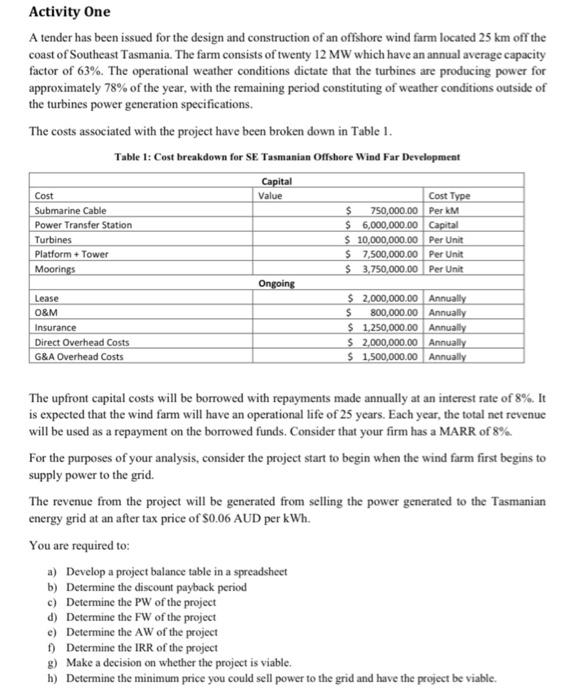

Activity One A tender has been issued for the design and construction of an offshore wind farm located 25km off the coast of Southeast Tasmania. The farm consists of twenty 12MW which have an annual average capacity factor of 63%. The operational weather conditions dictate that the turbines are producing power for approximately 78% of the year, with the remaining period constituting of weather conditions outside of the turbines power generation specifications. The costs associated with the project have been broken down in Table 1. Table 1: Cost breakdown for SE Tasmanian Offshore Wind Far Develepment The upfront capital costs will be borrowed with repayments made annually at an interest rate of 8%. It is expected that the wind farm will have an operational life of 25 years. Each year, the total net revenue will be used as a repayment on the borrowed funds. Consider that your firm has a MARR of 8% For the purposes of your analysis, consider the project start to begin when the wind farm first begins to supply power to the grid. The revenue from the project will be generated from selling the power generated to the Tasmanian energy grid at an after tax price of $0.06AUD per kWh. You are required to: a) Develop a project balance table in a spreadsheet b) Determine the discount payback period c) Determine the PW of the project d) Determine the FW of the project e) Determine the AW of the project f) Determine the IRR of the project g) Make a decision on whether the project is viable. h) Determine the minimum price you could sell power to the grid and have the project be viable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts